Highlights

- Initial beneficiation testwork for Sandy Mitchell Project delivered a high-grade rare earth concentrate with excellent recoveries.

- The testwork shows the greatest upgrade is by simple gravity separation.

- The final concentrate assays delivered 51.9% TREO (519,000ppm), comprising a very high value saleable product.

- AHK plans to conduct further metallurgical test work along with evaluation of the final mineral product for multiple potential commercial markets.

Shares of Ark Mines Limited (ASX: AHK) gained 9.5% on 24 November 2023 following the latest announcement. AHK stock traded at AU$0.230 apiece at the close of the session.

The company revealed the first phase beneficiation results for directly recovered air core samples from its 100% owned Sandy Mitchell Project. The testwork was conducted by Mineral Technologies.

As per the company, the first-pass beneficiation study demonstrated that simple gravity separation led to the highest REE extraction grades, validating a significant value-add of the project.

Data source: Company update

A detailed roadmap for Sandy Mitchell

After Phase 1 drill program, AHK initiated metallurgical characterisation and recovery testing at Carrara Laboratory of Downer Mineral Technologies in Queensland.

The company has received encouraging results from the metallurgical analysis exploration samples.

For initial sample selection and testing, Ark and Downer Mineral Technologies used CeO2 grades.

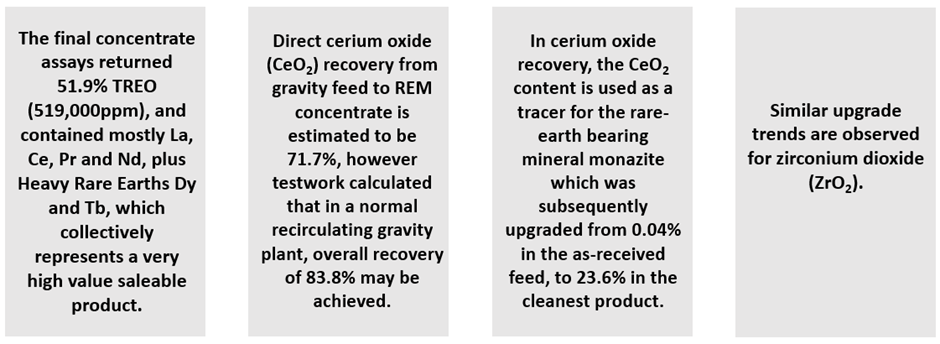

The CeO2 recovery of gravity feed reporting to the rare earth mineral concentrate was 71.7%. However, Mineral Technologies measured that 16.9% of CeO2 was trapped within intermediate material streams, and calculated that in a normal recirculating gravity plant, overall recovery of 83.8% may be achieved.

Major outcomes (Data source: company update)

The majority of this upgrade was achieved on the two stages of Wilfley table processing, simulating rougher and cleaner stages of a gravity plant, with a 52:1 upgrade (0.05% CeO2 to 2.61% CeO2) and 50% mass rejection.

The accessory zirconium oxide upgrade was similarly encouraging at 0.03% upgrading to 2.36%. Subsequent froth floatation stages produced only minor upgrades, with the final magnetic separation stage yielding a low impurity 23.6% CeO2 product, which equated to 52% total rare earth oxides as measured by laser ablation ICP-MS at Bureau Veritas.

The Phase 2 drill programme is about to be concluded at Sandy Mitchell. This will bring forth more samples for metallurgical testing, gravity separation and electrostatic magnetic separation.

Further, a class 5 FEL1AACE engineering design study will be conducted for commercial market evaluation of final products along with AHK’s resource estimation at the field.

The company will incorporate the final results from metallurgical test work into a Scoping Study at Sandy Mitchell before conducting a planned Pre-Feasibility Study.