Highlights:

- MRG Metals (ASX:MRQ) has conducted a scoping study and preliminary economic assessment (PEA) at the Corridor Sands project.

- The net present value (NPV) based on the scoping study and PEA has shown encouraging numbers.

- MRG plans to commence the prefeasibility stage (PFS) with an eye on enhancing the metallurgical options to increase the project NPV.

MRG Metals Limited (ASX:MRQ), an ASX-listed heavy mineral sands exploration company, has released an important update highlighting the significant net present value (NPV) of its Corridor Sands project.

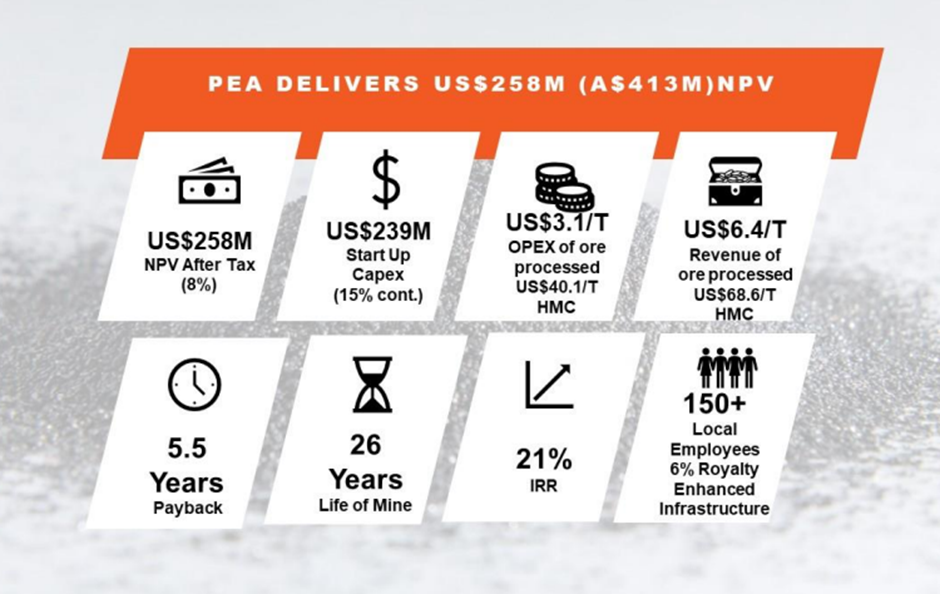

MRG used data from a scoping study and preliminary economic assessment (PEA) conducted by IHC Mining to determine the NPV of AU$413 million against the company's market capitalisation of AU$9 million.

Also, the board is confident of significantly increasing the NPV in the project’s next stage(s).

Source: Company update

The company commissioned IHC Mining to undertake the aforementioned study and assessment to ascertain the feasibility of an open pit mine and ilmenite processing plant constructed on-site at the Corridor Sands project in Mozambique.

It was also aimed at determining whether to proceed with more definitive studies.

The study and assessment covering the Corridor Central and Corridor South licences specifically targeted the Koko Massava, Nhacutse, and Poiombo deposits. The Instituto Nacional de Minas (INAMI) has accepted the mining licence applications for both licences and, further, changed the licence numbers for Corridor Central and Corridor South to 11142C and 11137C, respectively.

Basis of study

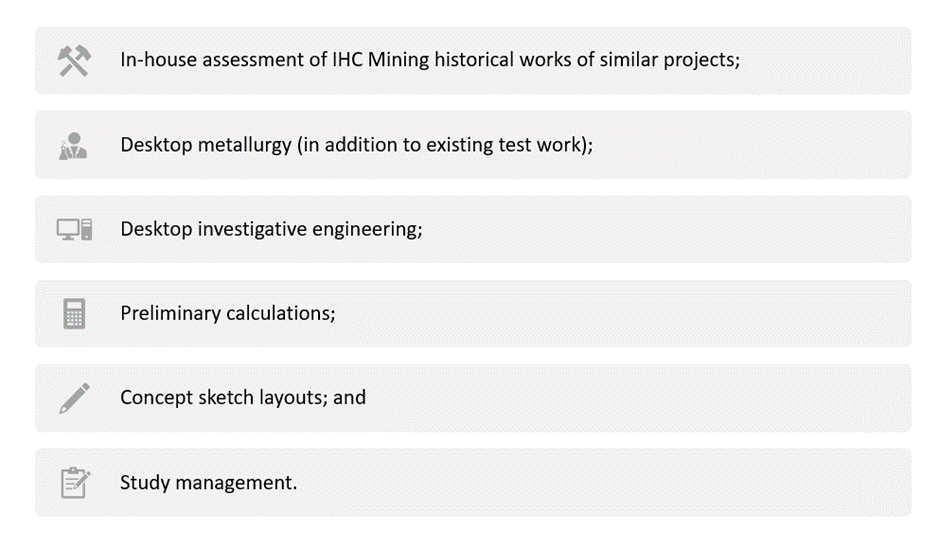

The scope of work (scoping study and associated financial modelling) outlined in the proposal issued by IHC Mining includes mainly the below-listed activities for mining unit plant, wet concentrator plant, mineral separation plant, and general process infrastructure.

Source: © 2022 Kalkine Media®; data source: company update

As per the company, dozer trap mining is the most appropriate strategy for the licences because of the presence of superior economics, a broad acre deposit, little to no overburden, and a pit depth of up to 50 m. This mining methodology is used by many of the tier 1 mineral sands producers.

The IHC Mining study also highlighted a significant mine life of 26 years, with excellent potential to expand.

Source: Company update

With the available metallurgical testwork results, the company is working to optimise ilmenite recovery through alternate process flow sheet options. The company plans to commence the prefeasibility stage (PFS) by focusing on optimising the metallurgical process to further increase the NPV.

Possibilities that can enhance the project’s NPV

With MRG progressing to the PFS, it has already identified a number of opportunities to substantially improve the NPV of the project. Some of them are discussed below.

- The company is considering the possibility of reduced CAPEX via different on-site processing options to optimize the NPV.

- The TZMI concentrate pricing was based on the bulk sample from the Koko Massava deposit. However, the company plans to start mining at Nhacutse/Poiombo, the comprehensive mineralogy results for which indicate a higher-value mineral assemblage.

- MRG is also looking into the low-value per tonne contribution of the non-magnetic concentrate and believes that further metallurgical test work is required to increase its contribution to the potential mine economics.

- MRG has planned an infill/extension drilling and mineralogical study of very high VHM/high THM zones that were not part of the scoping study/PEA. The company is looking to establish a new mineral resource estimate that may significantly impact the mine economics.

- The company is also planning to review plant relocation in the fourteenth year in the PFS stage in light of likely resource growth and pit optimisation over the next 12 months.