Highlights

- Tempest Minerals has released its half-yearly report for the six-month period ended 31 December 2022.

- During the period, Tempest conducted a large regional surface geochemistry sampling project at the Ktulu target for 91 drillholes with over 7,336 metres of diamond, reverse circulation and aircore drilling.

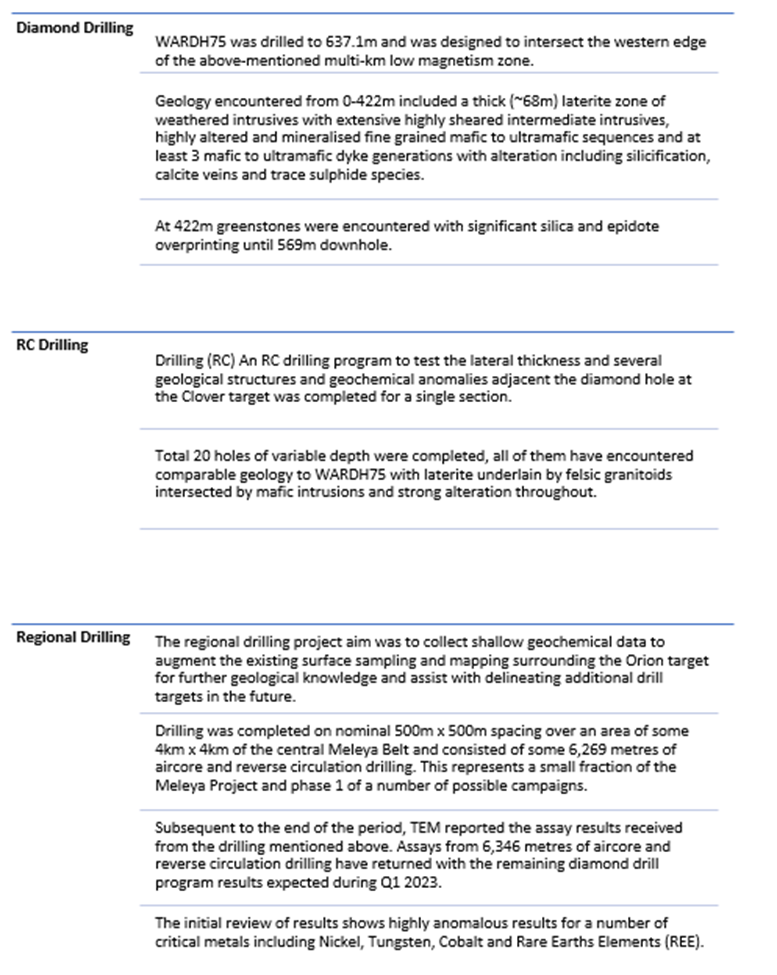

- TEM completed a diamond hole (637.1m) WARDH75 with thick sequences of highly altered mafic geology and minor sulphides observed throughout the hole at the Meleya Project.

- At the Euro Project, work centred around interpretation of soil sampling and previous drilling in addition to regulatory approval submissions for possible future drilling.

Tempest Minerals Limited (ASX: TEM) has been driving growth and progress across its projects with strong focus on mineral exploration and identification of new exploration opportunities. The company continued its principal activities during the half-year ended 31 December 2022 in line with its business priorities.

Here’s a quick overview of the consolidated report released by the firm earlier this month!

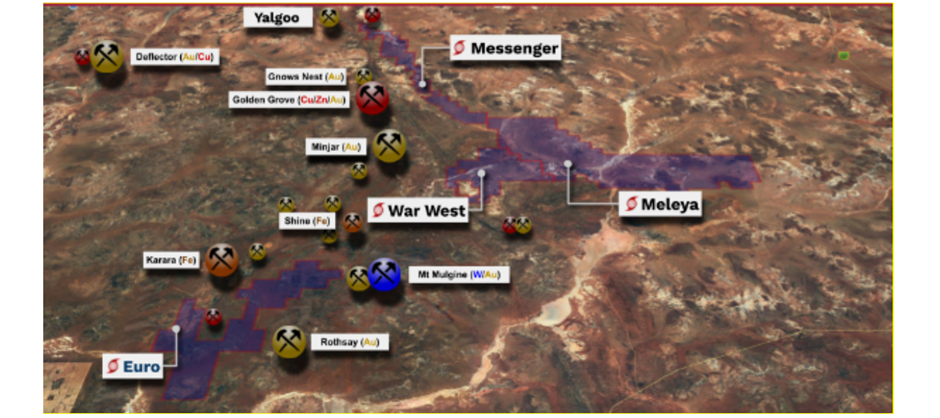

Overview of TEM Yalgoo projects

TEM’s exciting project areas in the Yalgoo region

Meleya Project: During the period, Tempest undertook a large regional surface geochemistry sampling project at the Ktulu target for 91 drillholes over 7,336 metres of diamond, reverse circulation and aircore drilling. The company intersected widespread alteration and minor sulphides at numerous locations.

