Highlights

- Mineral Commodities (ASX:MRC) marked significant progress in the September quarter in line with its Strategic Plan 2022-2026.

- The Company secured an offtake and funding agreement, the De Punt prospecting right, and a government critical minerals grant.

- MRC reported a fourth consecutive quarter of stabilised operating performance at Skaland, while Tormin’s operating performance remained strong and above budget expectations.

- Post the quarter, the Company announced a capital raising program worth AU$15.7 million.

The September quarter of 2022 was an exciting period for Mineral Commodities Limited (ASX:MRC), with several strategic milestones achieved as part of its Strategic Plan 2022-2026.

During the reported period, the Company entered into a non-binding offtake and funding agreement with the GMA Group, secured the De Punt prospecting right at South Tormin, and executed an agreement for an alternate process pilot-scale battery anode plant in Canada.

The period also saw the newly elected Australian Federal Government confirming critical minerals grant funding for MRC.

Subsequent to the period, the Company announced plans to raise up to AU$15.7 million in additional funding towards its Strategic Plan Growth Strategy. Click here to glance through MRC’s Strategic Plan 2022-2026 along with its world-class critical and industrial mineral assets.

Operational achievements at Skaland and Tormin

The Tormin Mineral Sands Operation in South Africa is one of the world’s highest-grade mineral sands operations in the world, while the Skaland Graphite Mining Operation is one of the world’s highest-grade operating flake graphite mines and is strategically located in Europe.

- Tormin operations: The Company achieved a 24% increase in material mined to 0.85 million tonnes during the September quarter. Also, the run-of-mine volumes for the quarter stood at circa 3.14 Mtpa. The mining and processing throughput for the operations remains above budget expectations.

- Skaland operations: The concentrate sales during the quarter saw a robust performance, with 2,530 tonnes of graphite concentrate sold, compared with 2,319 tonnes sold in the previous quarter. This was the fourth consecutive quarter of stabilised operating performance at Skaland.

MRC-GMA agreement for finished garnet products

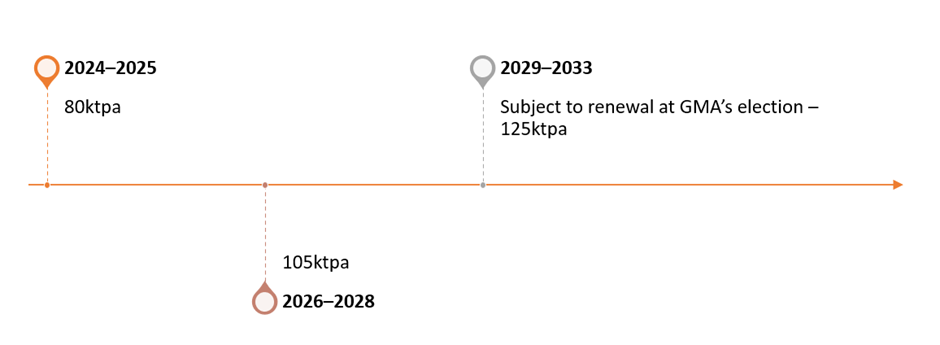

MRC entered into a non-binding offtake and funding agreement with Garnet International Resources Pty Ltd, a member of the GMA Group. As per the agreement, the Company will supply the below-mentioned volumes of finished garnet product to the GMA Group:

(Source: © 2022 Kalkine Media®, data source: Company’s update)

The Company expects the offtake agreement to form the foundation for expanding its revenue base and profitability at Tormin, which produced 145 kt of garnet concentrate in 2021.

Also, the GMA Group agreed to provide MRC US$10 million in loan funding, repayable over five years from 1 January 2024. As reported, the Company will channelise the funding for the design and construction of a 250-300 ktpa garnet and ilmenite mineral separation plant (MSP) in the Western Cape region of South Africa.

The Company believes the agreement is in tune with its strategic plan to transition into higher-value finished products. The Company estimates that the construction of the MSP will be completed by the December 2023 quarter.

De Punt prospecting right: a step towards exploration expansion

MRC was granted the De Punt prospecting right, 10240PR, at South Tormin, enabling the Company to extend exploration another 13 km south along strike of the Inland Strands deposit.

The development allows Mineral Sands Resources, the Company’s 50%-owned South African subsidiary, to begin prospecting activities, including a resource definition drilling program, on the deposit.

The development is in line with its strategic plan targeting larger-scale and diversified operations by increasing mineral resources to boost production significantly.

