Highlights

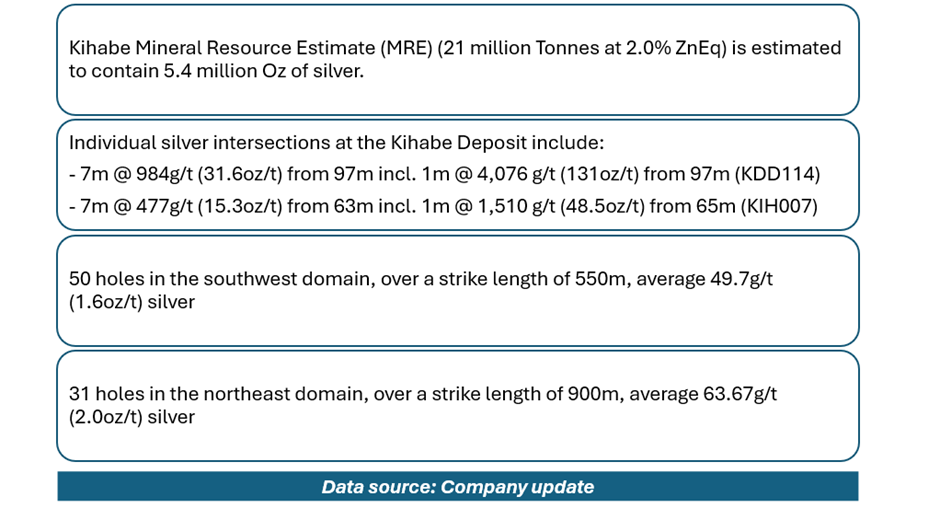

- The Kihabe mineral resource estimate (MRE) of 21 million tonnes at 2.0% ZnEq is estimated to contain 5.4 million ounces of silver.

- Silver is currently trading near a decade-high, driven by increasing demand for green technology applications.

- MTB is currently conducting metallurgical test work to assess on-site recovery of gallium and germanium.

- Gallium prices have surged by ~272% to US$811.2/kg since January 2020.

Mount Burgess Mining NL (ASX: MTB), an Australia-based mineral resource firm, has updated on the silver potential at its Kihabe-Nxuu project in Botswana, responding to recent inquiries. The project's silver content has gained significance amidst rising silver prices and predictions of an upcoming supply shortfall.

The Kihabe-Nxuu polymetallic project is situated in Botswana. Major highlights from the company’s update are:

Additional infill and extensional drilling is required in the southwest and northeast domains. Located 7km east of the Kihabe Deposit, the Nxuu MRE of 6 million tonnes reveals additional 1,040,000 ounces of silver.

Furthermore, the company is currently conducting metallurgical test work to assess on-site recovery of gallium and germanium. The Kihabe Deposit has a substantial exploration target of up to 100 million tonnes @12 g/t gallium.

MTB Chairman Mr. Nigel Forrester stated, “The importance of the silver content of the Kihabe-Nxuu Project is supported by its recent significant price increase to 10-year highs.”

He emphasised the positive impact of this development on the project,, anticipating increased demand for silver due to its critical role in green technologies such as solar panels, batteries, and wind turbines.

Additionally, he highlighted the significance of gallium within the Kihabe-Nxuu project, noting its remarkable price surge of 272% to US$811.2/kg since January 2020. This surge is predominantly driven by the demand for gallium nitride chips, which are increasingly replacing silicon chips in handling the higher heat generated by expanding 5G communication traffic in computers, laptops, and smartphones.

Earlier this month, MTB announced that its placement, initially aimed at raising AU$180,000, was oversubscribed by an additional AU$200,000.

The share price of MTB was AU$ 0.001 at the time of writing on 24 June 2024.