Highlights:

- MRG Metals (ASX:MRQ) has signed a Binding HoA for the acquisition of a strategically Valuable Heavy Mineral (VHM) sand deposit.

- Acquisition of Jangamo will help in optimisation of MRG’s start-up production pipeline in relation to MRG’s Corridor Mining Licence applications, currently awaiting approval.

- The main VHM at the Jangamo Project are ilmenite, rutile, and zircon.

Heavy mineral sands (HMS) exploration player MRG Metals Limited (ASX:MRQ) has signed a Binding Heads of Agreement (HoA) for the acquisition of a strategically Valuable Heavy Mineral (VHM) sand deposit.

MRG has secured the option agreement with Savannah Resources’ (LSE:SAV) subsidiary AME East Africa Limited (AME) for the acquisition of the Jangamo Project (Mining Concession 9735C) in Mozambique.

As per MRG, the project is a 65Mt @ 4.2% Heavy Mineral Sand (HMS) licence which holds an excellent mineralogy of 64.0% VHM plus 11% Titanomagnetite, for 75% product.

Source: © 2022 Kalkine Media®, data source: Company update

Overview of ML 9735C

In December 2019, the Minister of Mineral Resources and Energy had delivered Mining Licence 9735C to Matilda. The licence, covering 11,948 hectares, is valid till April 2044 and has a possibility of an additional twenty five-year extension.

Source: Company update

As per the company, the principal mineral sands production opportunity across the project is based on Jangamo deposit. The deposit holds a JORC 2012 compliant resource estimate of 65Mt at 4.2% Heavy Minerals.

The Jangamo Project which is located 170km NE from the Corridor Projects has seen substantial expenditure from AME. Till date, for the project acquisition and development AME has spent approximately US$4.1 million.

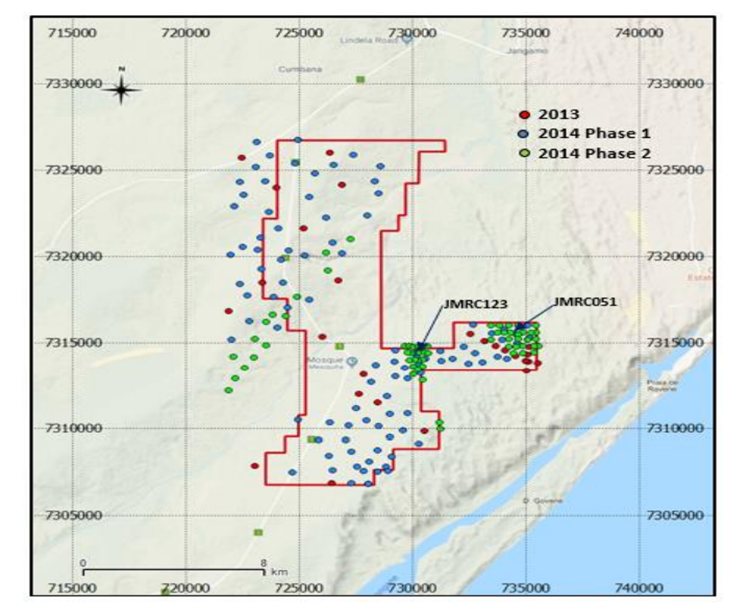

Historical Drilling and Resource results

As per the company, the main VHM at the Jangamo Project are ilmenite, rutile, and zircon. The combined drill data enabled the identification and delineation of two zones of mineralisation (i.e., >2.5% THM).

Source: Company update

The distribution of higher-grade sand indicates several mineralised blocks as mentioned below:

- Eastern mineralisation

- Central mineralisation

- South-eastern area of the Strandline

Preferred mining method: The key attributes based on which the mining method at Jangamo deposit was selected are as follows:

Source: Company update

Key aspects of the option agreement

MRG is given an exclusive 45-day due diligence period commencing on the date of signing the HoAs. It will give MRG time for validating all the relevant costs and commitments and any legal, regulatory, tax or commercial matters.

After the completion of the due diligence period, MRG may proceed with the transaction by executing an “Option Agreement”. The agreement will provide MRG a sixteen-month option period that can be extended by mutual consent.

During this due diligence period, AME will prepare a draft and negotiate the option agreement with MRG. The negotiation of the option agreement will take place assuming it is being entered into by both the parties within five working days following the expiry of the due diligence period, or earlier by agreement.

The Proposed transaction structure is shown via infographic attached below:

Source: © 2022 Kalkine Media®, data source: Company update

During the Option Period, MRG may exercise the option based on the following terms:

- US$0.8 million, payable at the sole discretion of MRG in cash, in new ordinary shares in MRG or a combination of both. The share will be based on the twenty-day volume weighted average price at time of exercise of the Option.

- For the years where the Project generates a Net Profit after Tax (NPAT), MRG to make a 1% royalty payment to AME on revenues from product sold. However, it will be capped at 50% of NPAT for any given year. The payment will be calculated annually for the year completed.