Australian government confirms critical minerals grant funding

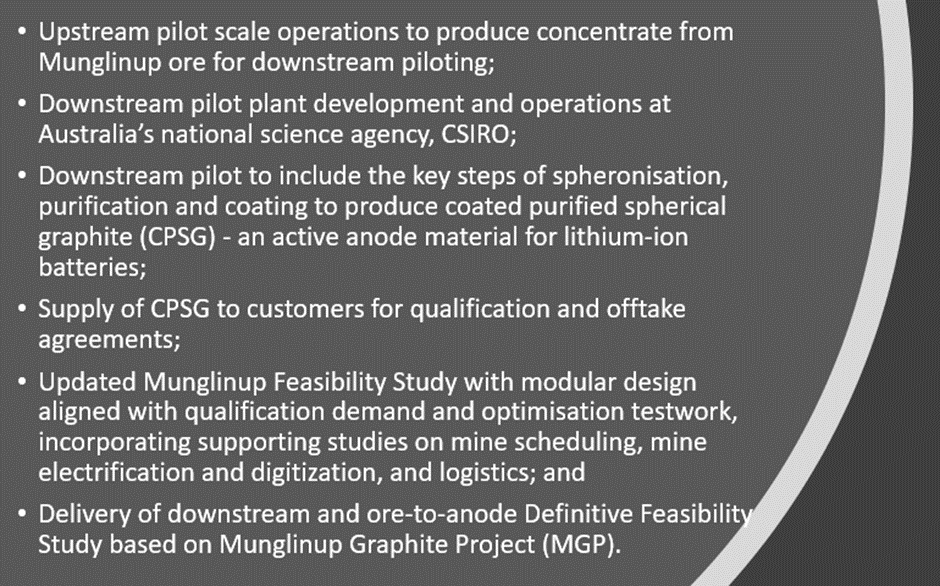

MRC received the confirmation of approval for the critical minerals grant from the Australian Federal Government to build a pilot-scale battery anode plant in the country. The grant comes under the Critical Minerals Acceleration Initiative.

The grant-funded project includes the following activities:

(Source: © 2022 Kalkine Media®, data source: Company’s update)

MRC expects this development to support its decision to increase the equity position in the Munglinup Graphite Project (MGP) to 90% and a final investment decision on an integrated ore-to-anode materials development at the MGP.

It will also support the Company in achieving a significant increase in graphite concentrate production beyond the current operating Skaland graphite mine in Norway.

Equity agreement and graphite purification collaboration

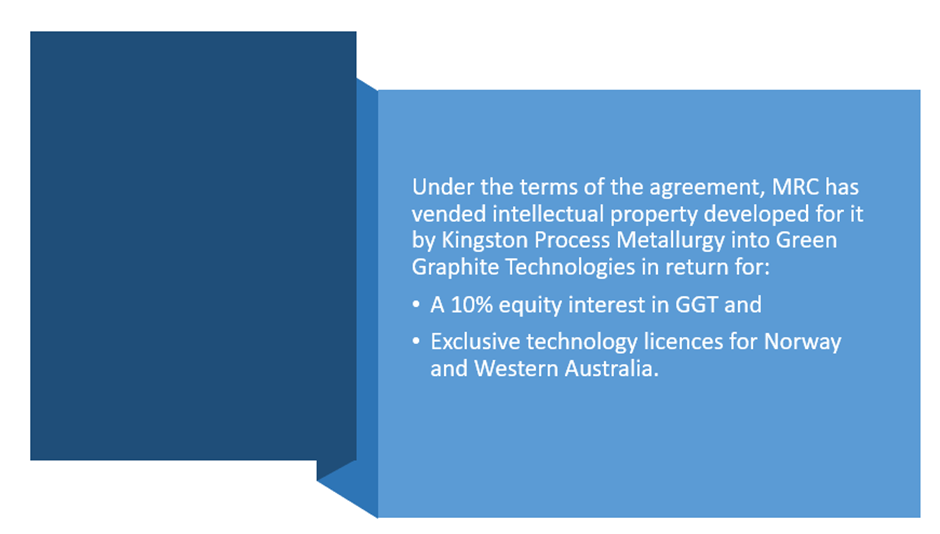

MRC entered into an equity and licence agreement with Green Graphite Technologies (GGT).

(Source: © 2022 Kalkine Media®, data source: Company’s update)

GGT also successfully received CA$1 million Canadian grant funding from Sustainable Development Canada for the pilot-scale development of the GraphPureTM process. The Company also holds the trademarked purification process GraphPureTM in Canada.

“The agreement allows MRC to cost-effectively advance two purification processes (GraphPureTM and the CSIRO process) through pilot-scale development, further de-risking this key enabling technology for natural graphite anode materials and supporting our strategic plan for vertically integrated ore-to-anode materials production,” said MRC Managing Director Jacob Deysel on the agreement update.

Financial footing

At the end of the quarter, the Company had US$1.9 million in cash and US$9.3 million in debt.

In October, MRC announced its plans to raise up to AU$15.7 million via a placement and rights issue.

The Company believes its proposed funding strategy is well timed to

- Enhance near-term cashflow generation from the Tormin operation

- Grow resources and reserve

- Deliver the next stage of its battery minerals downstream anode production execution plan

In essence, during and post the quarter, MRC continued efforts to meet the objectives of its Strategic Plan, which aims to return the Company to solid profitability through maximising profitability from existing assets, while expanding its resources and reserves and enhancing downstream vertical integration.

MRC shares last traded at AU$0.071 on 1 November 2022.