Highlights

- FY24Funds Under Management, Advice, and Administration (FUMAA) increased by 10% YoY to AU$13.51 billion, with statutory NPAT surging by 22%.

- FY24 net inflows from platform administration were AU$20 million, with total Funds Under Administration (FUAdm) reaching AU$102 million.

- The full-year dividend is 39.3 cents per share, representing a 30% increase from the previous year.

- FID shares traded higher by 12.38% on 15 August 2024.

Fiducian Group Limited (ASX:FID) has announced impressive financial metrics for the full year ended 30 June 2024 (FY24). For this period, shareholders have been rewarded with a total distribution of 39.30 cents per share, which includes a dividend of 21.1 cents announced for the second half of the year.

FY24 FUMAA up 10%, statutory NPAT jumps 22%

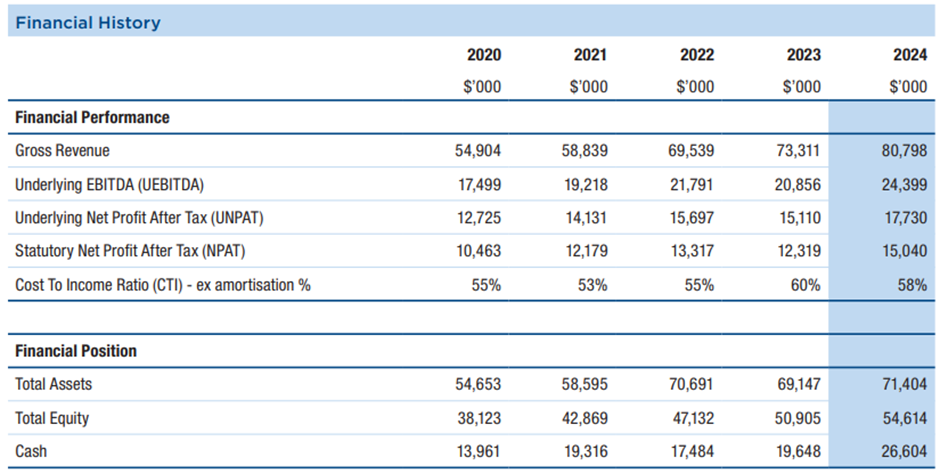

Compared to the previous year, Fiducian Group experienced significant financial growth. For the reported period, FUMAA rose by 10% to AU$13.51 billion, while net revenue increased by 11% to AU$60.59 million. Underlying EBITDA saw a jump of 17%, reaching AU$24.4 million, and statutory NPAT surged by 22% to AU$15.04 million.

The company’s network of salaried and franchisee advisers played a crucial role in this growth, contributing AU$281 million in net inflows during FY24. Notably, nearly 100% of these inflows from Fiducian’s aligned advisers were invested through the company’s platform in the multi-manager fund.

Over the past five years, Fiducian has maintained a steady growth trajectory.

Image source: Company update

FID shares trade higher

At the time of writing on 15 August 2024, FID’s shares were trading at AU$8.26 apiece, up 12.38% from the previous day’s close of AU$7.35 apiece.