Highlights

- Mount Burgess (ASX:MTB) has reported key advancements that reinforce the development of itsprojects.

- The company has received back-to-back encouraging results from diamond drilling across numerous holes at its 100%-owned Nxuu Deposit.

- Notably, MTB declared a Total Mineral Resource estimate of 21 million tonnes at 2.04% Zn equivalent for its polymetallic Kihabe Deposit.

Mount Burgess Mining NL (ASX:MTB) has started the new financial year FY23 on a strong note. The company has witnessed significant developments in recent times, boosting its confidence in the Kihabe and Nxuu Polymetallic deposits in Botswana.

MTB has secured an updated 2012 JORC Code-compliant Mineral Resource estimate for its Kihabe Deposit. Besides this, the company has also received assay results from various 2021 diamond drill holes at the Nxuu Polymetallic deposit.

Let us look at these key developments of MTB.

Encouraging assay results at Nxuu

In mid-July 2022, MTB received encouraging assay results from diamond drilling undertaken at the polymetallic Nxuu Deposit. These assays formed part of an 18-hole diamond drill campaign conducted in October-December 2021.

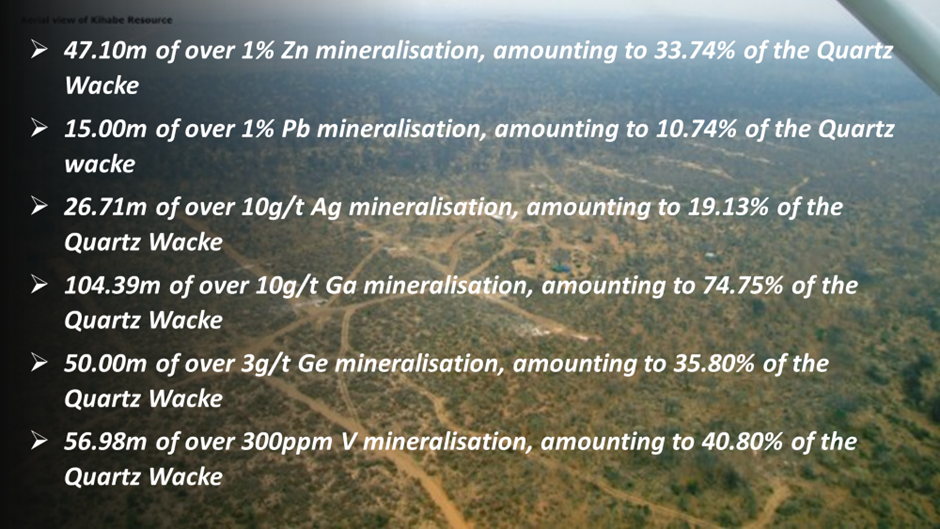

The results suggest that combined mineralisation of 117.43m (84.1%) exists within 139.65 m of oxidised Quartz Wacke beneath Kalahari sand, comprising the following intercepts:

Source: © 2022 Kalkine Media® | Image and Data Source: MTB update

The results indicate the potential for additional mineralisation to exist further west than first believed and would enable MTB to expand the known resource base. These results are highlighted by the length of mineralisation intersected in these holes.

Further assay results boost confidence in Nxuu

By July end, MTB received and assembled assay results for the remaining four holes at the Nxuu Deposit. These were the last four of the 18 diamond core holes drilled in 2021.

The results confirmed that substantial lengths of up to 34.33 m of continuous Ga mineralisation exist on the outer eastern perimeters. This indicated the possibility of additional extensions of Ga mineralisation.

Besides this, the results also confirmed that major lengths of up to 22m Zn, 34m Ge and 23m V2O5 exist within the main mineralised zone.

MTB declares MRE for Kihabe Polymetallic deposit

In a critical development, MTB declared an updated 2012 JORC Code-compliant Mineral Resource estimate (MRE) for the Kihabe Deposit.

The total resource is estimated at 21 million tonnes at 2.04% Zn equivalent and constitutes 11.7 million tonnes of Indicated Mineral Resource (55.9%) and 9.3 million tonnes of Inferred Mineral Resource (44.1%). The application of a 0.5% low cut to a Zn equivalent grade supported the estimation of the Mineral Resource.

The following metal volumes contributed to the 21 million tonnes:

- 321,000 tonnes Zn

- 154,000 tonnes Pb

- 4 million oz Ag

- 10,000 tonnes V2O5

MTB plans to run assays on samples from additional drilling for Ga/Ge/Cu, considered additional potential credits. Currently, these do not constitute the present Mineral Resource estimate.

Moreover, the oxidised part of the Mineral Resource is considered an additional resource for inclusion in a pre-feasibility study, planned for the completely oxidised Nxuu Deposit.

The latest exploration endeavours have advanced the development of the company’s resources at its Kihabe-Nxuu Polymetallic Zn/Pb/Ag/V/Ga/Ge project in Western Ngamiland, Botswana.

MTB shares traded at AU$0.005 on 6 September 2022.