Highlights

- The Offer involves one new share for every five held by shareholders, at AU$0.01 per New Share

- There is also 1 attaching New Option, with an exercise price of AU$0.025, for every New Share issued

- The Offer Price comes at a discount of 37.5% as compared to last traded price of ASX listed shares of Skin Elements

Australia listed biotechnology healthcare company Skin Elements (ASX:SKN) has announced a fund raising event for approximately AU$0.9 million. This involves a non-renounceable Rights Entitlement issue, with the company offering one new share for every five SKN shares held by eligible shareholders. The issue price is AU$0.01 per new share. There is one attaching New Option for every New Share issued.

The company has committed to use the funds toward business development, working capital and other aspects. More details about the fund raising offer -- exactly AU$932,270 (before costs) -- are below.

The Offer

Skin Elements Limited has announced a non-renounceable Rights Entitlement issue for capital raising. The price is kept at AU$0.01 per New Share, and there is also one attaching New Option for each new Share. The New Option has an exercise price of AU$0.025, with expiry date as three years from the issue date.

It is pertinent to note that the issue price (AU$0.01) is at a 37.5% discount as compared to Skin Element's most recent closing price (ASX:SKN) of AU$0.016. The company has stated that the raised funds would go into marketing and business development, and toward working capital for covering the business’s operating costs.

Underwriting Agreement

The Entitlement offer is fully underwritten and lead managed by 708 Capital Pty Ltd. The lead manager is entitled to a fee amounting to 6% of the total gross proceeds. Alongside, it is also entitled to 10 million New Options.

The fee would be payable, as elected by 708 Capital, in cash or as issue of New Shares with attaching New Options (calculated at issue price of AU$0.01). Payment of the latter would be subject to SKN's shareholders' approval.

Skin Element's directors intend to fully take up their respective entitlements.

Prospectus

The company has released the Prospectus of the Offer, which SKN says would be mailed to all eligible shareholders. Besides, it can be obtained in hard copy and/ or over electronic mail. Shareholders with registered address in Australia, New Zealand, Hong Kong, and China can partake in the issue, SKN has specified.

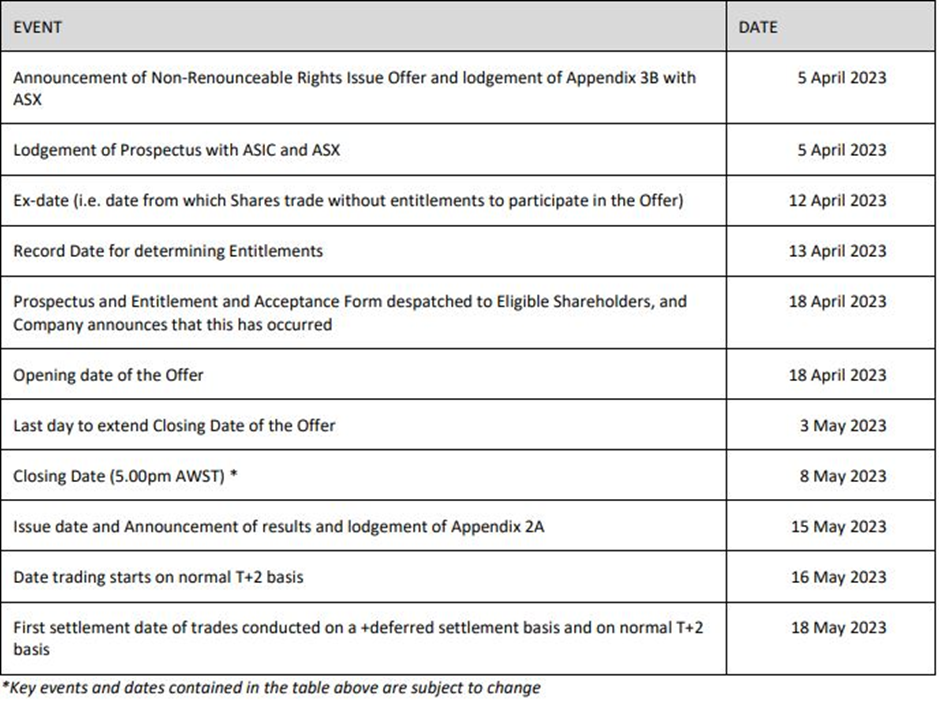

Lastly, the New Shares would be ranked on par with existing SKN shares on issue. The indicative timetable for the Offer, as released along with the announcement, is below.

Source: SKN ASX announcement dated 5 April 2023

About Skin Elements

The ASX-listed biotechnology healthcare company is focusing on anti-microbial SE Formula™ through its organic health care products range. SKN is an award-winning company with "innovative" approach toward development of plant based, organic products for skincare and personal care. The extensive range includes SuprCuvr TGA-registered, hospital-grade plant based disinfectant, Elizabeth Jane Natural Cosmetics brand, and more.