West Perth, Australia-based Entek Energy Ltd (ASX: ETE) is an energy sector company focused on acquiring and exploring oil and gas opportunities including conventional and unconventional in proven as well as producing regions. It is being led by a multi-disciplinary Board of experienced Directors with a proven track record established from working across projects in both Australia as well as the United States.

Entek Energy underwent a renewal during the financial year ended 30 June 2018 wherein a new management team was installed as the company embarked upon delivering on its new strategies and pursuing new opportunities.

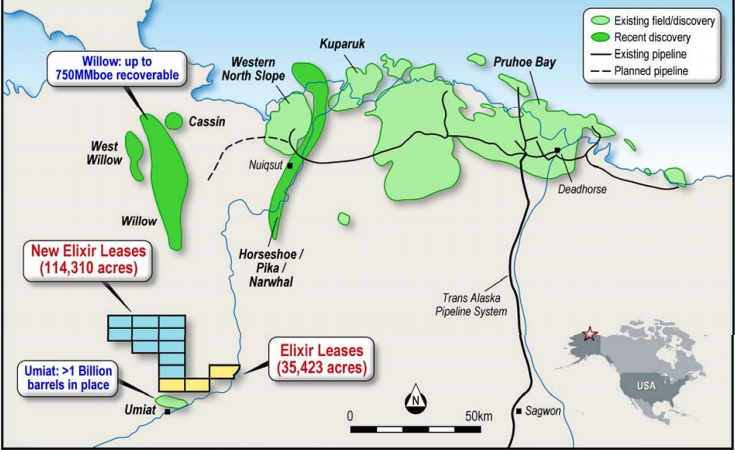

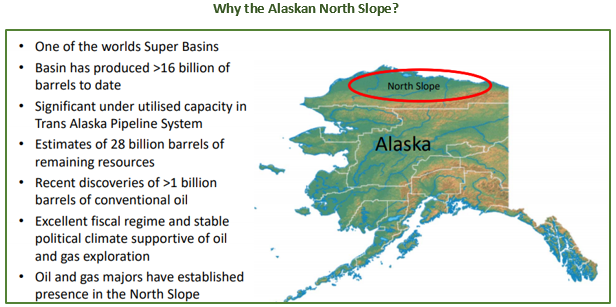

In line with its strategy, the company (as announced on 15 April 2019) completed the acquisition of 100%-working interest in 149,590 acres of leases in the National Petroleum Reserve ? Alaska (NPRA) area of the highly prospective Alaskan North Slope located in the United States. This was accomplished after the receipt of both Elixir and Entek Energy shareholder approvals.

Source: Investor Presentation dated 21 March 2019

Background - Alaskan North Slope Acquisition â On 31 January 2019, Entek Energy exercised its option (agreement signed on 30 November 2018) to acquire Emerald House LLC, a wholly-owned subsidiary of Elixir Petroleum Limited (ASX: EXR). Emerald held 100% ownership in three (3) leases (valid until 2024) spanning ~ 35,423 acres and was a high bidder on another 10 leases (which were subsequently awarded) spanning 114,310 acres (valid until 2029) on the North Slope of Alaska.

Pursuant to the transaction, Entek was to obtain all of the issued shares in Emerald to be held through its wholly-owned US-based subsidiary, Entek USA Inc. The average acquisition cost was around USD 10 per acre. At completion, Entek issued around 185 million convertible preference shares to Elixir, which would convert to 185 million ordinary shares (fully paid) in Entek upon in-specie distribution to Elixirâs shareholders, which was to occur in accordance with the revised timetable announced by Elixir on 10 April 2019.

Additional cash consideration, totalling USD 1,346,730, inclusive of the USD 500,000 loan facility, was paid at settlement.

Strategic Location - The leases are situated in the highly prospective Nanushuk oil play which has a good neighbourhood. To the north of the Emerald leases, ConocoPhillips is appraising itsâ Willow Field while to the immediate south, the Umiat Field holds an estimated 1,000 MMBbls OOIP. Thus, the project presents a unique opportunity for Entek to pick up acreage adjacent to emerging world class discoveries. The annual holding costs for the leases is USD 3 per acre.

