Highlights

- Cyprium Metals (ASX:CYM) has released its report for the March 2023 quarterly.

- The ASX-listed company hosts a suite of copper projects with over 1.6Mt of contained copper in mineral resources.

- The company believes that its copper development projects’ MREs are shallow, open in numerous directions and at depth, indicating good potential to substantially strengthen the present resource endowment.

- For Cyprium, Nifty has been a crucial near-term, long-life, brownfield copper development project. CYM appointed Mr John Featherby as a Non-Executive Director in April 2023.

Cyprium Metals (ASX:CYM) hosts a suite of copper projects with more than 1.6Mt of contained copper in mineral resources. CYM has been steering forward with the prime goal of becoming a multi-asset, mid-tier copper-producing company by developing mid- to late-stage based copper projects in Australia. It has been working on the projects holding the potential for advancement into production of Cu metal on site.

The ASX-listed company recently released its activities report for the last quarter ended 31 March 2023. In the March quarter too, there has been major progress in the execution of its growth strategy, particularly post completion of the Nifty Copper Project Restart Study.

Let’s dig deeper in the areas of development!

Cyprium’s Project portfolio

The company believes that its copper development projects’ mineral resource estimates (MREs) are shallow, open in numerous directions and at depth, indicating good potential to substantially strengthen the present resource endowment.

- Nifty Copper Mine with an MRE of 940,200 tonnes of contained copper

- Maroochydore Copper Project containing an MRE of 486,000 tonnes of contained copper

- Murchison Copper Project, comprising the Cue Copper-Gold Project (MRE of 51,500 tonnes of contained copper) and Nanadie Well (MRE of 162,000 tonnes of contained copper)

- Paterson Exploration Project, a farm-in agreement with IGO Limited

An insight into Nifty Project

For Cyprium, Nifty has been a crucial near-term, long-life, brownfield copper development project, which sits within the Tier 1 mining jurisdiction of Western Australia. There is extensive infrastructure in place to support the re-start of production within a year of the beginning of refurbishment work.

The company concluded the Nifty Copper Project Restart in March 2022 on the basis of the Phase 1 oxide component of an envisaged larger open pit to access the total resource. The larger resource is mainly sulphide copper that had formerly been treated in the existing 2.8Mtpa concentrator until November 2019, to produce a clean chalcopyrite concentrate. Production from the Phase 1 open pit is 146,100 tonnes of copper cathode at a rate of 25,000 tonnes per annum.

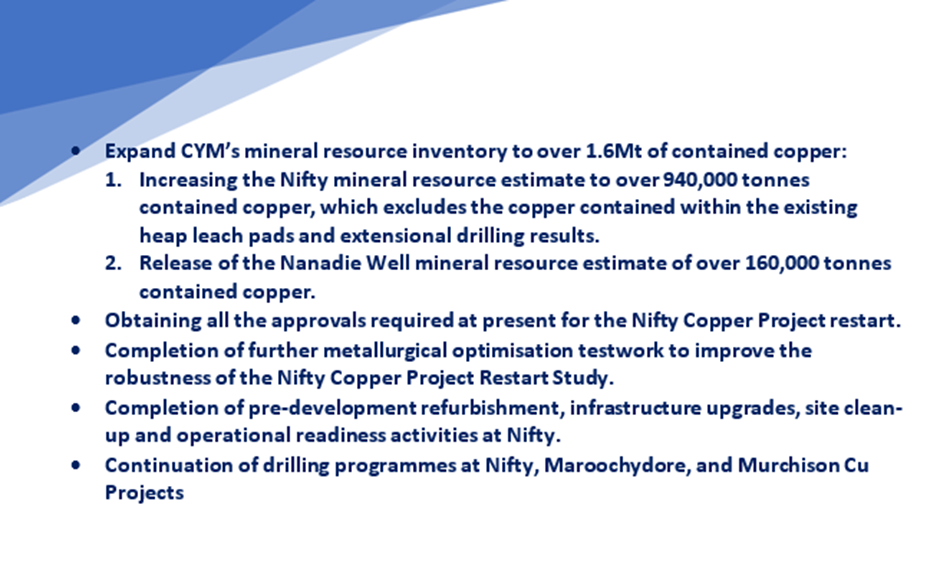

Post the completion of the Nifty Copper Project Restart Study, the company has achieved significant progress towards the execution of its strategy, including:

Data source: company update

Data source: company update

Notably, the growing interest in the battery minerals sector has led CYM to take forward the discussions that can help in building a fresh strategic plan.

According to the company, the strategic plan will focus on completion of further work on the 20-year super pit mine life development at Nifty, by including the significant sulphide portion of the orebody, which has an MRE of 795,900 tonnes of contained copper. The strategic review will include evaluation of refreshing cost inputs into the studies and alternative longer-term financing strategies. CYM will consider designing new asset realisation initiatives and composition of the board and management.

Secured loan deed

March 2023: CYM executed a secured loan deed of AU$6 million to support its near-terms funding requirements.

Board welcomed a new member

April 2023: CYM appointed Mr John Featherby as a Non-Executive Director. Mr Featherby is an apt addition to the team as he brings with him an extensive experience in the stockbroking and wealth management industry. He holds expertise in corporate relations, securing finance, and business development.