Highlights

- Arcadia Minerals has released its half-yearly report for the half-year ended 31 December 2022.

- The firm completed a follow-up detailed mapping program in the Tantalite Valley Complex to detect ultra-mafic outcrops. Samples were taken for mineralogical investigation at Stellenbosch University.

- Land use and Water supply agreements signed over the Swanson Ta-Li Project.

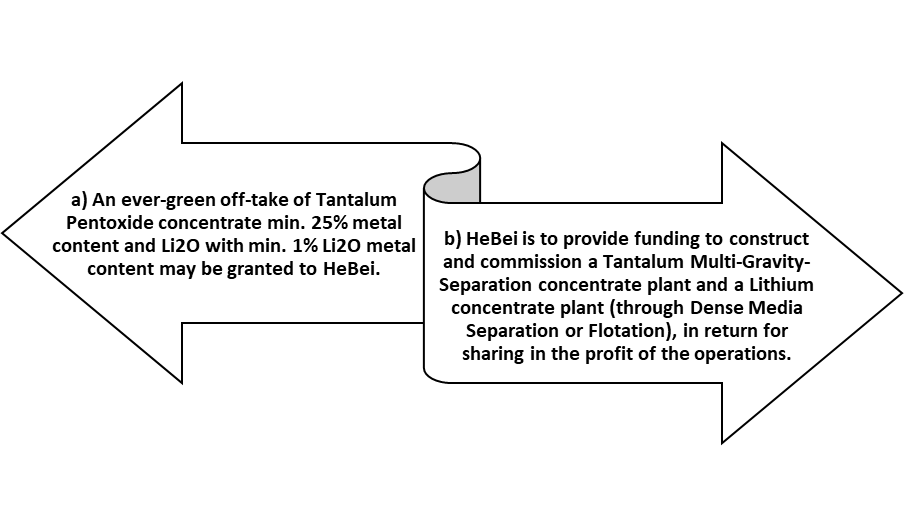

- Letter of Intent received from HeBei Xinjian Construction CC (HeBei) for offtake and funding of the Swanson Ta-Li Project.

- At the Madube Pan, in applying a cut-off of 500ppm, clays of over 500 ppm lithium content were intersected from eight drilled holes.

- Cyclone test work demonstrates ability to upgrade Lithium grades by ~28%.

- Acid leach test work results on Lithium clays using an organic acid confirmed 82% recovery.

- The JORC Mineral Resource for Bitterwasser Lithium Clays has been revised marking nearly 560% rise in resource and 430% rise in metal content.

Namibia-focused diversified metal exploration company Arcadia Minerals Ltd (ASX: AM7, FRA: 8OH) has released a consolidated report for the half-year ended 31 December 2022 tracking the company’s exploration activities across a suite of new-era battery metals (Li-Ni-Cu-Ta) and gold projects.

An eye into the key developments

- Swanson Tantalum/ Lithium Project (Swanson)

Orange River Pegmatite (Pty) Ltd (ORP), a subsidiary of Arcadia Minerals, sealed a water supply agreement with Namibia Water Corporation Limited, following which NamWater will supply 210m3 of water per day from NamWater boreholes at Warmbad under the proposed Swanson Mine Water Supply Scheme that will be outlined by ORP.

During the half-year, ORP completed a land use compensation contract for two decades or until ORP terminates the land-use agreement or until final termination of the Mining License.

Arcadia has also got a letter of intent from HeBei Xinjian Construction CC (HeBei) for an agreement under the below mentioned conditions:

The proposed transaction between HeBei and the Company relates only to ore mined from the Swanson Tantalum/Lithium Project located in, on and under Mining License ML 223 (ML223) in the Karas Region of the Republic of Namibia. The exploration potential of Arcadia’s EPL 5047 and EPL 7295 is excluded from the proposed transaction.

The aim of the proposed transaction is to embark on a program exploiting the current JORC Mineral Resource at Swanson, which reports an Indicated Mineral Resource of 1,439Mt at an average grade of 498 ppm Ta2O5, 72 ppm Nb2O5 and 0.14 % Li2O and an Inferred Mineral Resource of 1,145Mt at an average grade of 472 ppm Ta2O5, 75 ppm Nb2O5 and 0.17 % Li2O. The company’s focus is likely to be concentrated on D1 pegmatite for Lithium production as it holds the highest Lithium grade with a total Mineral Resource of 573 Mt at an average grade of 349 ppm Ta2O5, 95 ppm Nb2O5 and 0.38 % Li2O.

The transaction is expected to begin with a binding agreement, or after the conditions precedent is met, and will endure until ML 223 is lawfully terminated or the project becomes permanently uneconomical.

Kum Kum Nickel and PGE Project

During the half year period, a follow up detailed mapping program by Arcadia’s geologist and personnel from the University of Stellenbosch was undertaken in the Tantalite Valley Complex, with the aim of identifying ultra-mafic outcrops. Samples were taken for mineralogical investigation at Stellenbosch University. The results will allow Arcadia to plan a drilling program.

