Highlights

- The Australian-listed explorer mentions that uranium anomalies over Diobi Prospect are more extensive than that over Saraya Prospect, which has a 4-35 Mlb eU3O8 Exploration Target

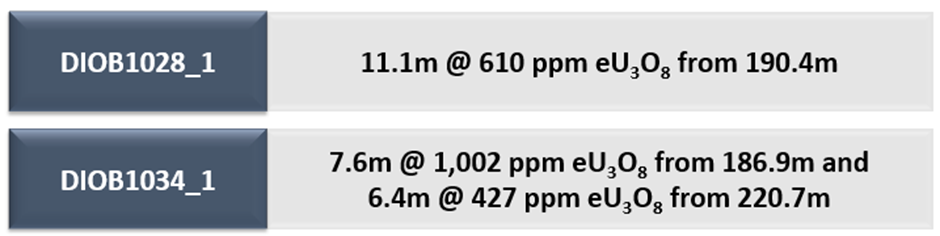

- The anomaly at Diobi includes high-grade historical drilling intercepts, which are on the periphery and outside the main anomaly

- Highlight results include 11.1m @ 610 ppm eU3O8 from 190.4m; 7.6m @ 1,002 ppm eU3O8 from 186.9m; and 6.4m @ 427 ppm eU3O8 from 220.7m

- HAR is targeting JORC maiden mineral resource over Saraya Prospect within the next one month

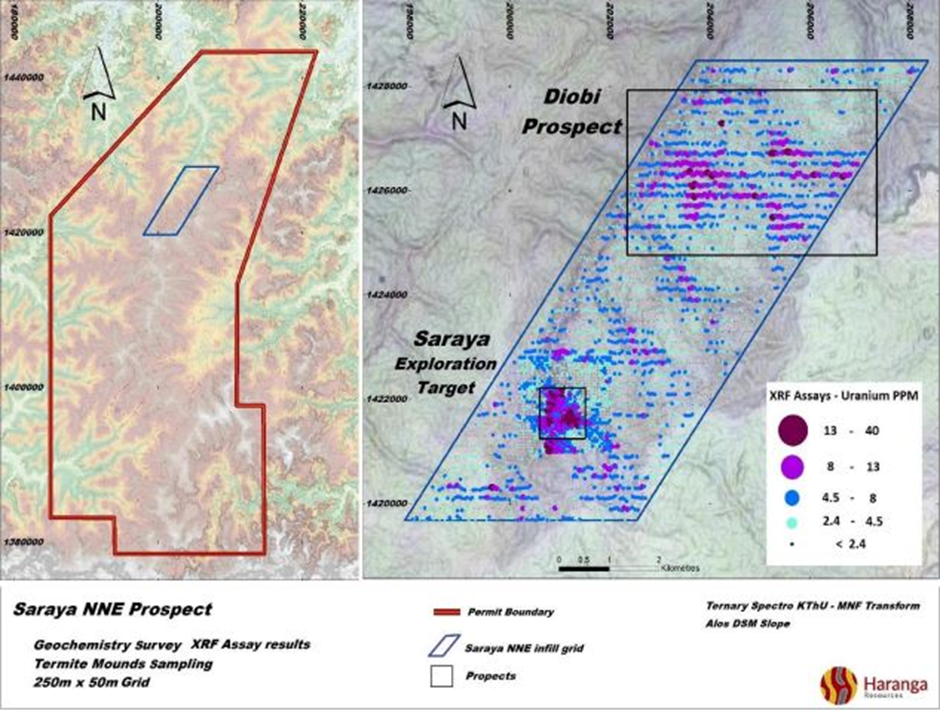

ASX-listed multi-commodity exploration company Haranga Resources Ltd (ASX: HAR FRA:65E0) -- having its primary focus on the Saraya Uranium Project in Senegal, Africa -- has informed that extensive uranium anomalies have been identified over its Diobi Prospect area. These anomalies -- up to 17 ppm uranium -- provide immediate drilling targets, HAR states. It is also mentioned that Diobi Prospect uranium anomaly is at least three times more extensive than that over Saraya Prospect.

The company is also carrying out infill termite mound sampling and assaying (expected to be finished in next three months) over Saraya South, Mandankoli and Sanela Prospects.

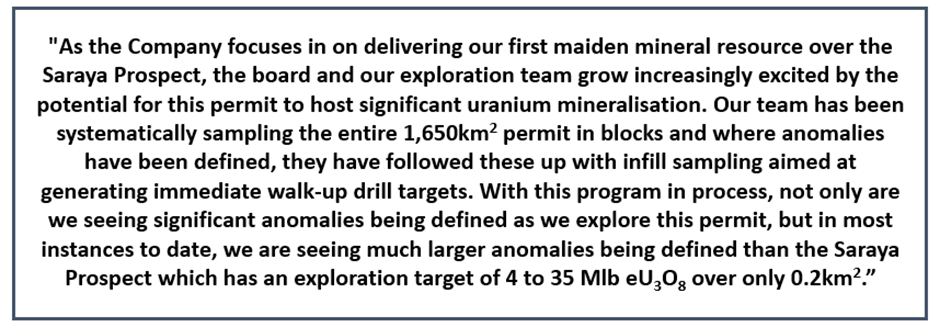

This is what HAR Non-Executive Chairman Michael Davy said among other things:

Source: Company update

More

The multi-commodity exploration company, which operates the Senegal-located Saraya Uranium Project, carried out a permit-wide termite mound sampling program, followed by follow-up infill sampling on a 200m x 50m grid. This exercise led to priority areas - Saraya NNE, Saraya South, Mandankoli, and Sanela.

Infill termite mound sampling performed over the Saraya NNE Block in March 2023 outlined anomalies of up to 17 ppm uranium along a structural trend (5km to the NNE of Saraya Exploration Target). HAR states that this anomalous area is known as the Diobi prospect.

Source: Company update

The anomaly at Diobi -- which is even more extensive when compared to that over the Saraya Prospect -- contains high-grade historical drilling intercepts of economical grade.

Data source: Company Update

Notably, at the Saraya Prospect, Haranga Resources has defined a 4-35 Mlb eU3O8 target.

The company states that historical drilling at Diobi did not test the main anomalies as defined by HAR's termite mound sampling.

Haranga is also undertaking a limited auger drilling orientation program (single drill). If successful, this will be used to test extension of uranium mineralisation in areas where thick laterite hides the mineralisation.

Infill termite mound sampling over Saraya South, Mandankoli and Sanela is also progressing. This sampling program is expected to be wrapped up within three months.

It is to be noted that the ongoing permit-scale sampling along with infill sampling over the recently identified anomalies are aimed at defining additional targets for drilling.

Statement by Non-Executive Chairman

Michael Davy, the Non-Executive Chairman of Haranga Resources has commented that during the process of defining anomalies across the permit, it is encouraging to find that on occasions like the Diobi Prospect, uranium intercepts of economic mineralisation are in proximity to or on the periphery of HAR's defined anomalies. He also notes that the progress made so far "reinforces" the company's confidence in Saraya Uranium Project's future success.

Source: Company update

HAR shares traded at AU$0.125 at the time of writing on 22 June 2023.