Highlights

- CTN is acquiring eight tenements in an agreement with Dreadnought Exploration Pty Ltd.

- The tenements spanning over 650 km² and a 65 km strike along the greenstone belts.

- These belts offer a unique exploration opportunity across multiple greenstones belts.

- Exploration planning has commenced with on-ground activity anticipated to start in the beginning of 2025.

Catalina Resources Limited (ASX:CTN) has acquired projects in the Yerilgee and Evanston greenstone belts from Dreadnought Exploration Pty Ltd, a subsidiary company of Dreadnought Resources Limited. Located in the underexplored Yilgarn Craton region, these projects present a rare opportunity for exploration across multiple zones with proven mineralisation potential for Cu-Zn-Ag massive sulphides, gold, lithium, iron ore and nickel.

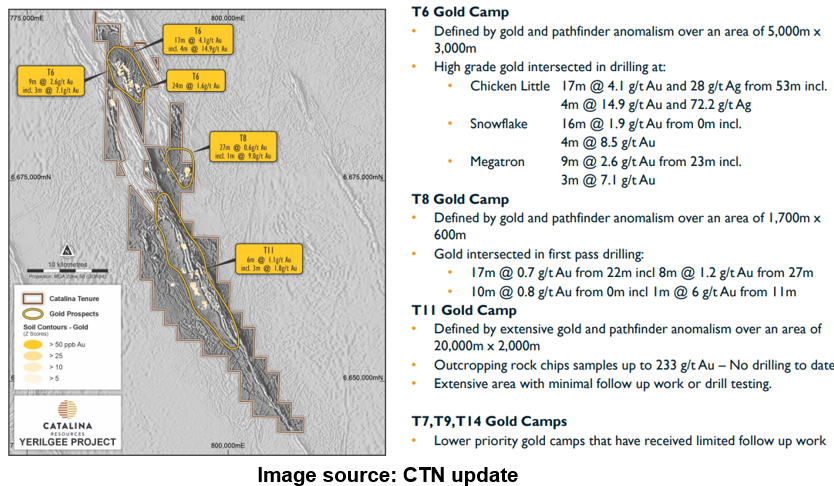

Notably, five camp-scale prospects within the project area show promising lithostructural settings and demonstrated gold mineralisation.

The acquired projects span over 650 km² with a 65 km strike along the greenstone belts.

Terms of the agreement

The company has executed a binding agreement with Dreadnought for eight tenements (E16/495, E30/493, E30/494, E77/2403, E77/2416, E77/2432, E77/2634 and ELA30/584) within the Yerilgee and Evanston Greenstone belts.

The agreement includes an initial cash payment of AU$25,000 upon agreement, followed by AU$225,000 at settlement. At settlement, CTN will issue 72,500,000 shares, which will be held in escrow for a year.

CTN has also agreed to grant DRE a 1% royalty on net smelter returns (NSR) from tenement E30/0584 and assume existing 1% NSR royalty obligations to Arrow (Strickland) Pty Ltd for specific tenements.

Additionally, a milestone payment of AU$1,000,000 in terms of cash or scrip shares will be payable if an inferred JORC-compliant gold resource exceeds 500,000 ounces, or an inferred mineral resource (other than gold) exceeds 500,000 ounces of gold-equivalent on any of the acquired tenements.

The company has commenced exploration planning with on-ground activity expected in the first quarter of 2025.

Yerilgee Greenstone Belt Overview

The Yerilgee Greenstone Belt, part of the 2.9 Ga Western Yilgarn greenstone succession, features diverse geology, including high-magnesium basalts, ultramafic volcanic rocks, sedimentary formations, and granites with iron formations.

Data source: Company update

- Nickel Mineralisation- The belt shares geological similarities with the Forrestania and Lake Johnston Greenstone Belts, showing significant potential for nickel deposits. Historical exploration has identified nickel sulphides and laterite nickel-cobalt mineralisation.

- Lithium Pegmatite Potential – Historical exploration activity has uncovered multiple pegmatite swarms with anomalous surface geochemistry, suggesting significant lithium potential.

- Iron Ore and Magnetite - Previous exploration activities which focused on iron ore has revealed high-grade magnetite mineralisation.

Evanston Greenstone Belt Overview

Image source: Company update

Gold Targets: The Evanston Greenstone Belt features two major camp-scale gold targets: T1 and T2, with proven mineralisation. Walk up targets are defined, and high-grade intercepts remain underexplored.

Lithium Pegmatite Potential: The belt also holds substantial lithium potential, featuring multiple pegmatite swarms with anomalous surface geochemistry for elements such as lithium, caesium, and tantalum.

CTN shares were trading at AU$0.003 per share at the time of writing on 11 December 2024.