Highlights

- Platina (ASX:PGM) has moved forward towards finalising the acquisition of Sangold, adding three projects to its WA gold portfolio.

- The company has signed a sale and purchase agreement to close the cash and share deal.

- Platina has lodged a PoW application while heritage survey clearances secured for M27/501 at Garibaldi.

- The company plans to obtain cultural heritage clearances at the other tenements to allow drilling of existing defined targets.

Australia-based Platina Resources Limited (ASX:PGM) has marked a major development concerning the acquisition of Sangold Resources Pty Ltd. A sale and purchase agreement has been executed, allowing the company to be on course to wrap up the deal. The development follows strong support from shareholders during the company's extraordinary general meeting.

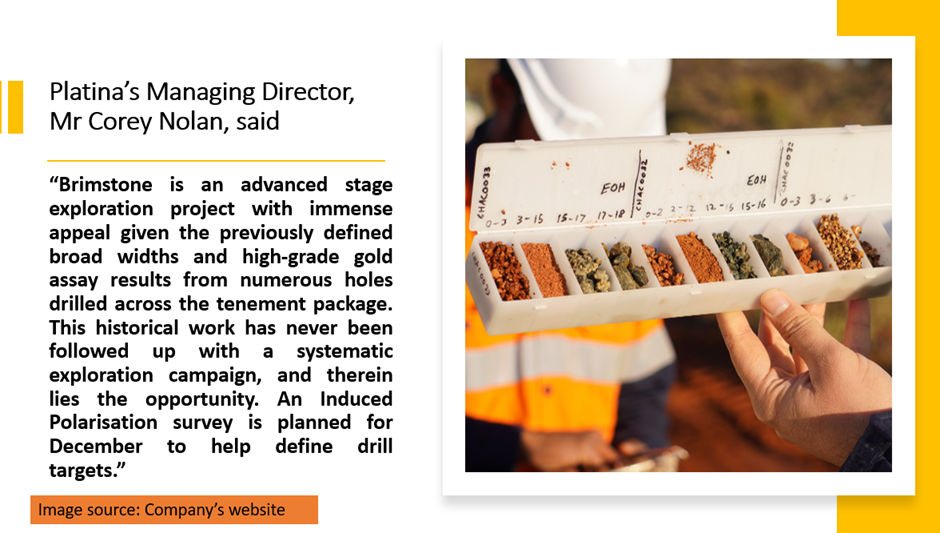

“The transaction will add critical mass to Platina’s gold project portfolio in Western Australia at a low acquisition cost in world-class gold districts,” said Platina Managing Director Corey Nolan.

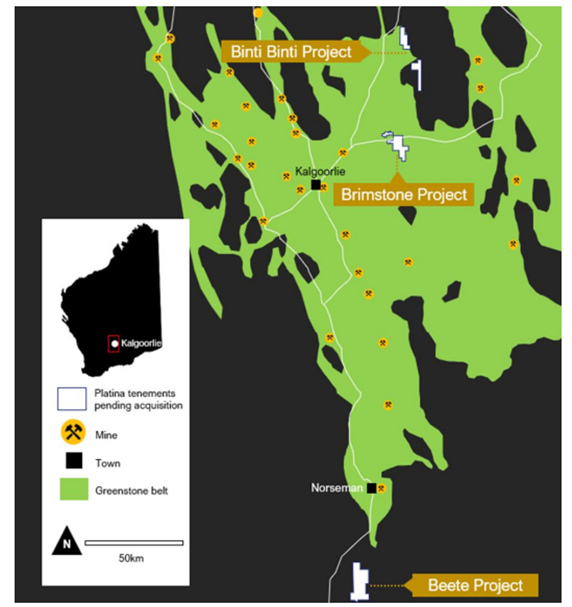

Sangold Resources owns the Brimstone, Binti Binti, and Beete projects.

Source: PGM update, 26 October 2022

Overview of the transaction terms

The consideration for the acquisition covers:

- AU$2.5 million worth of Platina’s shares, which account for 80.6 million shares. Of these, AU$2.4 million worth of shares will have an escrow period of 12 months while the remaining AU$100,000 will have a three-month escrow period.

- AU$150,000 in cash

- Performance shares: The consideration will also include AU$1 million worth of the company shares to be issued if a JORC-compliant inferred mineral resource above 100,000 ounces @ 1.5g/t is achieved on any of the tenements.

277km2 tenement package adds critical mass to WA gold portfolio

The advanced-stage exploration project, Brimstone has six separate walk-up drill targets, which also include the Garibaldi and Jammie Dodger prospects remaining open in all directions.

- Garibaldi prospect includes an historic hit of 55m @ 2.07 g/t gold

- Jammie Dodger prospect includes an historic hit of 22m @ 1.96g/t gold

Source: © 2022 Kalkine Media®, Data source: PGM update

Additionally, the other two projects, Beete and Binti Binti sit within renowned mining jurisdictions, including the Historical Beete Gold Mine inside the tenure being acquired.

The company plans to pursue fieldwork over the Beete project including soil sampling and auger drilling.

Also, Platina believes in the potential of this new tenement package, which, as per the company, has the capacity to generate near-term positive exploration results.

What is in store?

Platina has already lodged a Programs of Works (PoW) application with the Department of Mines, Industry Regulation and Safety. Also, the company has received clearances for conducting a heritage survey over M27/501 at Garibaldi.

After finalising the transaction, the company plans to obtain approvals for conducting cultural heritage surveys at the other tenements in order to advance with the drilling of existing defined targets.

Click here to zero into Platina’s recent developments.

PGM shares were trading at AU$0.018 midday on 1 November 2022.