TEM completed a diamond drill hole (WARDH74) for 427.1m during the period. Around 40m of cover and lateritic clay horizons underlain by repeating sequences of greenstones sequestered by the emplacing intermediate intrusives were intersected during drilling.

Throughout the hole, intermittent minor sulphides were intersected along with contained intermittent potassium-feldspar epidote and silica flooding alteration.

TEM is expecting assay results from the diamond drilling at the Master Target in the first quarter of 2023.

Significant data from drilling campaigns

The Euro Project

From legacy drilling, thick gold intercepts were marked in the Project. However, much of the greater Euro Project has not been explored yet. Previously, major gold mineralisation has been confirmed in the north of the project. According to the ASX release, the Euro Project has also shown itself to be highly prospective for precious, base metals and other commodities.

Work during the period centred around interpretation of soil sampling and previous drilling in addition to regulatory approval submissions for possible future drilling.

The Messenger Project

During the period, TEM assessed data from previous mapping campaigns and continue to correlate geology to the current Meleya work.

The Mount Magnet Region

During the reporting period, the company concluded geological mapping and assessing the potential correlations to historic work or exploration targets this may produce.

TEM’s position in the global lithium market

Tempest Minerals has been developing a strong de-risked position in the global lithium market since the year 2017. Be it in Australia or overseas, the firm has been growing its interests by developing its exploration projects portfolio across Western Australia, Africa, and the USA.

TEM has a sizable holding of about 40 million shares in Premier African Minerals (AIM:PREM), following a 2020 divestment deal. PREM holds huge premium to the deal price due to advancements and potential upside in the portfolio.

TEM holds exposure to the Tonopah Lithium Project in Nevada, USA under an agreed payment of AU$250,000 payable upon ASX listed Argosy Minerals Ltd (ASX:AGY) announcing a JORC compliant reserve at the project of minimum one million tonnes of lithium carbonate equivalent product or beginning of commercial production of lithium product at the Tonopah Lithium Project.

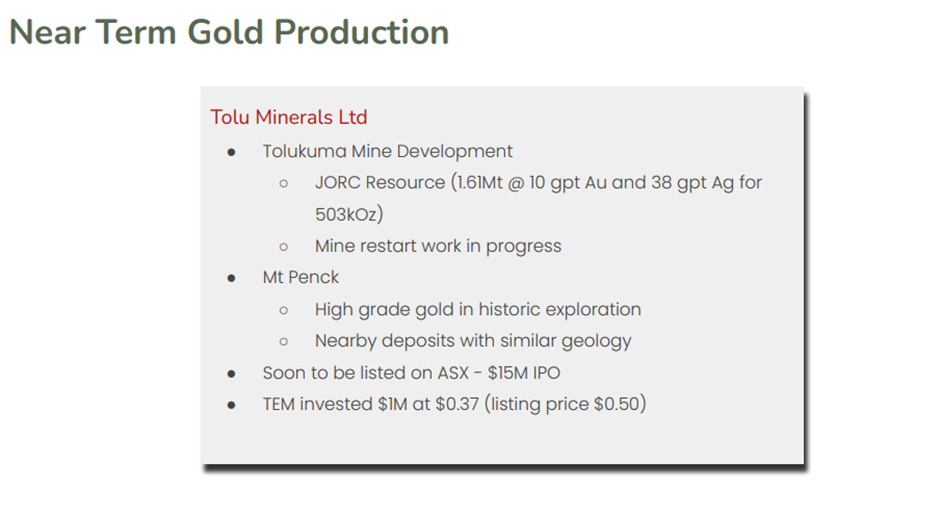

Entering the PNG sector

TEM subscribed for 2,702,703 Shares at an issue price of AU$0.37 in Tolu Minerals Ltd (formerly called Lole Mining Ltd) in late September 2022, for a total investment of AU$1 million.

With this transaction, TEM could move ahead to the final stage of acquisition of the Tolukuma Gold mine. This also brought with it great exposure to high grade pre-production projects into TEM’s portfolio.

Merging with New Nevada Acquisition and IPO

Tempest Minerals intends to combine the underexplored hard rock lithium exploration

projects in WA held by its 100% subsidiary, West Resource Ventures Pty Ltd (West Resources) with the Smith Creek lithium brine Property in Nevada USA and take forward an Initial Public Offering (IPO). The company has decided to rename West Resources as Electra Minerals Ltd.

Under the terms of the deal, West Resources and Iconic Minerals Ltd entered into a binding agreement, wherein West Resources will acquire Lithium of Nevada Pty Ltd (LON) for the rights of up to 50% acquisition of the Smith Creek Project and raise approximately AU$3.5 million as pre-IPO capital and then AU$10 million as part of an Australian Listed IPO to develop the projects.

The company is holding discussions with the parties involved. Planning and documentation processes are also underway.