Highlights

- KRR received promising assay results from RC drilling at Langrenus, revealing significant gold concentrations.

- Phase 2 drilling at Providence identified significant geochemical anomalies in gold, bismuth, and copper.

- A second phase of RC drilling is planned for the Kurundi main prospect following the completion of regional drilling.

- KRR anticipates generating new drill targets from the ongoing processing of 2023 geophysical results.

- The company closed the quarter with over AU$4.2 million in cash.

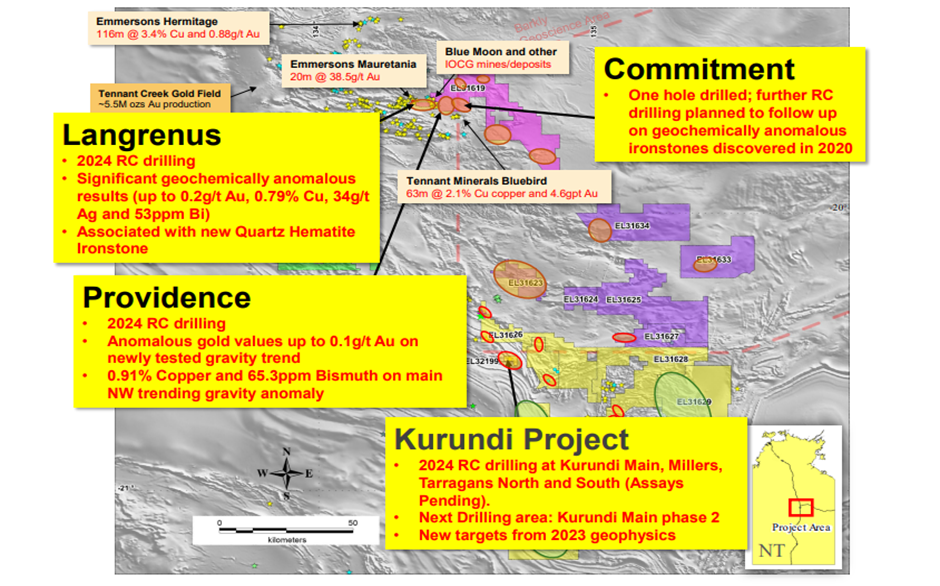

King River Resources Limited (ASX:KRR), an Australia-based gold exploration company, concluded its September quarter with significant advancements in exploration activities at the Tennant East Project area in Northern Territory’s Tennant Creek region.

The company reported encouraging assays from drilling focused on Iron Oxide Copper-Gold (IOCG) targets at the Langrenus and Commitment prospects.

This drilling effort is part of KRR's AU$2 million budget, aimed at following up on targets identified during the 2023 geophysics program across various sites, including Rover East and Barkly. These areas were strategically chosen for their proximity to known high-grade copper and gold deposits, with additional drilling phases planned for the year ahead.

Image source: Company update

Promising Assay Results from Langrenus Drilling

KRR reported promising assay results from initial drilling at Langrenus, comprising 15 RC holes totaling 2,262m. The results revealed significant geochemical anomalies and gold concentrations. Notable findings included a broad quartz hematite structure with values reaching up to 0.2g/t Au, alongside other elements such as 53ppm Bi, 206ppm As, 93ppm Sb, 178ppm Co, and 3.8ppm Ag.

As per the company, these new geochemically anomalous results are encouraging and provide a strong structural target along the strike of the complex ironstone and mineralised trend that hosts the Mauretania and Hopeful Star deposits.

Further exploration is planned to investigate the orientation and extent of this newly identified geochemical anomaly.

Promising Geochemical Findings Unveiled at Providence

KRR also received results from phase 2 of RC drilling at Providence, covering five holes over 678m. This targeted program aimed to follow up on structures and geochemical findings from KRR's 2023 drilling campaign and to gather data for deeper exploration of gravity anomalies and structural intersections.

Notably, two of the holes revealed significant geochemical anomalies, including encouraging gold, bismuth, and copper results. As per the company, these findings are promising, and further exploration is planned to investigate the orientation and extent of the associated ironstone structures.

KRR anticipates generating additional drill targets as it processes and interprets 2023 geophysical results across its projects. Meanwhile, drilling at Kurundi Regional targets is complete, with assays pending. The rig will return to Kurundi Main for a second phase of drilling, and preparations are underway for testing the Kuiper and Rover East gravity targets.

Firm financial footing

On 8 July 2024, the company received a cash payment of AU$1.6 million related to the sale of the Speewah Project.

At the end of the quarter, KRR had a receivable of AU$2.4 million from Tivan Limited, due by February 2025, following restructured payment terms announced in February 2024. Additionally, Tivan has agreed to issue more shares if their value falls below AU$10 million on 17 February2025.

Furthermore, KRR extended its on-market share buy-back program for another year, though no shares were purchased during this quarter.

As of 30 September 2024, KRR's cash position stood at AU$4,200,176.

The share price of KRR was AU$ 0.009 at the time of writing on 29 October 2024, up over 12.5%.