Is Kalkine legit? Is it worth your money? These questions pop up in the mind of many, so read on as we bring you up to speed with this research firm.

Let’s look at few key features: -

Establishment & Leadership: - Kalkine is an equities and stock market research firm founded in 2014 with its head office based in Sydney. It is a registered Australian company and its ACN 154 808 312 and Australian Financial Services Licence (AFSL) number is 425376. This AFS licence authorises Kalkine to provide general financial product advice. Kalkine primarily operates online, providing investors with recommendations on which stocks to buy, hold or sell along with stock market insights, analysis and financial information. Kalkine has positioned itself as a prominent figure in the world of stock investing and market research. On a global scale, Kalkine Group has around 19k paid subscribers, indicating a level of popularity and trust among investors in different jurisdictions.

Investment Philosophy: Kalkine's investment philosophy centers on identifying well-diversified companies with various investment themes, such as value-investing, growth-investing, momentum-investing, and possibly others.

Decision Making Process: The decision-making process is based on both qualitative and quantitative factors. The goal is to identify research-driven attractive investment opportunities within the market for varied asset classes including stocks, commodities, cryptocurrencies and much more.

Performance Reporting: Kalkine is quite transparent in reporting its yearly performance numbers on the website for respective research products backed by qualified third-party auditors to ensure credibility. The website provides updates on 'Sell' recommendations, enabling the audience to gauge percentage gains or losses incurred in each position.

It's important to note that while the information provided sheds light on Kalkine's claimed position and approach, it's essential for potential users or investors to conduct thorough research, including verifying the accuracy of the claims made and assessing the quality and relevance of the investment recommendations.

So, is Kalkine legit? The answer is an absolute YES.

Kalkine publishes equity research reports as a general advice on ASX-listed and globally listed stocks identified as the key opportunity areas for investors in this complex world of financial markets.

