Highlights

- MTB is advancing the Kihabe and Nxuu deposits in Botswana, focusing on resource exploration and development.

- The company made significant strides for approval of an Environmental Impact Assessment (EIA) to facilitate drilling at the Nxuu deposit.

- Combined indicated and inferred resources at the Kihabe and Nxuu deposits total 27 million tonnes.

- Significant mineralisation has been confirmed at the Nxuu deposit, with assays for gallium and germanium underway.

MTB's strategic direction emphasises the extraction of valuable metals like vanadium pentoxide, gallium, and germanium to enhance project value. Mount Burgess Mining NL (ASX:MTB) is dedicated to developing the Kihabe and Nxuu deposits in Botswana. Throughout the financial year 2024 that ended 30 June 2024, the company focused on resource exploration and development within the Kihabe-Nxuu project while assessing the path forward.

Approval to advance drilling at Nxuu deposit

In FY24, the company actively engaged with the Department of Environmental Affairs (DEA) in Botswana to secure approval for an Environmental Impact Assessment (EIA). This approval is essential for conducting 2,600 metres of HQ drilling at the Nxuu deposit, enabling the company to quote a JORC 2012 indicated/measured resource estimate, a critical step towards preparing a pre-feasibility study, followed by a definitive feasibility study.

As of the latest update in September 2024, the Department of Environmental protection (DEP) has approved the revised EIA for the project, allowing the application to progress to the next step: a public review of the EIA, paving the way for the infill drilling campaign.

Resource update: Nxuu and Kihabe deposits

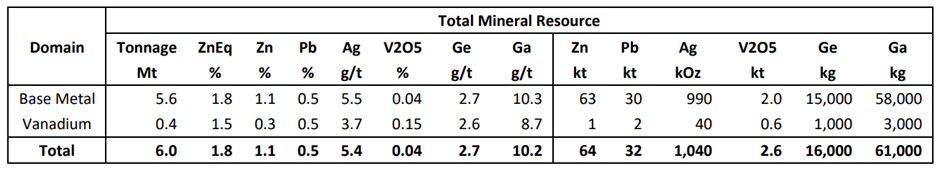

Combined indicated and inferred resources for both the Kihabe and Nxuu deposits now total 27 million tonnes at a 0.5% zinc equivalent low-cut grade.

Data source: Company update

Resource advancement at Nxuu deposit

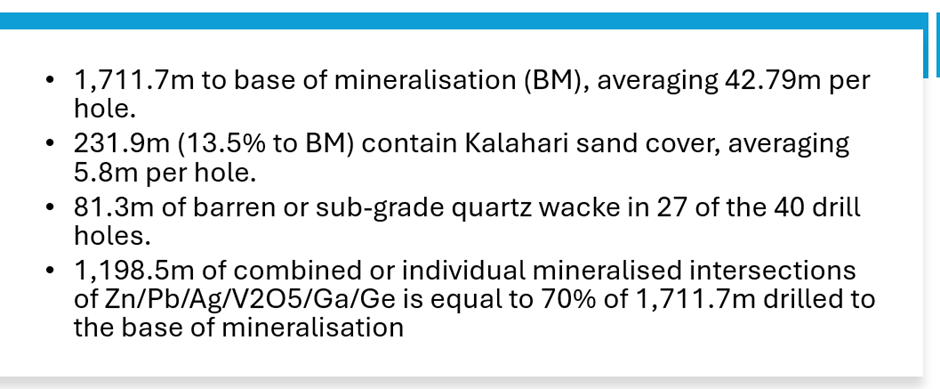

At the shallow basin-shaped Nxuu deposit, 40 drilled holes were assayed for gallium (Ga) and germanium (Ge), along with vanadium pentoxide (V2O5). The results indicated significant mineralisation:

