Highlights

- Mount Burgess Mining has shared an update concerning exploration and resource development activities at its Kihabe-Nxuu polymetallic project in Botswana.

- The ASX-listed company plans to put its initial focus on the Nxuu Deposit development activities.

- At the Kihabe Deposit, total 39 diamond core holes and 111 reverse circulation drill holes have been drilled so far.

Mount Burgess Mining (ASX: MTB) today shared an update about exploration and resource development activities, and the proposed development of the Kihabe-Nxuu polymetallic (Zn/Pb/Cu/Ag/V2O5/Ge/Ga) project in Botswana.

Nxuu Deposit

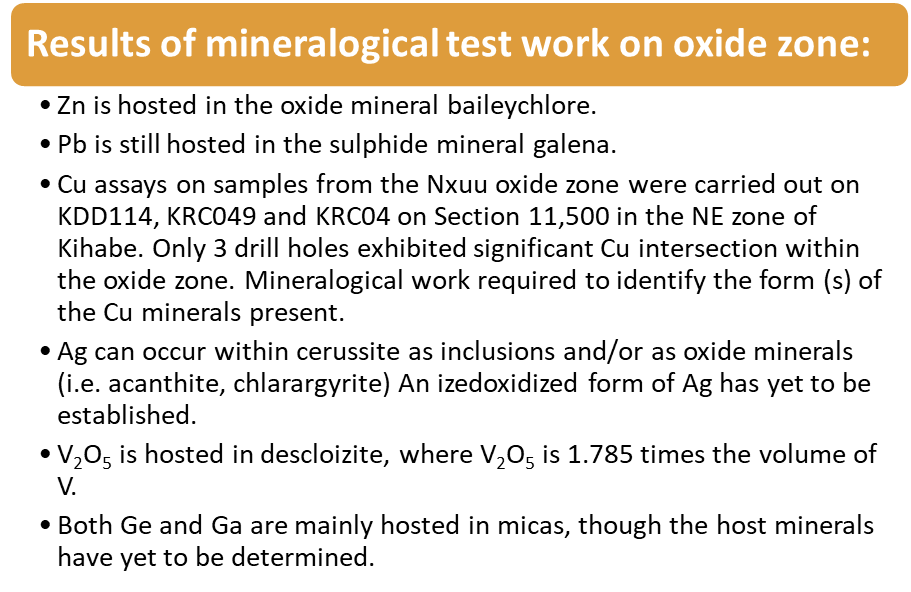

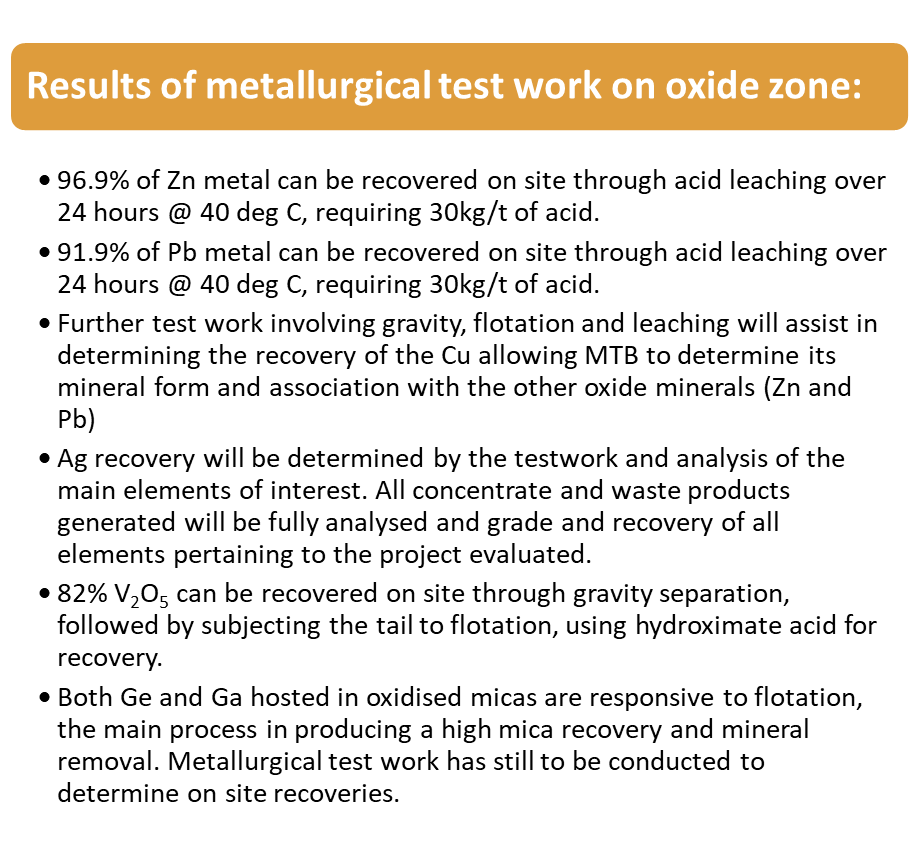

The shallow basin shaped Nxuu Deposit holds zinc, lead, silver, V2O5, gallium and germanium mineralisation in an oxidised, weathered quartz wacke to a depth of 62m, in the northeast area of a fold closure. The ASX-listed company plans to first develop this deposit, highlighting it as a low-risk and low-cost operation.

Data source: company update

Data source: company update

Kihabe Deposit

Located 7km west of the Nxuu Deposit, this deposit has a mineralised strike length of 2.4km, striking in a southwest/northeast direction, on the southern margins of a fold closure. Around 39 diamond core holes and 111 reverse circulation drill holes have been drilled into the deposit so far.