The previous 2D seismic study had suggested the existence of stratigraphic reservoirs similar to those observed in the Willow Field, which is primarily a stratigraphic reservoir system, consisting of the shallower Nanushuk formation and the deeper Torok formation.

Besides, following Elixirâs bid submission in December 2018, a new paper confirming the lease area as an oil mature zone was released stating that there was around 7.3 billion barrels of undiscovered oil potential in Nanushuk play.

Source: Investor Presentation dated 21 March 2019

The completion of the above acquisition concluded a phase of reconstruction and refocusing of Entek commenced by the Board in September 2017 and building upon work undertaken by the previous Board.

The company consequently announced the commencement of an exploration program devised for the Alaskan asset and comprised the following key highlights â

- Comprehensive review of the existing 2D seismic data.

- Prospective Resource assessment.

- Potentially 3D seismic acquisition in 2019/20.

- Secure investment partners.

- Continue to build a high-quality portfolio in this exciting province.

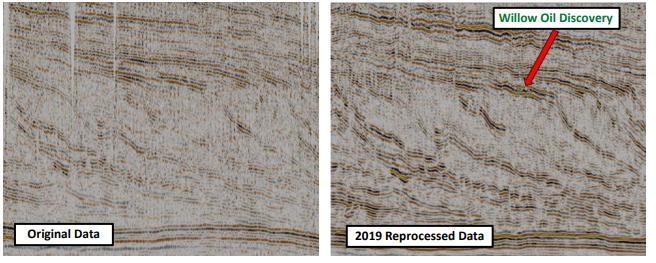

Recent updates on activities at Alaskan North Slope- On 23 May 2019, Entek Energy announced to have initiated a low-cost exploration programme over its Alaskan leases and engaged Denver based 3D Imaging Technology to undertake the reprocessing of approximately 600 kms (365 miles) of 2D data originally acquired by the United States Geological Survey (USGS) in the 1970s and 1980s.

Besides, the company also added that it was freezing an initial internally generated prospective resource assessment, centred on one of the main Nanushuk leads identified using the current 2D dataset. This work was due for completion prior June 2019 â end.

Most recently on 18 July 2019, Entek Energy updated that it had completed the reprocessing of the data from the Entek Leases and the Conoco operated Willow field. The reprocessing enhanced the data quality as depicted in the pre and post reprocessing images given below.

Source: Companyâs announcement dated 22 July 2019

Way Ahead â The reprocessed data, in addition to other regional seismic and well data, is now planned to be integrated into a more detailed study, which is named as the Integrated Nanushuk Technical Regional Overview (INTRO Project) using assistance of the field experts from sequence stratigraphy, geochemistry, basin modelling, petrophysics and core scanning technology. The INTRO Project is scheduled for completion by the end of September 2019 followed by a maiden Independent Prospective Resource Report to be developed by the company for the area.

Leadership Changes - To facilitate the change in focus of the company and to provide the necessary level of technical expertise going forward, the Board was restructured and now features-

- Mr Dougal Ferguson as the Managing Director

- Mr Peter Stickland as the Non-Executive Chairman

- Mr Tony Walsh as the Non-Executive Director

- Mr Arron Canicais as the Company Secretary

Recently on 1 July 2019, Mr Mark McAuliffe stepped down as the Non-Executive Director of the company effective 30 June 2019.

Cash position - As at 31 March 2019, the company had a net cash and cash equivalent of AUD 3.15 million. Additionally, the company had guided to spend around AUD 1.75 on active exploration, evaluation, staff and other costs in the June 2019 quarter.

Stock Performance - Entek Energy Ltd has a market cap of around AUD 3.43 million with approximately 489.73 million shares outstanding. On 25 July 2019, the ETE stock was trading at AUD 0.007 with approximately 0.115 million shares traded (AEST 2:18 PM). In addition, the ETE stock has generated a positive return yield of 16.675 in the last one month.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.