Highlights

- Musgrave Minerals (ASX:MGV) has received excellent Stage 1 prefeasibility study (PFS) outcomes for its Cue Gold Project.

- The results confirm Cue is a technically and financially robust project.

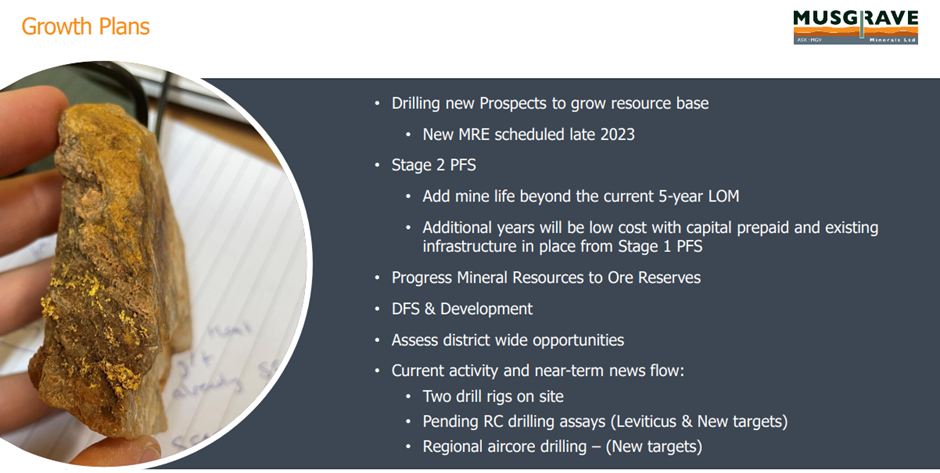

- MGV is planning to conduct Stage 2 PFS to extend the life of mine (LOM) as drilling tests new prospects and extends and upgrades existing Inferred Mineral Resources.

In the latest announcement, Musgrave Minerals Limited (ASX: MGV) revealed the outcomes of a Stage 1 Prefeasibility Study (PFS) conducted at its 100% owned Cue Gold Project, situated in the Murchison gold region of Western Australia.

As per the study results, Cue is a technically and financially robust project. The study confirms it to be a financially attractive standalone project with an initial 5-year LOM highlighting low cost, high margin gold production.

Shares jump

MGV shares were trading at AU$0.245 midday on 17 April 2023, up more than 2% from the last close.

Data source: Company update

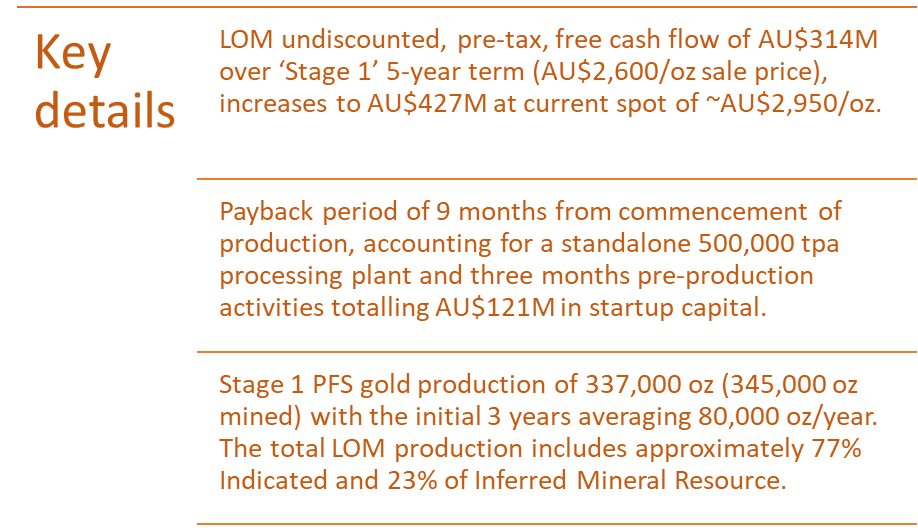

Financial metrics of the project:

- AU$528M EBITDA, with a C1 cost of A$934/oz.

- Average LOM AISC of AU$1,315/oz, with sustaining capital of AU$93 million over the LOM.

- Pre-tax NPV of AU$235 million, with an IRR of 95% (AU$215 million and 91% post-tax).

- Stage 1 PFS cost profiles are based on the existing inflationary environment, with 86% of the costs having a direct Q1CY23 quoted price from service provider.

What we know about Stage 2 so far…

The Stage 2 PFS is expected to scale up mine life by expanding and converting current Inferred Resources to Indicated category, which is likely to include the resources which have been discovered newly, says the company.

As of now, MGV has been marking new targets, making new discoveries, and strengthening the resource base successfully. Also, there is significant upside growth potential for this project as there have been recent new discoveries, such as Amarillo and Waratah likely to increase the resource base this year with completion of Stage 2 PFS in early 2024.

Image source: Company presentation