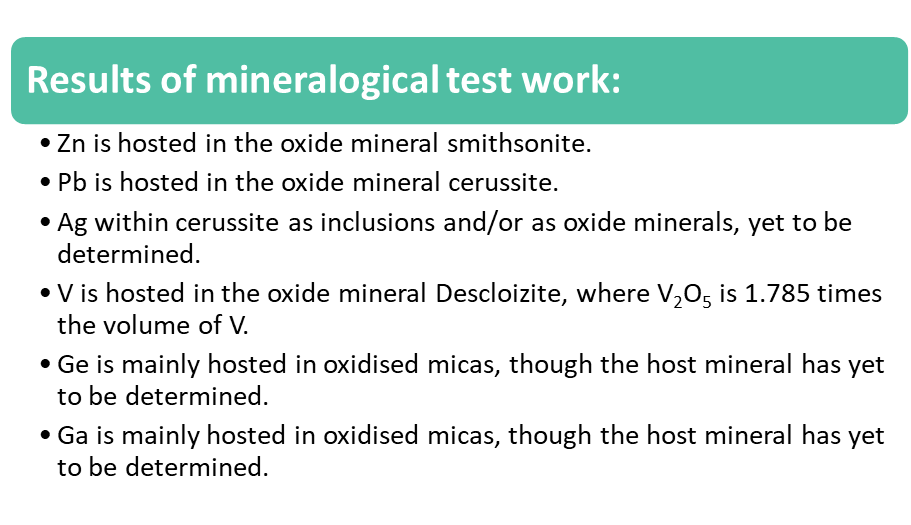

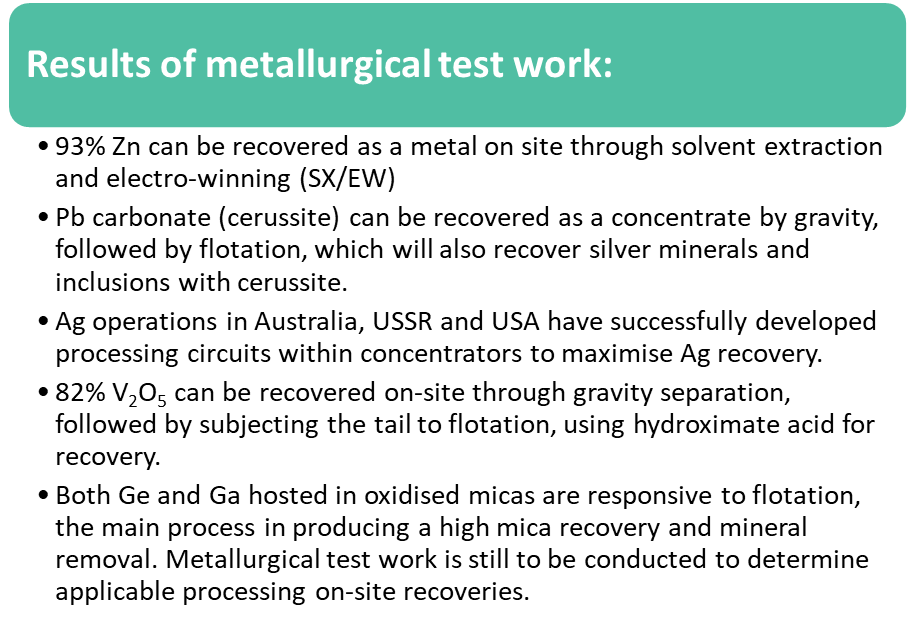

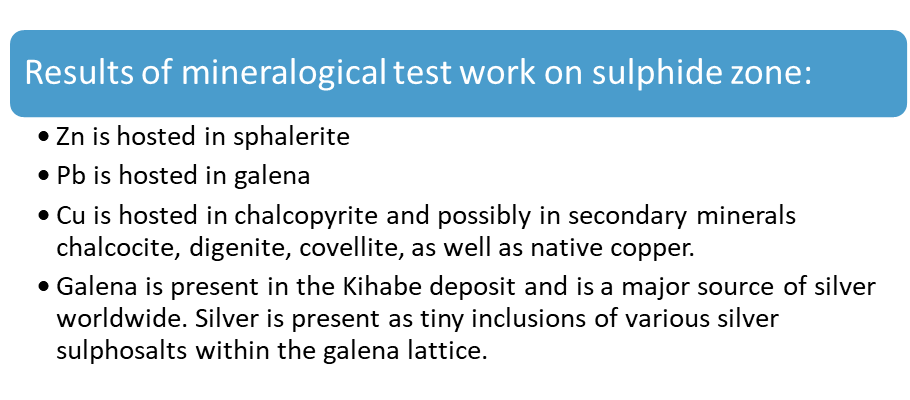

At the deposit, zinc, lead, copper, silver, V2O5, germanium and gallium mineralisation occurs in quartz wacke which is on an almost vertical contact with a barren dolostone. The Mineral Resource Estimates has been done down to vertical depths of 175m. Nearly one-fourth of the top portion to the depth of 175m, has been logged as being in oxide and transitional zones, with the bottom 75% logged as being in a sulphide zone.

With a 0.5% ZnEq low-cut grade, it is evident that the oxide and transitional zones have:

- 85,000 tonnes of Zn metal, which = 26.4% of the total 322,000 tonnes of Zn metal.

- 44,000 tonnes of Pb metal, which = 28.5% of the total 154,000 tonnes of Pb metal.

- 1,700,000 Oz of Ag metal, which = 30.9% of the total 5,500,000 Oz of Ag metal.

- 4,000 tonnes of V2O5, which = 44.4% of the total 9,000 tonnes of V2O5.

To date, seven diamond core holes have been drilled to the base of oxidation, and assayed for germanium and gallium. The results highlighted that germanium and gallium may emerge as key credits for the project, for greater mineralised tonnes and additional metals, highlights the company update.

Data source: company update

Data source: company update

Data source: company update

Proposed development of the Project

- For a Pre-feasibility study at the project, the company will have to declare a Measured/Indicated Mineral Resource Estimate, as per the 2012 JORC Code. For the study, MTB will have to conduct an additional 2,500m of vertical, HQ diamond core, in-fill drilling, which the company expects to wrap up within 60 days.

- MTB has inked a Memorandum of Understanding with Botala Energy, involved in developing a CBM gas project in Eastern Botswana. Once in production, Botala Energy can ensure LNG to MTB for a solar/hybrid power supply.

- MTB is looking forward to hold a Definitive Feasibility Study on the Nxuu Deposit.

The ASX-listed shares of Mount Burgess traded at AU$0.003 on 12 May 2023.