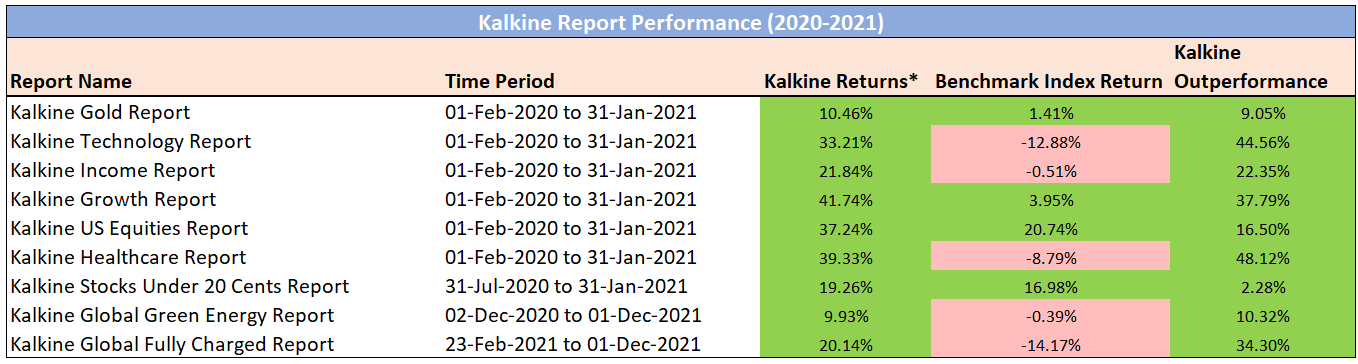

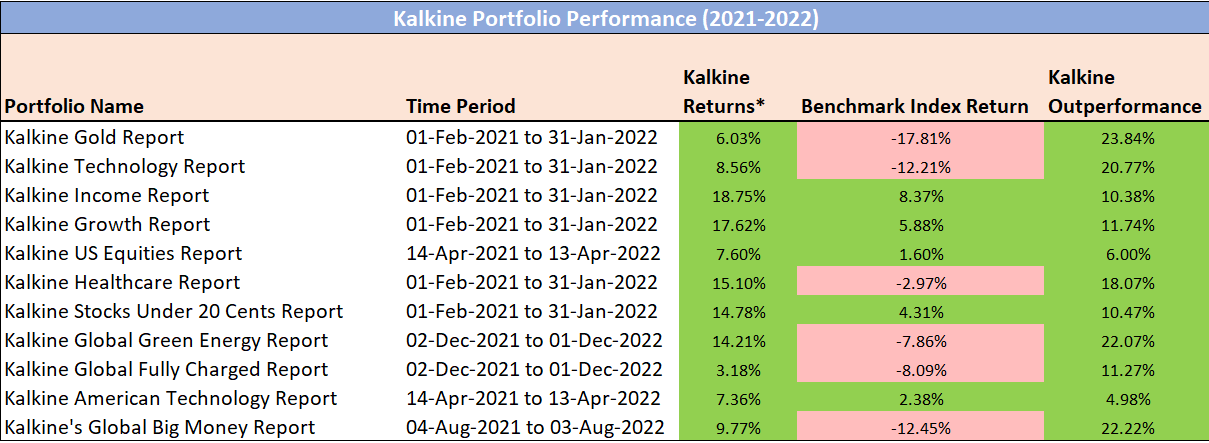

Guided by the core principles of transparency and creditability, Kalkine publishes its yearly portfolio performance versus benchmark index performance as verified by an independent external auditor on the website. The performance summary for the years 2020-2021 and 2021-2022 can be viewed as below: -

Note: Kalkine Technology Report & Technology Index Performance do not include dividend yield.

Past performance is not a reliable indicator of future performance.

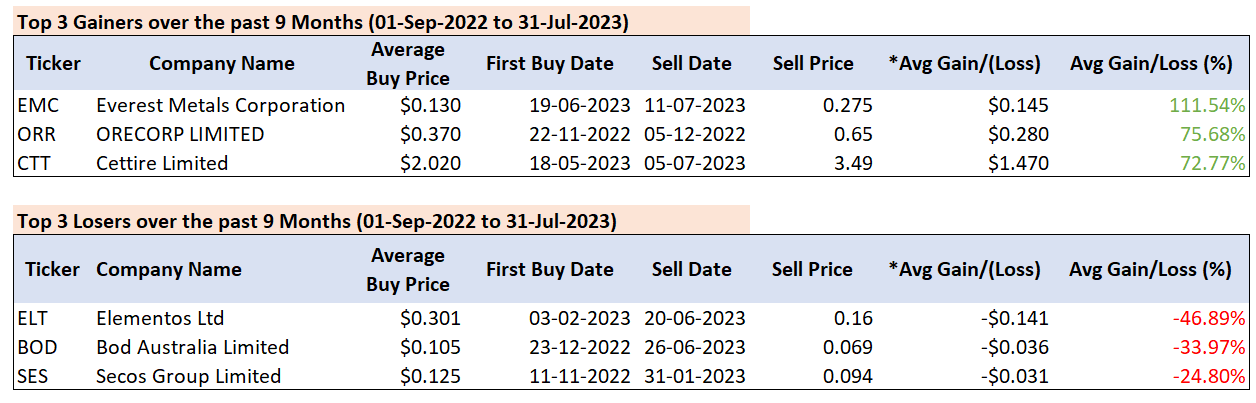

Below are some of the recent winners and losers from Kalkine’s stock coverages in fundamental analysis reports over the past nine months. On average the top three gainers yielded 86.66% gains while the top three losers have resulted in -35.22% losses over the period. One of the top performing stocks, Everest Metals Corporation Limited (ASX:EMC) yielded 111%+ returns in a short span of less than a month.

Past performance is not a reliable indicator of future performance.