Data source: Company update

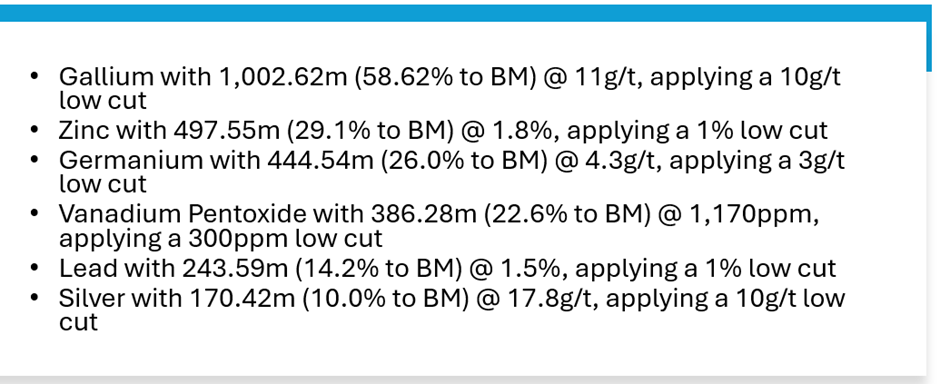

Total of 1,198.5m of individual or combined mineralised intersections contains the following intersections–

Data source: Company update

Gallium and germanium have recently been classified as critical minerals by the United States Geological Survey.

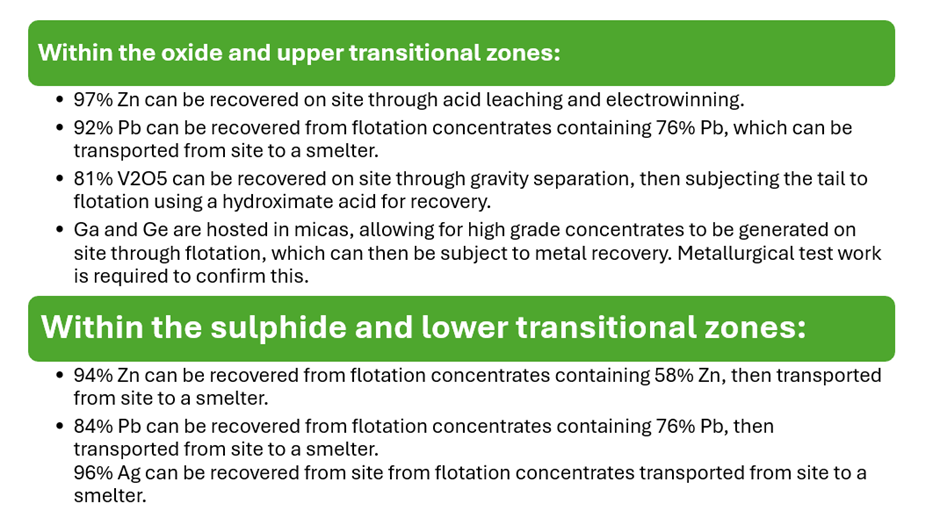

Metallurgical work at the Nxuu deposit has demonstrated that 93% of zinc and 82% of vanadium pentoxide can be recovered on site. Moreover, lead and silver can be recovered on-site. Metallurgical testing for gallium and germanium is currently underway.

Kihabe resource update

The indicated/inferred resource at the Kihabe deposit stands at 21 million tonnes, applying a 0.5% low cut for Zn/Pn, containing 321,000 tonnes of Zn, 154,000 tonnes of Pb, 5,400,000 ounces Ag and 10,000 tonnes of V2O5.

The significant zones of Cu, Ga and Ge mineralisation can only be included in the Kihabe MRE after further drilling and assaying.

Metallurgical and mineralogical test work has demonstrated the following-

Data source: Company update

Share placement boosting financials

In July 2023, the company announced a capital raise of AU$ 530,000 through a share placement. Further, in June 2024, a placement of AU$180,000 was oversubscribed by an additional AU$200,000.

Strategic Focus: Low-Risk Development at Nxuu Deposit

MTB's strategic direction emphasises advancing the development of its Nxuu deposit, which is regarded as a low-risk, low-capital project with a fast track to production.

The company aims to extract not only zinc, lead, and silver, but also valuable metals such as V2O5, Ga, and Ge, which are increasingly in demand for modern technological applications such as vanadium redox flow batteries, semiconductors, and solar panels. MTB believes these metals, consistently present in assays, could significantly enhance the project's value.

The company is exploring effective methods for on-site extraction of these metals.

MTB shares last traded at AU$0.002 apiece on 01 October 2024.