Highlights

- A8G has re-evaluated data from the May Queen South Bauxite project in light of rising gallium prices.

- Elevated levels of gallium (Ga) have been identified, enhancing the resource's potential value.

- Gallium prices have more than doubled since 2021 due to increased demand in the electronics and semiconductor industries.

Australasian Metals Limited (ASX:A8G) has uncovered significantly elevated levels of gallium (Ga) in a re-evaluation of data from its May Queen South Bauxite project. These findings have the potential to significantly enhance the value of the May Queen South Bauxite deposits.

Given the high demand for gallium in the semiconductor industry, this development is expected to create favourable opportunities for the company.

Elevated Gallium Results

The May Queen South Bauxite project is strategically located in central Queensland, near rail links that provide easy access to the Port of Bundaberg and the Port of Brisbane. The project has a JORC 2012 inferred Mineral Resource Estimate (MRE) of 54.9Mt @ 37.5% total Al2O3 and 5.2% TiO2 and 7.9% Rx SiO2.

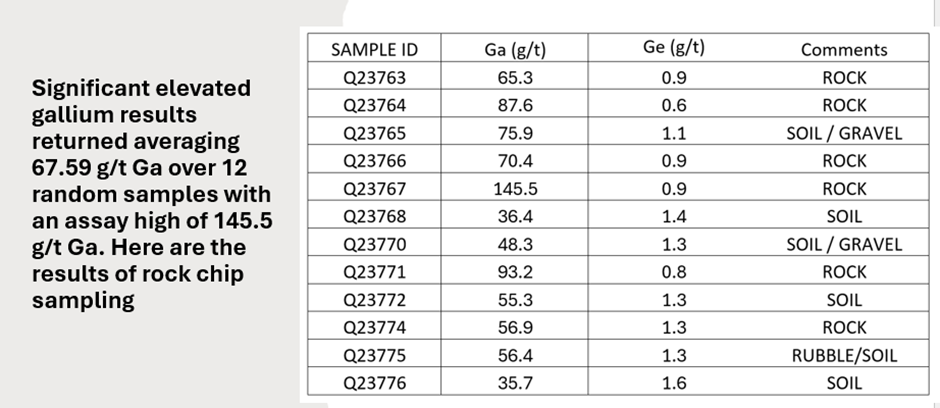

Considering the rising gallium prices, the company re-assayed samples collected during last year’s exploration program using the ALS method ME-MS85.

Data source: Company update

The sample Q23767 (an outcrop of brittle lateritic rock) returned the highest Ga grade of 145.5 g/t.

Rising gallium prices

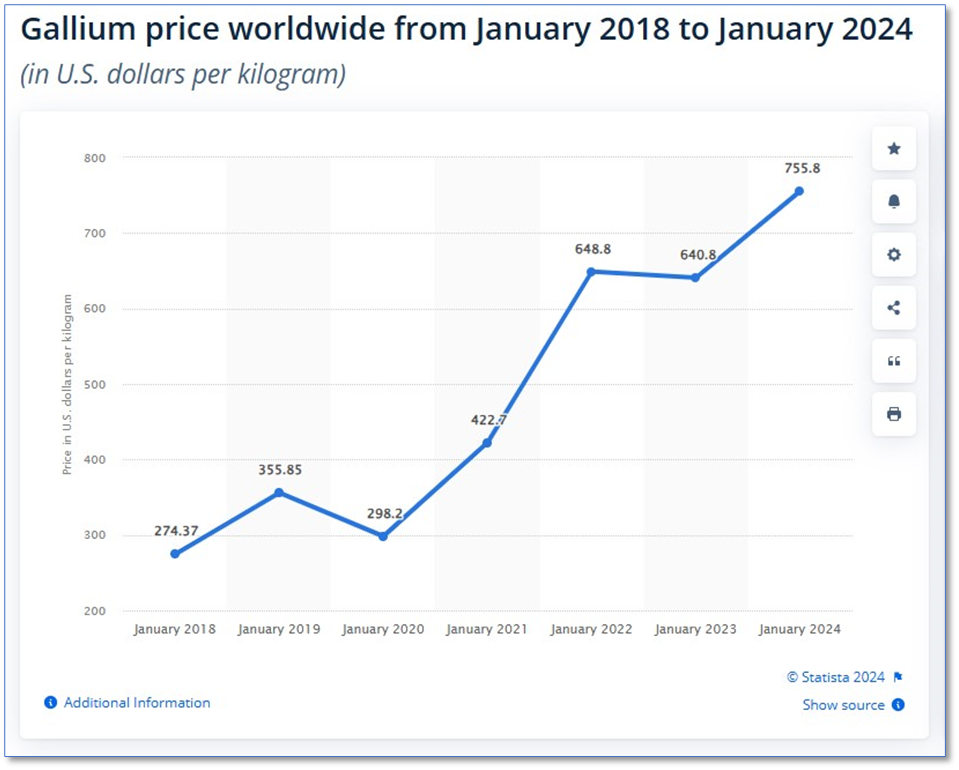

In recent years, gallium prices have surged due to growing demand in the electronics and semiconductor sectors. Gallium is essential for producing compound semiconductor wafers used in integrated circuits, LEDs, laser diodes, photodetectors, and solar cells. Its unique properties, such as a low melting point and ability to form valuable compounds, make it crucial for advanced technologies.

China currently dominates the global gallium market, producing about 98% of the world's supply. Recent disruptions, including price inelastic demand and Chinese export controls in August 2023, have caused prices to more than double since 2021, rising by 115.12%.

Image source: Company Update

What’s ahead?

The company has obtained all recent historical data, including initial metallurgical test work for the project.

Size reduction, scrubbing, and sizing were conducted at Brisbane-based Core Resources laboratory, using representative bulk samples of 25 to 50kg from the surface duricrust and bauxite resource. This testing aimed to determine the possibility of beneficiating 'premium quality' DSO (Direct Shipping Ore) product through basic crushing, scrubbing, and screening processes.

The sample pulps from the resource drilling were securely archived by the previous owner, Atlantic Lithium Limited and now, A8G is in the process of retrieving them. The team will assess these samples again and incorporate the results into the resource model to forecast the gallium resources within the current mineral resource estimate.

Moreover, the company has a network within the downstream processing and product offtake sector in Asia and is actively engaging with potential partners and customers.

A8G shares traded at AU$0.130 apiece on 7 October 2024.