Highlights

- Musgrave Minerals (ASX:MGV) has entered into a bid implementation agreement (BIA) with Ramelius Resources (ASX:RMS) .

- As per the agreement, RMS will offer to buy out all the issued ordinary MGV shares through a cash and scrip off-market takeover offer.

- MGV has been offered 1 RMS share for every 4.21 MGV shares held and AU$0.04 in cash for every MGV share held

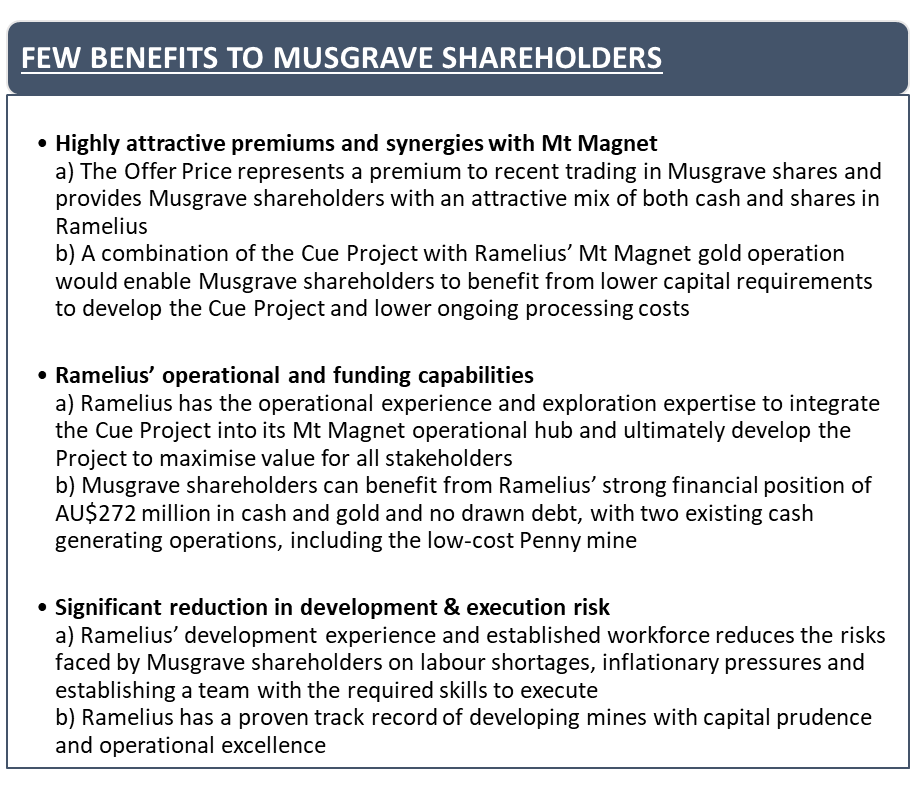

Australian gold exploration company Musgrave Minerals Ltd (ASX: MGV) has entered into a bid implementation agreement (BIA) with Ramelius Resources Limited (ASX:RMS). As per the agreement, Ramelius would offer to acquire all the issued ordinary shares of MGV through a cash and scrip off-market takeover offer.

Triggered by the ASX announcement, the company shares traded in green at AU$0.335 with over 17% jump from the last closing price, at the time of writing on 3 July 2023. The company has a market cap of over AU$168 million.

In-depth details of the offer

Under the terms of the recommended offer, Musgrave shareholders will get one RMS share for every 4.21 MGV shares held and AU$0.04 in cash for every MGV share held.

The offer consideration values each MGV share at AU$0.34, on the basis of the 1-day volume weighted average price of RMS shares on 30 June 2023 of AU$1.263, and implies an undiluted equity value for MGV of ~AU$201 million. Under the offer, Musgrave shareholders will own about 12.4% of the combined company.

Support from Musgrave Board and Major Shareholders

The Directors of Musgrave have unanimously recommended that MGV shareholders accept the Ramelius offer, in the absence of a superior proposal. Also, Musgrave Directors have inked binding pre-bid agreements for the 2.43% of Musgrave shares on issue, accepting within 5 days after the offer opens.

Notably, MGV’s largest shareholder, Westminex Pty Ltd, has also supported the offer by entering into pre-bid agreements for 9.70% of Musgrave shares on issue.

Data source: company update