Highlights

- IMU has dosed the first patient in Phase 1b allogeneic CAR T clinical trial using azer-cel

- Azer-cel is presently being studied in a Phase 1b CAR T clinical trial in patients with NHL, a type of blood cancer

- The azer-cel clinical drug is being provided by IMU’s manufacturing facility in North Carolina

Imugene Limited (ASX: IMU) has hit a new milestone in its clinical study designed to find a treatment for cancer.

The ASX-listed company has dosed the first patient in a Phase 1b allogeneic CD19 CAR T clinical trial using azer-cel. The first dose was administered to a patient suffering from Diffuse-Large B-cell lymphoma (DLBCL), a sub-set of blood cancer called non-Hodgkin’s lymphoma (NHL).

Details of Phase 1b study

The Phase 1b allogeneic (allo) CAR T study is being carried out in subjects diagnosed with non-Hodgkin’s lymphoma (NHL) and B-cell acute lymphocytic leukemia (ALL).

Data source: Company update

What is azer-cel?

An allogeneic off-the-shelf CD19 CAR T, azer-cel is made and supplied by a facility of the company located in North Carolina, where the proprietary next generation azer-cel process has been developed into a potential first-in-class cell therapy drug.

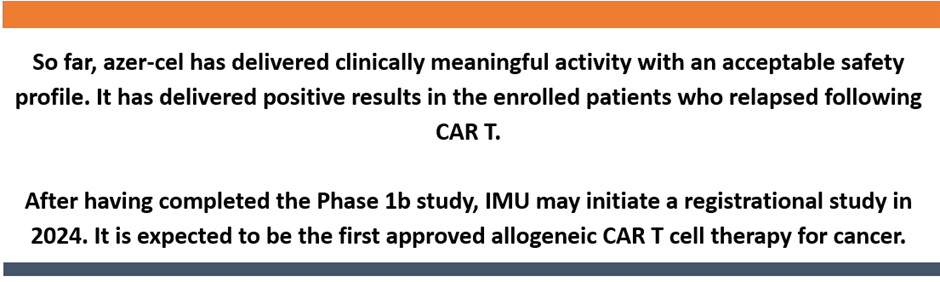

In September, the U.S. Food and Drug Administration (FDA) had given positive feedback on the manufacturing process of azer-cel for use in the registrational (to-market) clinical study, and potentially for producing the commercial drug product.

Besides its use in blood cancers, azer-cel may be used in combination with IMU’s own onCARlytics to treat patients with solid tumours in the future. This application of the clinical drug will make its way to a potentially bigger market of oncology, says the company.

IMU shares trade higher

IMU shares were spotted trading at AU$0.120, with a gain of over 9%, midday on 10 November 2023.