Highlights

- IOUpay has shared an update on its three income generating assets: IDSB, Mobile Banking, and the BNPL business.

- The ASX-listed firm’s investment partner, I.Destinasi Sdn Bhd (IDSB) is progressing the renewal process for IDSB’s AG Code as the agreement between IDSB and the Accountant General’s office in Malaysia expired earlier this month.

- Its BNPL division is registering growth in transaction volumes with new batches of merchants being activated.

- IOUpay is also considering introducing new variations to the BNPL business model to accelerate its path to profitability.

ASX-listed financial technology (fintech) company IOUpay Limited (ASX: IOU) has released an update on the Australian Securities Exchange (ASX) sharing details about its three income generating assets: IDSB, Mobile Banking, and the Buy Now Pay Later (BNPL) business.

Renewal of IDSB AG Code

IDSB is advancing the renewal process for IDSB Accountant General Salary Deduction Code (AG Code) as the long-standing formal agreement between the Accountant General’s office in Malaysia and iDestinasi Sdn Bhd (IDSB) expired earlier this month.

The Company expects the AG Code by IDSB to be formally renewed in the coming week, post the Hari Raya holidays in Malaysia.

As per the company release, recent trading at IDSB has been strong. Its monthly dividend payments to the Company have been at RM235,200 (approximately AU$80,000) in recent months, pursuant to the Company’s 21% shareholding.

The earnings run rate established in IDSB’s management accounts for January and February 2023 suggest that it would register a 15% increase in net profit this year as compared to 2022.

If the business continues to grow as expected, IDSB may list on the Bursa Malaysia in the future, states IOUpay.

Mobile Banking

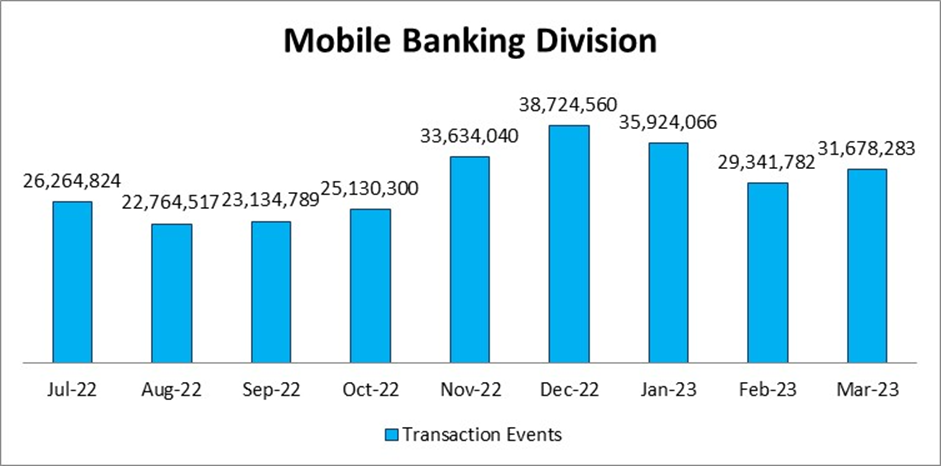

IOUpay has been able to scale up its Mobile Banking division posting high transaction volumes every month.

Source: Company Update

IOUpay’s Mobile Banking division provides the core of the Company’s fintech offering and continues to be profitable, with performance enhanced in recent months following cost cutting initiatives undertaken by the Board.

The Company has been building its customer base, bringing new customers onboard and is in talks with major new partners. Further, trials with Huawei are in progress for a significant new mobile messaging business deployment in Malaysia.

Buy Now, Pay Later

IOUpay recommenced its BNPL business on 27 March 2023, following a brief pause during March, with carefully selected groups of merchants offering the myIOU BNPL service, and strict vetting of customers.

There has been growth in transaction volumes following the addition of new batches of merchants. At present, the myIOU BNPL business hosts 75,000 registered customers and an active database of 3,000 merchants.

The Board’s cost cutting initiatives across the group have resulted in savings of 40% in the BNPL division. IOUpay is also planning to bring in new variations to the BNPL business model to further boost its profitability.

Additionally, the Company is harnessing its partnership with IDSB, and the BNPL division is

building novel loan products for the low credit risk market of ~1.6 million civil servants in Malaysia.