Highlights

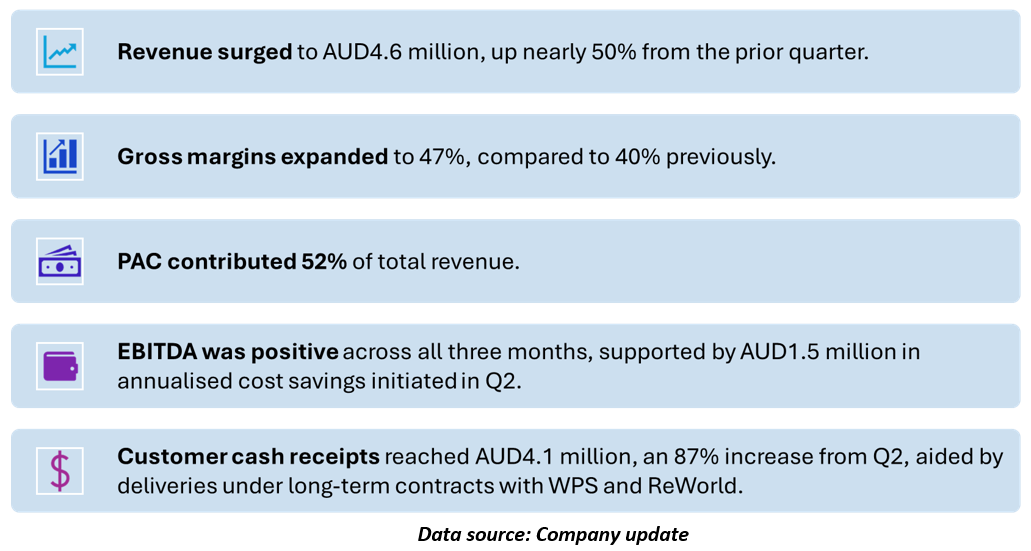

- Revenue has grown to AUD4.6 million in the March 2025 quarter, marking a near 50% increase on the prior quarter.

- Carbonxt has advanced commissioning at its Kentucky activated carbon facility in preparation for commercial production.

- In latest quarter, the company increased PAC sales amid rising regulatory-driven demand and has seen ACP sales recover following resumed operations at a major customer site.

- The company has maintained positive EBITDA each month of the quarter.

- Carbonxt raised over AUD2.2 million through a placement, convertible note, and SPP.

- The company banks on improved product mix position and cost reductions to drive financial performance in FY26.

Carbonxt Group Ltd (ASX:CG1), a United States-focused cleantech company, delivered a pivotal March 2025 quarter, advancing toward production at its Kentucky facility while achieving revenue growth, improved margins, and operational recovery.

The company develops and manufactures environmental technologies to support compliance with air and water emission standards. Its primary operations in the US include R&D and production of activated carbon pellets (ACP) and powdered activated carbon (PAC) for industrial applications.

Revenue, Margins, and Cash Flow Trend Upward

The March quarter marked a notable uptick in the company’s financial performance:

Kentucky Facility Advances Toward Commercial Production

During the reporting period, CG1 advanced towards commercial operations at its flagship Kentucky facility, which remains in the commissioning phase. Developed via its investment in NewCarbon Processing LLC, the plant achieved mechanical completion during the quarter. Carbonxt currently holds a 40.3% stake, with the option to increase its ownership to 50% through further investment. The facility, once operational, is expected to contribute in margin and revenue expansion.

Managing Director Warren Murphy highlighted that while commissioning is ongoing, the company has made "disciplined" progress across operations and capital structure, saying, “We’re grateful for the continued support of our shareholders which will help accelerate our investment in Kentucky and expand our presence in the growing U.S. water treatment market.”

Product Line Momentum Builds Across Key Markets

Operational momentum remained strong across Carbonxt’s key product lines:

- PAC Sales: Throughout the quarter, PAC sales remained encouraging, and the deliveries under the ReWorld continued. PAC demand continued to benefit from regulatory drivers, particularly U.S. EPA regulations targeting PFAS (forever chemicals) in drinking water.

- ACP Recovery: Sales of ACP rebounded in Q3 after disruptions at a key customer site. Volumes returned to anticipated levels, driven by resumed operations at the customer’s facility.

Carbonxt also restructured the lease at its Black Birch facility in Georgia, reducing monthly lease payments by over 50% through a share-based arrangement. This move improved the company's cost structure without compromising operational control.

Capital Raising

In April 2025, Carbonxt raised additional AUD 1.5 million through a share placement and increased its convertible note facility to AUD 1.665 million. The capital raise is expected to help fund the first phase of the Kentucky facility expansion and strengthen working capital. Additionally, the company completed a Share Purchase Plan (SPP) on 3 April 2025, raising AUD 739,000 from shareholders to support increased ownership in the Kentucky facility.

Looking ahead, Carbonxt anticipates continued momentum as regulatory changes and increased demand in the U.S. water treatment sector drive uptake of its PAC and upcoming granular activated carbon solutions. The company expects to deliver AUD 7.2 million in contracted revenue from WPS and ReWorld in the second half of FY25. With a restructured cost base, customer contracts, and the Kentucky facility nearing operational readiness, Carbonxt eyes scaling its presence and expanding earnings in FY26.

CG1 shares traded at AUD 0.054 on 29 April 2025.