Highlights

- Empire Resources (ASX:ERL) owns four highly prospective projects where the company has been seeking to advance exploration.

- ERL is committed to delivering value through exploration across its current projects and is backed by an exploration team of experienced professionals.

- ERL remains on the lookout for value-accretive investment opportunities that align with its development objectives.

Gold- and copper-focussed Empire Resources Limited (ASX:ERL) is an exploration and development company that owns four highly prospective projects. The company has made notable progress during the financial year 2022.

The projects of ERL comprise several exploration targets with excellent potential, and the company has been progressively making inroads, especially at its flagship Yuinmery Copper-Gold Project.

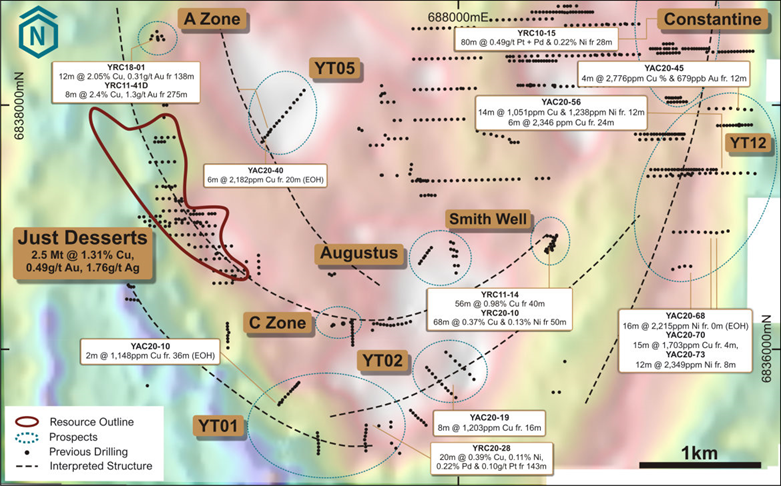

Yuinmery project

ERL’s Yuinmery Copper-Gold Project has six granted tenements, including two mining and four exploration tenements. The present JORC 2012 resource for the project stands at 2.52 Mt @ 1.31% Cu, 0.49 g/t Au, and 1.76 g/t Ag using a 0.5% Cu cut-off.

The Yuinmery project area sits between the Youanmi shear zone and the Yuinmery shear zone on the western and eastern boundaries, respectively. Moreover, the southern area covers the southern closure of a northerly plunging syncline.

Source: ERL

Through consistent exploration efforts, ERL has enhanced the understanding of the geology, alteration characteristics and structure at the Yuinmery project. This is coupled with the discovery of new copper-gold, copper-nickel, and platinum group metal occurrences that have now improved ERL’s opportunities to target previously untested areas.

