Donaco International Limited (ASX: DNA) operates in the leisure and hospitality businesses across the Asia Pacific region, which include hotel and casino in northern Vietnam and in Cambodia.

Donaco today, on 11th June 2019, announced the appointment of Paul Arbuckle as Chief Executive Officer of the company. The management shared its views on Paulâs appointment and considered it as an important development towards the companyâs plan to provide a fresh start, to revitalise the businesses, and restore value for shareholders. The company detailed the key terms of the CEO contract. In addition, the commencement date for his services will be 12th June 2019. His service tenure is not fixed and will be continued until terminated by either party with the notice period of six months. The remuneration has been fixed at $400,000 per annum. The company has set his short-term incentive at $200,000 per annum in cash and long-term incentive at $200,000 per annum in equity incentives, which are subject to meeting KPIs.

The company also announced that Extraordinary General Meeting (EGM) will be held on 18th July 2019, which has been called in response to a requisition by shareholders (hold 5.04% of the votes that may be cast at a general meeting of the company), (a) Spenceley Management Pty Ltd as trustee for Spenceley Family Trust; (b) Spenceley Management Pty Ltd as trustee for Spenceley Family Superannuation; and (c) Antonia Caroline Collopy. The EGM will consider two resolutions (a) Removal of Mr Joey Lim Keong Yew as a Director of the Company (b) Removal of Mr Benjamin Lim Keong Hoe as a Director of the Company.

Statement from Requisitioning Shareholders: The abovementioned three shareholders raised the concerns on the appropriateness of Joey Lim and Benjamin Lim remaining on the Board of Donaco. The key reasons were:

- Recently, as on 6th May 2019, the Takeovers Panel noted the unacceptable situations in relation to the affairs of DNA. The declaration noted that on 05th May 2017, Mr Joey Lim and certain associates of his (who are also associates of Mr Benjamin Lim) granted a security interest over 27% of DNA shares on issue to secure a loan amount to US$34 million from OL Master (Singapore Fund 1) Pte. Limited (OCP) to Alpha (where Joey Lim is a principal shareholder and sole director). Alpha defaulted under the loan, hence, OCP gave a formal notice with this regard. As Alpha defaulted, OCP had the right to control the exercise of the voting power attached to the 27% interest, which was undisclosed till 1st March 2019.

- DNA noticed that the appointment of receivers over the 27% interest (as on 4 March 2019) may impact its loan agreement with Megabank and the current scheduled repayment dates regarding this loan may be preponed. Additionally, DNA noted that the strategic review process, which was likely to be completed in March, had been delayed by shareholder matters.

- The company concluded the employment of Joey Lim as an executive of DNA with immediate effect as on 19th March 2019.

- Joey Lim did not appear at the most recent AGMs in 2017 and 2018. Also, he did not deliver his own Managing Directorâs address.

Change of Interests of Substantial Holder: The company recently announced that OCP Asia (Singapore) Pte. Limited and all its related bodies corporate and associates as investment manager of OL Master (Singapore Fund 1) Pte. Limited (OL Master) and OL Master Limited (Together, the OCP Group) has reduced its voting power in the company to 27.25% from 37% earlier.

Notice of Initial Substantial Holder: The company confirmed that Spenceley Management Pty Ltd as trustee for Spenceley Family Trust; Spenceley Management Pty Ltd as trustee for Spenceley Family Superannuation; Antonia Caroline Collopy have become a substantial holder with voting rights of 5.04%.

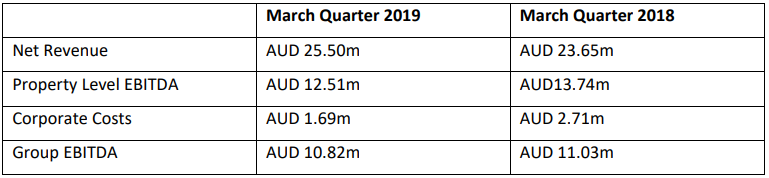

March Quarter Trading Update: Recently, the company has released its March 2019 quarter numbers and updates. The groupâs net revenue for the three months at $25.50 million was above the $23.65 million on pcp. Overall corporate costs at $1.69 million were well below $2.71 million reported in the prior corresponding period. The group EBITDA for the quarter was $10.82 million, a tad lower as compared to $11.03 million in the March 2018 quarter.

Group Summary (Source: Company Reports)

The overall group results for the quarter March 2019 were in-line with the prior corresponding period and largely driven by higher group revenues and prudent management of corporate expenses. DNA Star Vegasâs numbers were in-line with the pcp at the revenue level but were below at the EBITDA level on the back of increased staff and legal expenses. VIP turnover for the period was THB20.3 billion, higher when compared apples-to-apples on the back of addition of new junket groups as management rebuilt the VIP gaming business. Main hall turnover came in at THB64.6 million on pcp after introducing new mass market tour groups, mainly from Thailand. EBITDA for the segment was lower to THB197.6 million for the March 2019 quarter from THB264.6 million posted in the March 2018 quarter. VIP win rate was 3.37% for the period, an increase of 2.80% experienced during the 2018 March quarter. VIP win rate on FY19 YTD basis came in at 3.01%.

Aristoâs net gaming revenue at US$4.5 million and EBITDA at US$2.3 million were in-line with the pcp in USD terms due to tight cost control. The Aristo business recorded a lower rolling chip turnover of US$294.1 million in the quarter as compared to US$368.1 million in the March 2018 quarter due to the rebuilding of VIP business from the soft start to FY19.

In todayâs trading session, the stock reached a high of $0.160, and closed at $0.115 (up 21.053%), reacting to the news of the appointment of new CEO and the announcement of EGM date. The stock has significantly risen in the last six months with 75.93% gain. The market capitalisation for the stock stands at $78.24 million. The range of 52-week high and low stands at $0.210 to $0.036.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.