Highlights

- Initial assay results from maiden drilling at Haunted Stream highlighted extensive shallow gold.

- FAU completed a two-tranche placement to aid the Haunted Stream drilling program.

- The Mabel Creek project was sold for AU$0.2 million in cash and AU$0.1 million in TLM shares.

First Au Limited (ASX: FAU) reported significant initial drill assays for Haunted Stream in the June 2023 quarter. The Gimlet gold and Snowstorm projects also witnessed significant developments during the reported period.

Moreover, the company sold its Mabel Creek Project and completed a two-tranche placement during the latest quarter.

Encouraging gold results from Haunted Stream drilling campaign

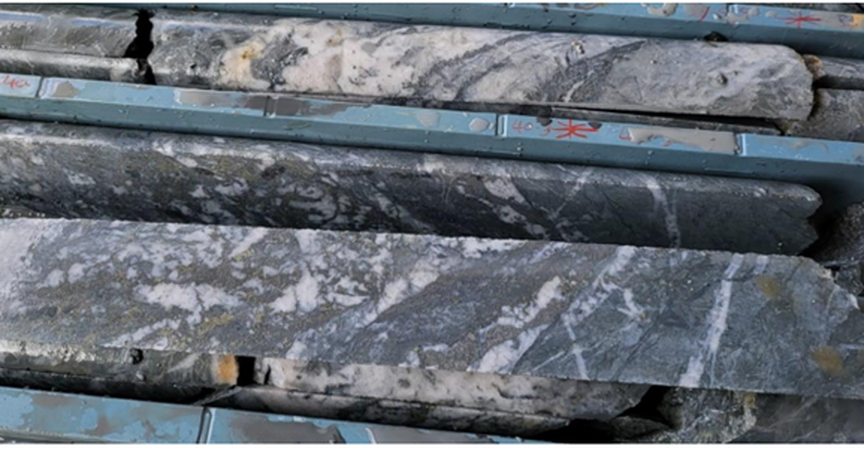

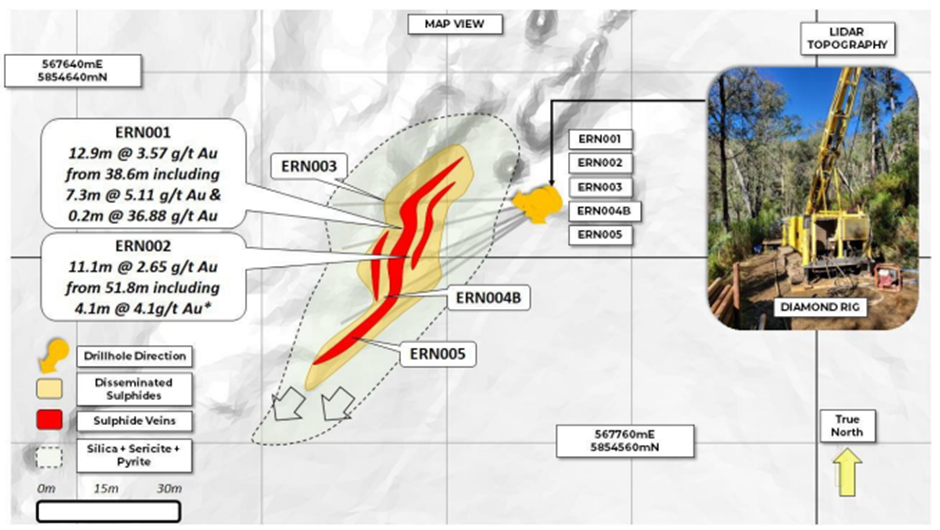

During the quarter, the gold and base metal explorer shared initial assay results from the maiden drilling program at Haunted Stream project, Victoria. The program defined a shallow high-sulphidation gold system.

Here are the assay results from the first two drilled holes –

- ERN0001 – 12.9m at 3.57g/t Au, including 7.3m at 5.1g/t Au and 0.2m at 36.88 g/t Au from 38.3m

- ERN0002 – 11.1m at 2.65g/t Au, including 4.1m at 4.1 g/t Au and 0.25m at 12.81 g/t Au from 51.5m

Image source: Company update

The company informed that the 11-hole diamond drill program was completed for 1,083m.

FAU seeks approval for Snowstorm project

The company is seeking approval to undertake further exploration at its Snowstorm project. FAU, which resubmitted its work plan during the quarter, expects to receive the required approvals by the end of this calendar year.

The underground bulk sampling would allow the company to conduct detailed mapping of the system, which should help in getting a deeper understanding of geological continuity and the grade of mineralisation. This program would also establish the potential economics of the system.

Gimlet gold project receives mining lease

A mining lease was granted to the Gimlet gold project during the June quarter. With this development, FAU has the opportunity to either advance the project independently or find a buyer or partner for the project.

The project contains an inferred resource of 120,000oz’s Au @ 3.19 g/t Au.

FAU completes two-tranche share placement

In February 2023, FAU received binding commitments from investors for a two-tranche share placement at 0.3 cents per share to raise AU$1.5 million before costs. One free attaching option was allocated to every two placement shares. The option has an exercise price of 1.2 cents and expiry in 18 months from the date of issue.

Proceeds from the capital raise were directed towards drilling at the Haunted Stream project.

Details of the recently completed project sale

During the June quarter, the company concluded the sale of its Mabel Creek Project to Talisman Mining Ltd (ASX:TLM) for a cash consideration of AU$0.2 million and AU$0.1 million worth of TLM shares.

FAU has received the cash consideration and has been issued 580,852 ordinary TLM shares.

The project sale would allow the company to focus on its core projects.

In essence, FAU remains focused on advancing its Victorian Project including Haunted Stream while reviewing options to create value from its Gimlet gold project.

FAU shares last traded at AU$0.003 on 31 July 2023.