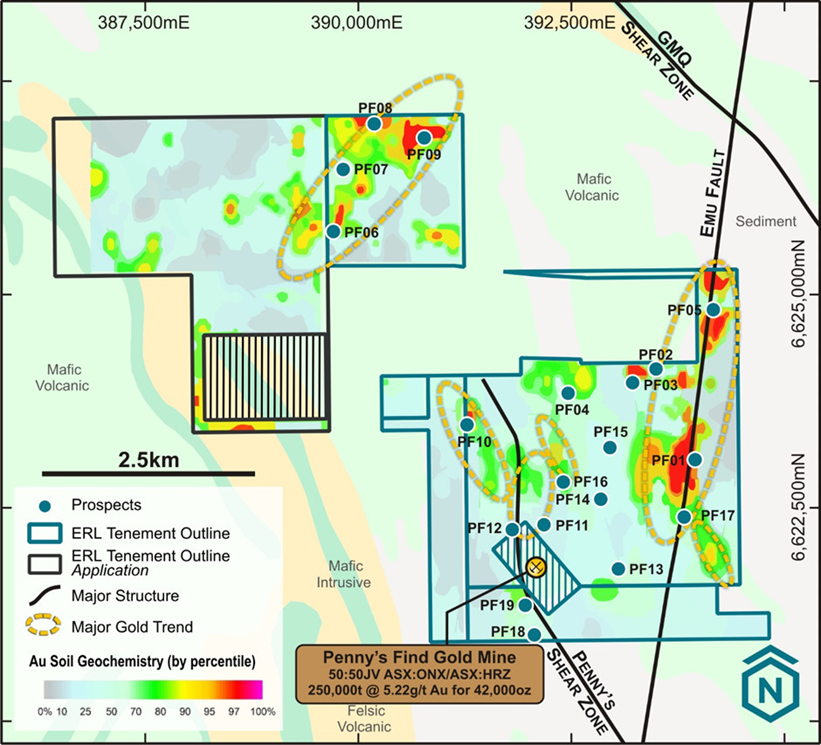

Penny’s Gold project

Located 45 km east of Kalgoorlie in Western Australia, the Penny’s Gold project comprises gold mineralisation that exists within a lower-order northwest-trending shear intersecting a northerly trending structure that is interpreted to continue to the north across the project area. Notably, the project lies within the north-northwest-trending Gindalbie greenstone belt.

Source: ERL

There lie several northerly and northwest-trending structures to the east of the northerly trending structure and within the project area, as interpreted from reprocessed aeromagnetic data.

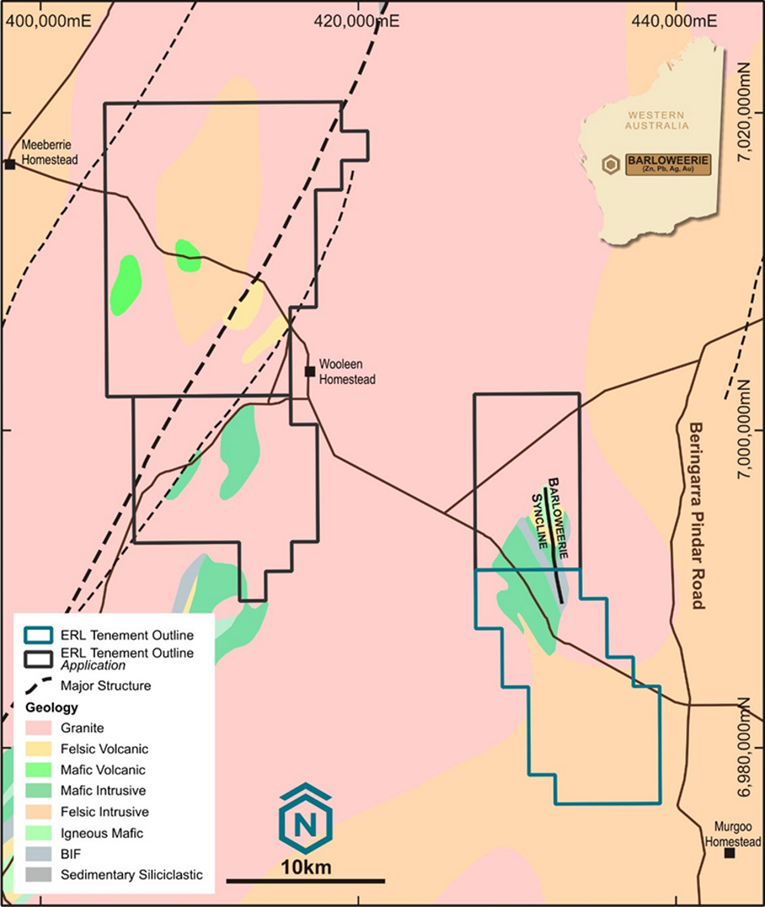

Barloweerie Project

The Barloweerie Project comprises one granted exploration licence (EL) and three exploration tenements in application spread across an area of 533 km2. The EL includes part of the Barloweerie greenstone belt where highly anomalous zinc, silver, lead, copper, and gold mineralisations were discovered during historical exploration in a volcanogenic massive sulphide setting.

