Highlights

- Maiden aircore drilling at the Beete Gold Project had identified multiple gold anomalies.

- Infill drilling, geochemical analysis, and drone surveys planned at Beete for 4QCY24.

- Two new mineralised zones identified at Challa Gold Project, including one with 12m at 0.66g/t Au and another with 4m at 0.37g/t Au.

- AU$5.945 million milestone payment received from Rio Tinto, with potential future payments of up to AU$4.5 million.

Platina Resources Limited (ASX:PGM) has released its quarterly activities report for the period ended 30 September 2024, highlighting several significant milestones. During the three-month period, the company identified multiple gold prospective targets at the Beete Gold Project and secured a milestone payment of AU$5.945 million from the sale of its scandium project.

Following the quarter, PGM further bolstered its portfolio with the discovery of gold mineralisation at the Challa Gold Project.

Multiple new gold targets confirmed at Beete

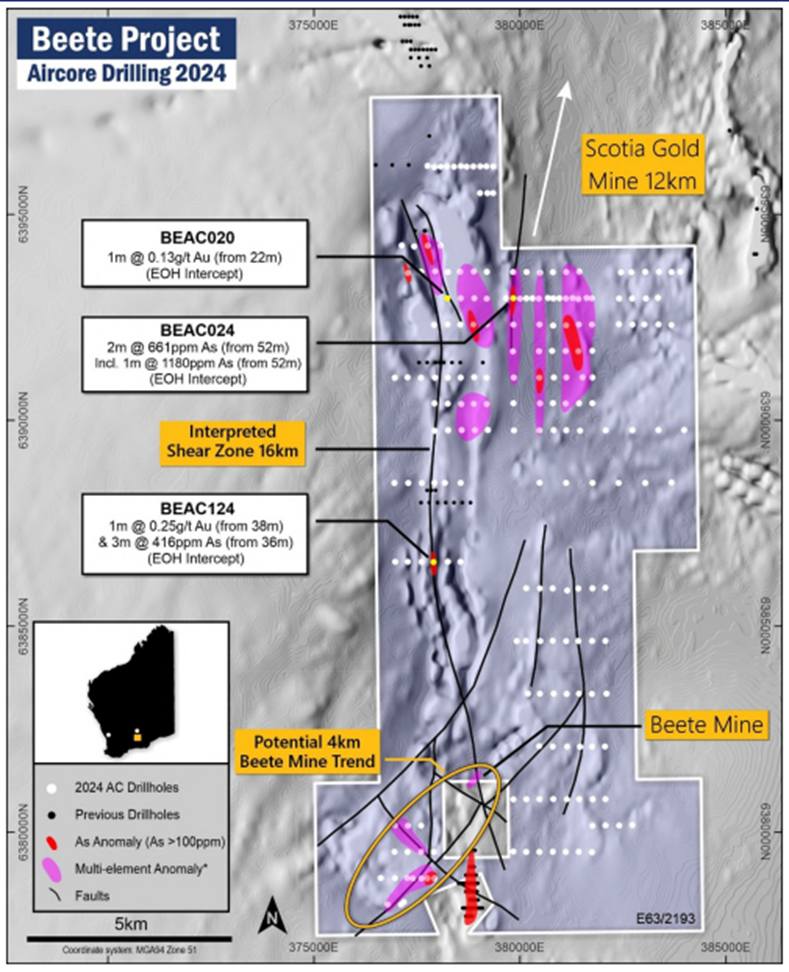

During the quarter, the company concluded a maiden aircore drilling program at the Beete Gold Project, covering 6,331m across 202 holes. The results confirmed several new anomalous gold targets within the project area.

These target areas feature gold concentrations exceeding 10 ppb and arsenic clusters above 100 ppm, aligned with geophysical trends. Elevated levels of various elements, including bismuth, molybdenum, tin, lead, copper, silver, and zinc, were also detected.

Data source: Company update

The aircore drilling averaged a depth of only 30m, therefore, infill drilling is planned to gather more precise data on these anomalous zones. In 4QCY24, the company intends to expand its exploration activities with comprehensive geochemical analysis, drone magnetic surveys and infill air core drilling.

Image source: Company update

Two New Gold Targets Confirmed at Challa

After the quarter end, the company announced the discovery of two new gold targets at its Challa Gold Project. This followed the completion of a second phase of aircore drilling, which involved 1,856m across 41 holes.

The hole CHAC0155 encountered a mineralised zone of 12m at 0.66g/t Au from a depth of 100m, including 4m at 1.7g/t Au. This marks the first greenfield gold intersection along the NW-trending splay of the Challa shear zone and within the western part of the Windimurra igneous intrusive complex.

Another noteworthy result was found along a N-S fault in the CHAC0140 hole which intersected 4m at 0.37g/t Au from a depth of 72m. Both mineralised intersections were found at depths of 94-117m, suggesting the presence of prominent faults or shear zones.

These findings confirmed the presence of gold mineralisation on Platina's tenements. Encouraged by these results, the company plans further drilling to explore the up-dip and along the strike of the mineralisation. Deeper and shallower slimline RC drilling is planned to understand the geometry of the gold system, along with additional heritage surveys for expanded access.

AU$5.945Mn Milestone Payment from Rio Tinto

In July 2024, the company received a milestone payment of AU$5.945 million (US$4 million) from Rio Tinto as part of the sale of its Platinum Scandium Project. This followed an earlier payment of AU$10.8 million received in August 2023.

Platina is also positioned to receive additional payments of up to AU$4.5 million, contingent on Rio Tinto achieving key project permitting milestones and the return of its warranty retention bond.

The company ended the September 2024 quarter with a cash balance of AU$12.695 million.

PGM shares traded at AU$0.023 apiece at the time of writing on 31 October 2024.