Highlights

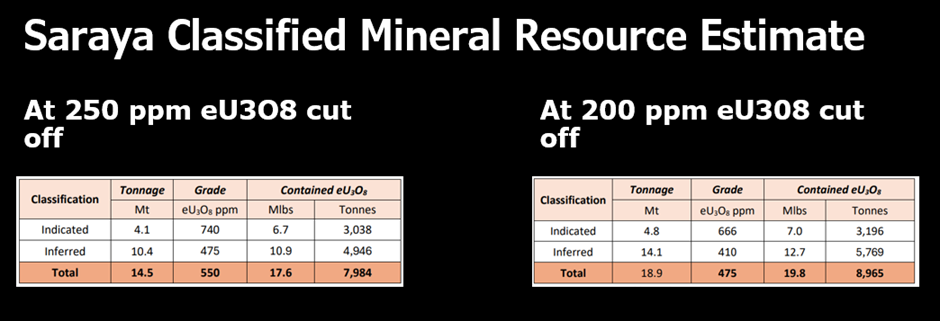

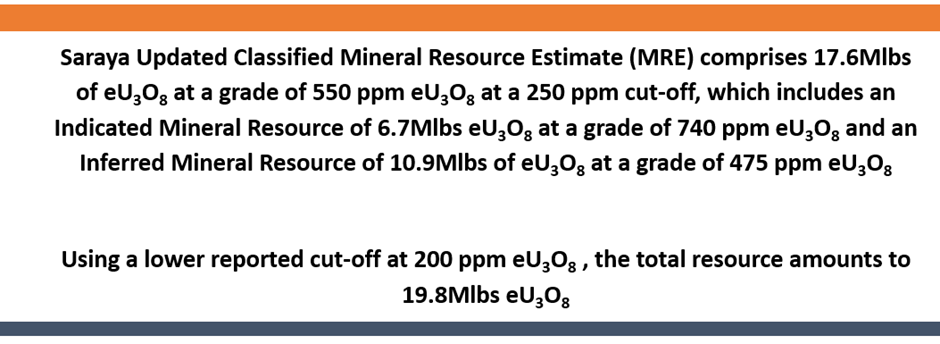

- The Mineral Resource Estimate (MRE) of the Saraya Uranium Deposit is 17.6Mlbs with a 250ppm cut-off and at lower cut-off of 200ppm, total resources reaches 19.8Mlbs.

- The Saraya uranium project covers a total area of 1,650km2.

- The project shows potential for exploration upside, with several regional anomalies indicating a larger footprint than the Saraya resource.

- Approximately 80% of the MRE is within 140 metres of the surface, suitable for open-pit mining.

- Recent ore characterisation tests and comprehensive termite mound sampling have enhanced confidence in the Saraya resource.

Haranga Resources Limited (ASX:HAR, FRA:65E0) has reported an upgrade to the MRE for its Saraya Uranium Deposit in West Africa, which covers an area of 1,650km2.

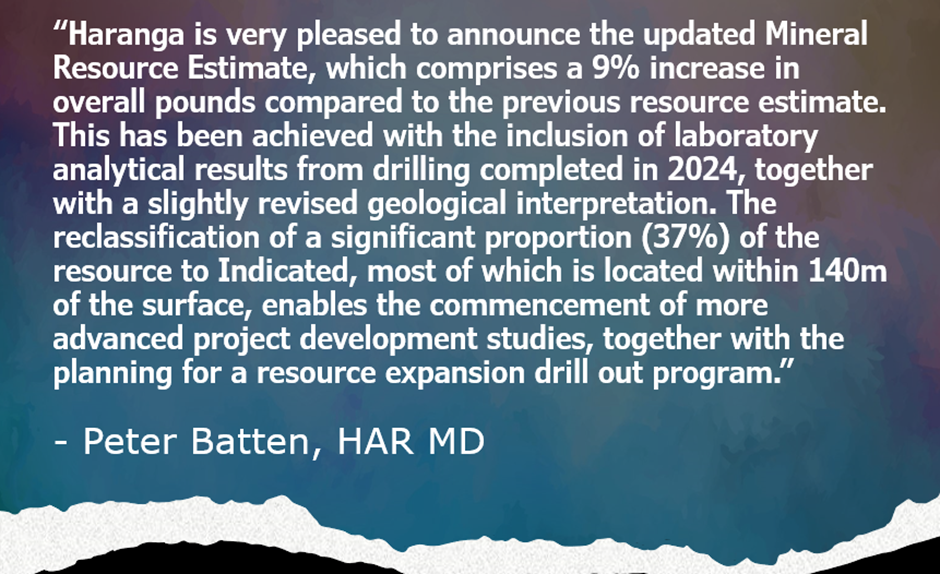

The updated classified MRE includes 17.6Mlbs of eU3O8 at a grade of 550 ppm eU3O8 with a 250 ppm cut-off. When the cut-off is lowered to 200 ppm eU3O8, the total resource increases to 19.8Mlbs eU3O8, reflecting a 9% surge in total pounds over the previous MRE.

Data source: Company update

This updated MRE is based on the data from 519 historical drill holes, 22 recent diamond drill holes conducted by the company, metallurgical test work, and geological confirmation from 29 reverse circulation drill holes.

Additionally, the company highlights potential for significant exploration upside, with several regional anomalies identified so far exhibiting a substantially larger footprint than the Saraya resource mineralisation.

Upgraded Saraya MRE

The updated MRE was prepared by Odessa Resources Pty Ltd (Perth) in line with the 2012 JORC Code.

Data Source: Company Update

Approximately 80% of the resources is within 140 metres of the surface and is suitable for open-pit mining. Additionally, the mineralisation extends along strike, down-dip, and down-plunge.

Exploration advances across Saraya Deposit

In 2022, Haranga announced an Exploration Target ranging between 4 and 35Mlb of eU3O8, with an estimated grade of 350 to 750 ppm. The tonnage and contained eU3O8 reported in the MRE are at the midpoint of the target range, while the estimated grade is closer to the upper end.

The company has focused on several NNE extensions, using termite mound sampling (TMS) and auger or aircore drilling to identify new RC and diamond core drilling targets and potential resource extensions.

A comprehensive termite mound sampling (TMS) strategy was implemented across the entire permit area with 15,845 samples collected and analysed using a handheld XRF device designed for enhanced uranium detection. Results from the final two blocks are pending.

Additionally, eight out of nine identified anomalies through the permit survey were further investigated. Infill sampling of 18,727 samples has been conducted, with assays pending for 4,065 samples.

Preliminary results, particularly from the Sanela prospect, have demonstrated significant uranium anomalism and new extensions to the Saraya deposit mineralisation. These promising results are anticipated to accelerate drill targeting.

Recent ore characterisation tests on a representative bulk sample from Haranga's diamond core, which included both acid and alkali leach tests, yielded positive results, boosting confidence in the Saraya resource.

HAR shares were trading at AU$0.05 apiece at the time of writing on 27 August 2024.