Source: Kalkine

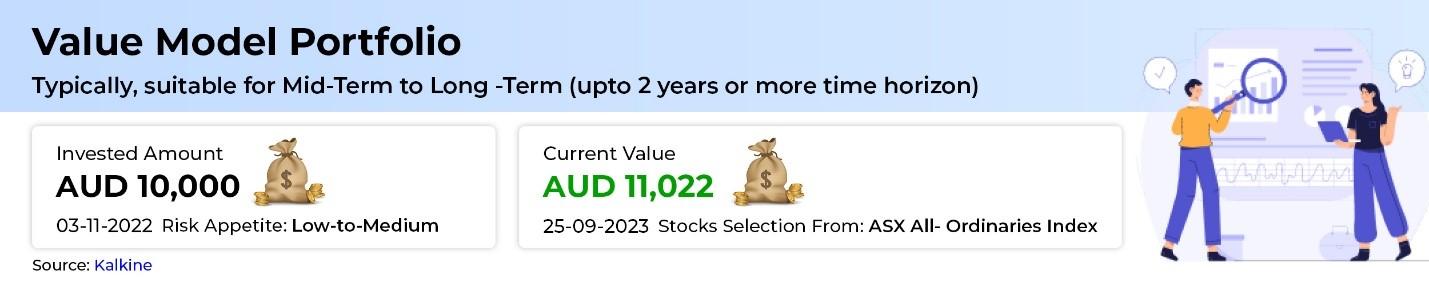

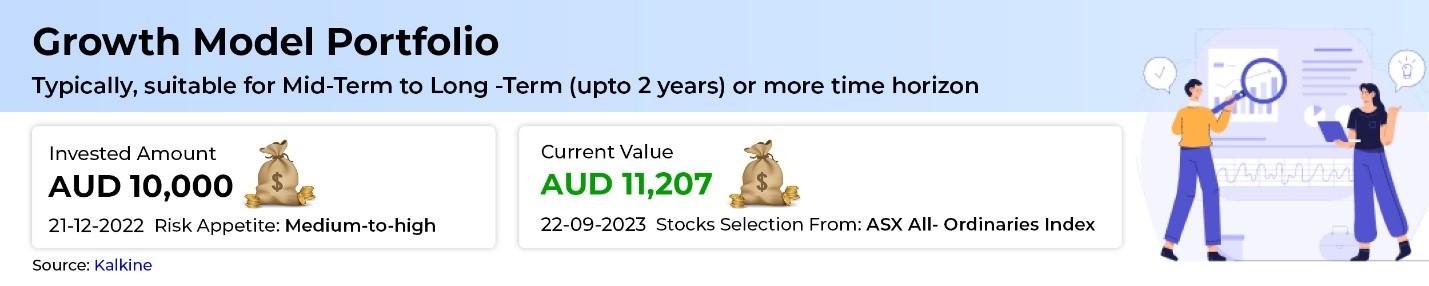

For medium-to-long term investors, Kalkine identifies ‘Model Portfolios’ to be an opportunity area for different types of audiences as general advice only. Kalkine’s theme-based model portfolios are visible on its website and the stock prices are tracked in an automated manner to present updated portfolio performance in an efficient manner.

The availability of theme-based model portfolios and automated tracking of stock prices can provide valuable insights and guidance to investors who are interested in specific investment themes or strategies.

Let’s have a look at the performance so far for respective portfolios launched in November-December 2022: -

THE BOTTOM LINE - Historical returns should not be viewed in isolation; they should be considered alongside the associated risks and market conditions. In isolation, past performance does NOT guarantee future results, as various factors such as market changes, macroeconomic variables, or management decisions can lead to markedly different future performance.

Kalkine’s in-house research team is the core engine publishing data-driven tech-enabled reports for subscribers. The company’s disciplined approach, extensive fundamental research, and the technical eye is backed by a team of rich experienced analysts with professional background holding qualified certifications such as Master’s in Business Administration with specialization in Finance and or Chartered Financial Analysts (CFA). Also, our research team members are RG -146 certified for Tier 1 Generic Knowledge and Securities and Managed Investments - General Advice.

So that is how we can conclude that Kalkine is here to help investors make informed decisions in an efficient manner!

Disclosure: Kalkine Pty Ltd (Kalkine) is a related entity of Kalkine Media Pty Ltd. (Kalkine Media).The inclusion of Kalkine in this article should not be construed as an endorsement or recommendation of its products, services, or activities. Readers are encouraged to conduct their own research and due diligence before engaging with Kalkine in any capacity.

_09_29_2023_10_46_12_745913.png)