Karibib Copper-Gold Project

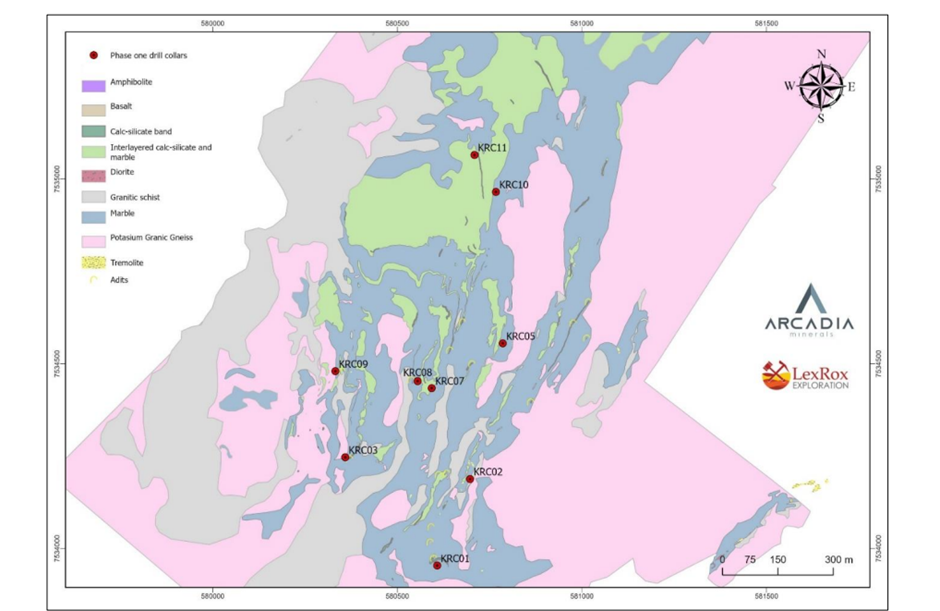

Location map showing drilled holes

Location map showing drilled holes

The Karibib exploration project is situated near the mining town of Karibib, Namibia. The Project is held through the Company’s 80% owned subsidiary (see-through 68%) Karibib Pegmatite Exploration (Pty) Ltd.

The drilling program commenced in August 2022 at the Karibib Copper-Gold Project which focused on lithologies known to contain mineralisation following comprehensive mapping and from previously attained grab sampling data. 551m (10-hole) Reverse Circulation (RC) Drilling program completed in September 2022.

The drilling campaign was conducted over 10 drill holes at a -60 and -75 degree inclination and at different azimuths and depths as per the inferred geometry and geology of the targeted zone.

The company has stated that visual mineralisation was observed successfully in 8 of the 10 drill holes, namely KRC01, KRC02, KRC03, KRC07, KRC09, KRC10, KRC11 and KRC13.

Also, one hole was drilled to intersect mineralisation at deeper depth. Under the drilling program, a 3km x 1km section of the 20km x 2km metasedimentary structure was covered. 240 samples that are known to contain mineralisation in the area were taken from lithologies, and sent for analyses to Scientific Services in South Africa.

Bitterwasser Lithium Clays Project

Cyclone Test Work Result

During the period, Multotec Process Equipment (Pty) Ltd was appointed to conduct cyclone test work of 800 kg Bitterwasser representative clay samples from the Eden Pan. The program was held with the objective of finding out if the fine clay fraction of <10µ fraction could be separated from the rest of the larger material that consisted particularly calcite, dolomite and quartz.

The cyclone results indicated that 30.4% of the feed material reported to the underflow (coarse material) and 69.6% of the material to the overflow (fine material). The overflow is showing a cumulative % passing 10µm of 96.9%, which states that the majority of the -10µm material is reporting to the underflow stream.

From the results it is observed that the underflow sample resulted in a 27.9% increase in the grade compared to the ore fed sample. The cyclone test work has therefore confirmed that using a 14-micron cut off, the cyclone overflow results in a 30% reduction in volume with a concomitant increase of 28% in the lithium grade compared to the ore material. Total lithium recovery could be 89.6%.

Leach Test Work Results

During the initial leach test work, the organic acid exhibited leach recoveries of 82% of the lithium within 1 hour at a temperature of 60C. The second phase of leach test work is currently underway and will include various acid doses, varying PH’s, temperatures and leach resident times. Based on these results an acid will be selected to conduct bulk leach test work.

During the period, auger drilling was undertaken at the Madube Pan (517 hectares in size), which is the second of fourteen exposed clay pans located at Bitterwasser. The Madube Pan intersected similar lithology of green clay units as encountered in Eden Pan. Visual analysis of core revealed that holes drilled in the centre of the pain intersected the green clay unit, as was the case with Eden Pan.

AM7 shares were spotted trading at AU$0.175 on 24 April 2023, with market capitalisation of AU$16.24 million.