Highlights

- Arcadia Minerals focused on lithium and tantalum exploration during the June quarter.

- Advancements in leach work on clay samples explored new lithium extraction methods, resulting in a high grade leachate using water and no acid, with low impurities.

- An experienced project manager was appointed to oversee the construction of the Swanson Tantalum/Lithium Project.

- Critical long-lead equipment for the Swanson Project was completed, with deliveries expected soon.

- Arcadia raised AU$500k through a CDI placement and plans a non-renounceable rights issue.

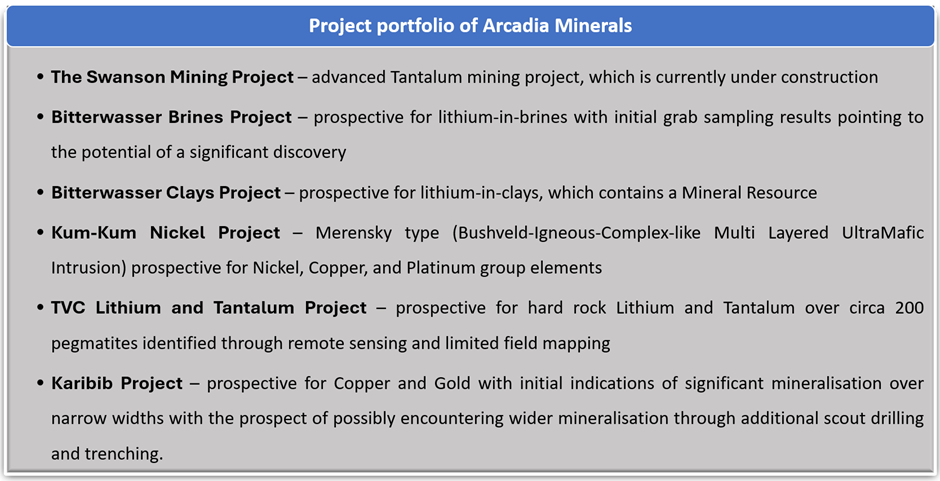

In the June quarter, Arcadia Minerals Limited (ASX: AM7, FRA: 8OH), a diversified exploration firm, continued to make notable developments across its Swanson Tantalum Mining Project and the Bitterwasser Lithium in Clays and Brines projects.

Key advancements included progress in alternative lithium extraction methods and sampling work for mineralisation testing.

Notably, Arcadia appointed an experienced project manager to oversee the construction of its Swanson Tantalum/Lithium Project and confirmed the completion of manufacturing of essential long-lead equipment, with delivery expected soon.

On the financial front, the company launched a AU$500,000 CDI placement and announced plans for a rights issue, in addition to entering a non-binding ATM financing agreement that could potentially raise up to AU$2 million.

Data source: Company update

Lithium in Brines and Lithium in Clays Projects

During the quarter, leach tests on clay samples explored alternative lithium extraction methods.

The results indicated that a high-grade lithium leachate with a concentration of 170 mg/L could be produced through sulphate roasting and water leaching, without the use of acids. These preliminary findings suggest that the leachate has low impurities and could be a viable alternative for lithium extraction.

Samples from brine drilling were collected and sent for assaying.

Swanson Tantalum / Lithium Project

In June 2024, the company appointed Eugene Barrington Coetzee as the project manager for the Swanson Tantalum/Lithium Project. Coetzee brings extensive experience in the operation, construction, and maintenance of processing plants. He will manage the project's construction including strategic planning, project execution, commissioning, and the transition to production.

Additionally, the manufacturing of key long-lead equipment, such as multi-gravity separators and spiral circuits, was completed. Deliveries of this equipment are expected in the coming months.

New Rights Issue and ATM Financing

In May 2024, the company announced a placement of over 8.33 million Chess Depository Interests (CDIs) at AU$0.06 per CDI, aiming to raise AU$500k primarily from existing shareholders. Director Michael Davy committed to subscribe to AU$20k worth of CDIs, equivalent to 333,333 CDIs, pending shareholder approval.

In addition to the placement, Arcadia plans to conduct a non-renounceable rights issue for all eligible CDI holders. This rights issue is intended to provide existing shareholders with the same investment opportunity as those participating in the placement.

Furthermore, the company entered into a non-binding At-The-Money (ATM) Financing Term Sheet with 8 Equity Pty Ltd during the quarter. This facility enables the company to raise up to AU$2 million over three years.

AM7 shares last traded at AU$0.040 on 07 Aug 2024.