Highlights

- Mount Burgess conducted a thorough review of the high-grade silver domains at the Kihabe polymetallic deposit.

- The mineral resource estimate for the Kihabe Deposit includes 5.4 million ounces of silver.

- The Kihabe Deposit has a substantial exploration target of up to 100 million tonnes with an average of 12 g/t of gallium.

- MTB emphasises that rising silver prices and anticipated supply deficits have significantly increased the value of the project's silver content.

- The company is seeking approval for an Environmental Impact Assessment (EIA) for HQ diamond core drilling at Nxuu.

Mount Burgess Mining NL (ASX:MTB) concluded the June quarter with significant developments at its Kihabe-Nxuu polymetallic project. The company conducted a detailed review of high-grade silver domains at the Kihabe deposit and collected samples for mineralogical and metallurgical tests to validate the on-site recovery of gallium and germanium from the Nxuu and Kihabe Deposits.

The Kihabe-Nxuu Project is located on Tribal Land in Botswana. The company is seeking approval for an EIA from Botswana’s Department of Environmental Affairs for 2,600 metres of HQ diamond core drilling at Nxuu. This drilling aims to deliver a JORC-compliant resource estimate and support subsequent feasibility studies.

During the quarter, the company raised AU$ 380k through the issue of 253,333,333 shares at AU$ 0.0015 through GBA capital.

MTB pursues silver opportunities at Kihabe Deposit

MTB notes that, given the recent rise in silver prices and forecasts predicting a structural deficit in the coming years, the significance of the project's silver content has increased.

Additionally, the importance of gallium and germanium has been highlighted by their recent price surges. Since January 2020, gallium prices have surged by 298% to US$889.30 per kilogram, and germanium prices have climbed 162% to US$3,327.10 per kilogram.

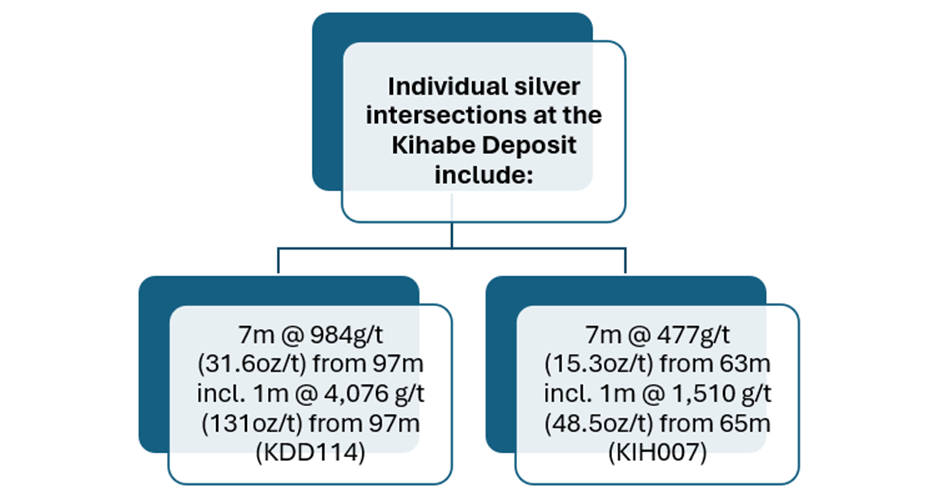

Key highlights from the Kihabe Deposit Silver Domains include:

- The Kihabe Mineral Resource Estimate, totaling 21 million tonnes at 2.0% ZnEq, is projected to contain 5.4 million ounces of silver.

- A global silver deficit of 215.3 million troy ounces is anticipated for 2024.

Data source: Company update

The company is also conducting metallurgical testwork to evaluate the onsite recovery of gallium and germanium, which are not yet part of the Kihabe Mineral Resource Estimate.

The Kihabe Deposit has a large exploration target of up to 100 million tonnes with an average of 12 g/t of gallium.