Source: ERL

The project has witnessed limited modern exploration since 1987. This was when the project delivered strong mineralisation through RC and diamond drilling, including the following intercepts:

- 5 m @ 4.8% Zn from 38 m (SDH34).

- 1 m @ 3.9% Pb from 15 m (SDH19).

- 5 m @ 100.0 g/t Ag from 28 m (SDH31).

- 2 m @ 0.58% Cu from 19 m (SDP8).

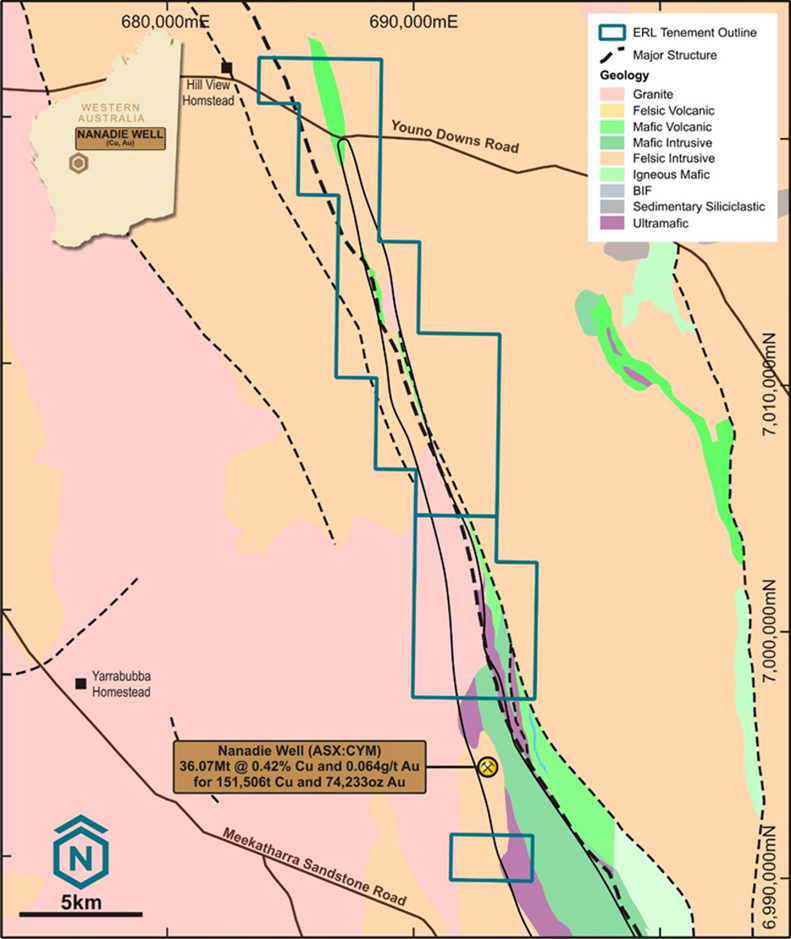

Nanadie Well Project

Under the Nanadie project, ERL has three granted exploration licences totalling 127.3 km2, and the project partially overlies the Barrambie Greenstone Belt. This project lies immediately along a strike from the Nanadie Well Copper Project of Cyprium Metals Limited (ASX:CYM).

This project of CYM consists of a JORC 2004 inferred resource of 40.4 Mt @ 0.40% Cu and 0.10 g/t Au containing 162,000 t of copper and 130,000 oz. of gold.

Source: ERL

ERL believes that multiple geochemical and geophysical anomalies have been identified along the Nanadie Well Regional Shear that require additional investigation.

Bottom line

Overall, ERL’s experienced team of exploration, development, and financial resources are dedicated to the development of a sustainable and profitable mineral business. The company strives to capture value from direct exploration in its present projects and identify value-accretive investment opportunities that align with its development objectives.

ERL’s stock was noted at AU$0.008 on 5 October 2022.