Highlights

- Commencement of infrastructure (road building) at the Swanson mine.

- Arcadia completed the field work over exploration permits EPL 5047 and EPL 7295 at its Swanson Project, where +200 unexplored pegmatites have been identified - Initial fieldwork over 8 pegmatites identified tantalum rich pegmatites.

- AM7’s subsidiary completed a 100% acquisition interest in the Bitterwasser Lithium Clay Project.

- AM7 received a binding firm commitment from investors for AU$1.5 million via issue of 15M CDIs at an issue price of AU$0.10 per CDI – Major shareholder Raubex Group Ltd participated in the capital raise.

- The company plans to progress activities such as exploration drilling and pre-economic assessment (PEA) and scoping study across the projects.

Diversified exploration company Arcadia Minerals Limited (ASX: AM7, FRA: 8OH) swept through the first quarter of the ongoing fiscal year 2024 with large headways in development activities across its key projects, including Swanson Tantalum/Lithium Project and Bitterwasser Lithium Projects.

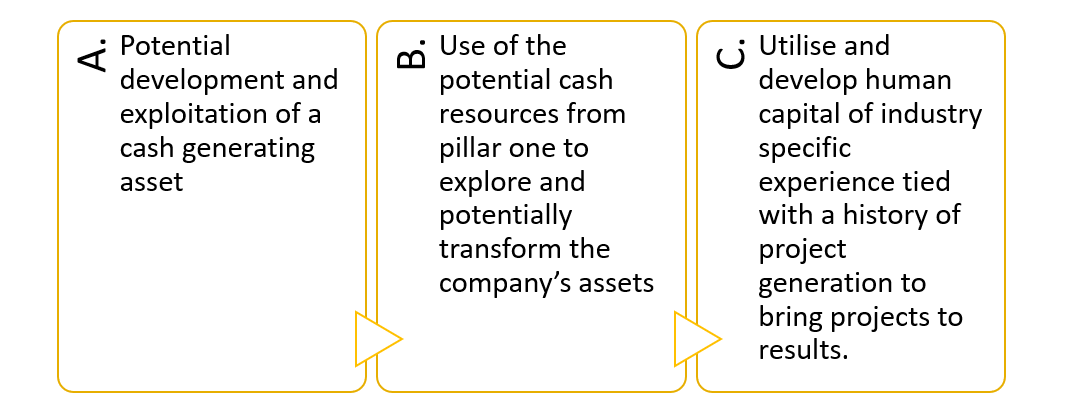

In this piece, we note significant updates from the recently released quarterly activities report of the company for the period ended 30 September 2023. It will list out the milestones that Arcadia chalked up in the last quarter following its three-pillar strategy.

AM7’s Three-Pillar Business Strategy

Exploration progresses at Swanson Tantalum/Lithium Project

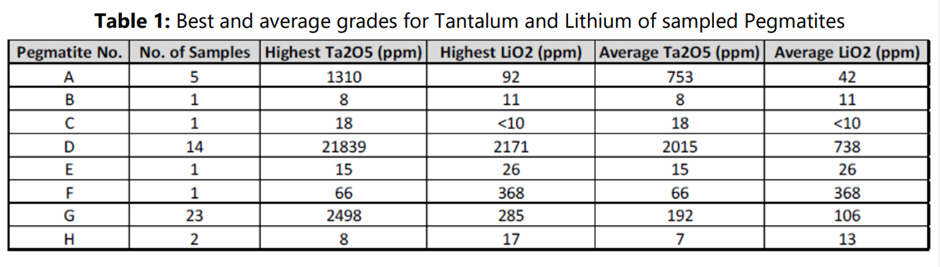

During the September quarter, Arcadia completed the field work over EPL 5047 and EPL 7295 at its Swanson Project. Also, AM7 explored the licences by taking 48 rock chip samples over eight outcropping pegmatites located on EPL 5047.

Out of these 8 pegmatites, 3 demonstrated elevated tantalum mineralisation, while 11 of the 48 samples taken over the pegmatites returned grades >233ppm Ta2O5.

Image source: Company update

AM7 increases Bitterwasser Lithium Clay Project holding to 100%

Arcadia’s 50%-owned associate, Brines Mining and Exploration Namibia (Pty) Ltd (BME), completed the acquisition of the entire issued shares of Bitterwasser Lithium Exploration (Pty) Ltd (BLE). With this development, Arcadia now holds 100% interest in the Bitterwasser Lithium Clay Project.

Image source: Company website

1.5M raised to fund projects

AM7 received binding firm commitments from sophisticated and professional investors during the quarter for AU$1,500,000 capital via the issue of 15 million CDIs at an issue price of AU$0.10 per CDI. The placement was supported by the company’s major shareholder Raubex Group.

The proceeds from the placement will be utilised to advance exploration work at the key projects, described below.

What’s in plan for the December quarter?

AM7 is looking forward to conduct exploration on the Bitterwasser clay project in the next two quarters. The activities will include an infill drilling program over the Eden pan to convert a large proportion of the Mineral Resource from the Inferred category to Indicated category.

Arcadia has also planned a pre-economic assessment (PEA) and scoping study over the Eden Pan to analyse its initial economic potential.

At the Bitterwasser Brines Project, AM7 has planned total six holes in the phase 1 drilling program to estimate the lithium grade of the brines detected at the site.

Further mapping/sampling over the +200 identified pegmatites on EPL’s 5047 and 7295.

The company aims to complete the road infrastructure to the Swanson mine and finalise the order placement of all outstanding plant equipment.

AM7 shares traded at AU$0.080 on 9 November 2023.