Highlights

Below is a summarised highlight of the non-renounceable pro-rata offer available to shareholders, as per the Replacement Prospect:

- Ordinary fully paid Shares at an issue price of $0.006 each on the basis of one new Share for every ten Shares (held on 20 November 2019)

- Free-attaching Quoted Options based on one Quoted Option for every nine new Shares;

- the Entitlement Offer is for a maximum of 102,115,978 Shares, to raise up to approximately $612,000 (before costs);

- Entitlements not taken up pursuant to the Entitlement Offer will form the Shortfall Offer- issue price being $0.006 each.

- the Placement Subscribers (related to the 8 November 2019 Placement) who are Eligible Shareholders are entitled to participate in the Entitlement Offer. The offer of up to 38,566,940 Placement Options to the Placement Subscribers is made pursuant to this Prospectus.

- The Placement Options Offer includes 961,538 Quoted Options to Directors James Walker and 5,769,231 Quoted Options to Paul Evans.

- The Shareholder approval will be sought at DW8âs AGM on 29 November 2019 for the issue of up to 31,730,769 Quoted Options to the Placement Subscribers.

Identifying and investing in early-stage technology-driven ventures, the emerging technology company, Digital Wine Ventures (ASX:DW8) aims to disrupt and digitally transform segments within the USD 423.59 billion global beverage market. The Company provides access to capital, expertise and share services, and has an effective and efficient management team, a strong pipeline of potential customers and strategic partnerships.

DW8âs cornerstone investment and a cloud-based SaaS platform WINEDEPOT launched a couple of months ago, and its integrated trading and logistics platform is already being used, connecting key stakeholders in the wine industry using technology.

Besides this, DW8 onboarded Casella Family Brands in October, Australia largest and most successful family-owned wine business, implying DW8âs potential to transform a $40 billion worth market, digitally.

Issue of Replacement Prospectus

The market and investors were eagerly waiting for DW8âs update after its securities were placed in a trading halt on 13 November 2019, pending an announcementâs release.

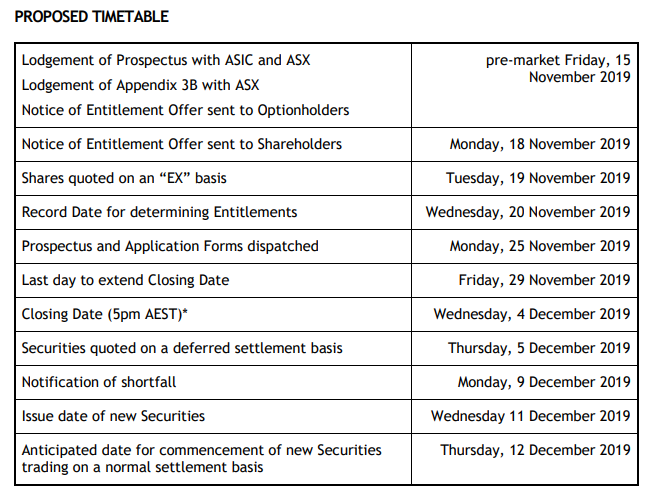

On 15 November 2019, the Company issued a Replacement Prospectus for altering the Original Prospectus issued on 12 November 2019, pursuant to a non-renounceable pro-rata Entitlement offer, which was made to eligible shareholders for one new share for every ten shares held on the record date (18 November 2019) at an issue price of $0.0065 per share for ~$660,000 before costs. The Replacement Prospectus will be dispatched to Eligible Shareholders on 25 November 2019 and was lodged with the ASIC post Directors consent.

- It reflects an adjustment to the issue price of the Entitlement Offer to $0.006 (raising ~ $612,000 before costs) to comply with requirements of Listing Rule 7.11.2;

- The Entitlement offer is for maximum of 102,115,978 shares and 49,913,160 Quoted options. Quoted options can be exercised at $0.015 per share and will expire on 31 December 2022;

- DW8 has obtained a valuation from Bentleys Advisory (WA) Pty Ltd of the Quoted Options, at $0.0037 each;

- The ratio of the Entitlement Offer free-attaching Quoted Options, offered under the Replacement Prospectus has been adjusted to one free-attaching Quoted Option for every nine new shares issued under the Entitlement Offer;

- Shortfall Offer- If the Entitlement Offer is undersubscribed, any number of securities not taken will fall under this offer and will be issued at a price of $0.006 per share.

- There is an offer of up to 38,566,940 Placement Options to subscribers which participated in the Placement occurred on 8 November 2019, based on one free-attaching Quoted Option for every four shares subscribed for and issued under the Placement;

- The Replacement Prospectus is inclusive of a revised use of funds and pro-forma balance sheet based on the new issue price and adjusted Ratio and a revised timetable.

- Offers have no minimum subscription condition attached

- There are no underwriters for the Offers

- None of the Offers, after being exercised fully, will lead to change in control structure of the company

- Peak Asset Management will act as a lead manager to the Entitlement Offer

(Source: DW8âs Report)

Non-Executive Chairmanâs Address

Mr Piers Lewis, DW8âs Non-Executive Chairman addressed shareholders and invited them to participate in this non-renounceable pro-rata 1-for-10 Entitlement Offer. He notified that DW8 recently completed a Placement, after it issued and allotted 127,344,683 fully paid ordinary shares to sophisticated investors at $0.0065 per share, on 8 November 2019.

The current Prospectus incorporates an offer to Placement Subscribers of 38,566,940 free-attaching Quoted Options on the basis of one Quoted Option for every four Placement Shares issued, along with Quoted Options proposed to be issued to Directors, James Walker and Paul Evans.

The funds raised through the Placement and the Offers would be applied towards additional human resources, technology research & development, marketing and advertising and general working capital.

Replacement Notice to Option holders of Non-Renounceable Rights Issue

The Entitlement Offer is available exclusively to eligible Company shareholders who have registered addresses in Australia or New Zealand and hold companyâs shares on the Record Date. The Company notified that while wine veteran and Chief Executive Officer Mr Dean Taylor intends to take up all or part of his entitlement, Mr Piers Lewis does not intend to take up his entitlement at this stage.

There is no obligation for shareholders to participate in the Entitlement Offer unless they decide to exercise their Options into Shares by 20 November 2019 (Record Day).

Digital Wineâs Financial Stance and Stock Performance

The Company has Total assets worth $1,288,451, Total liabilities worth $388,333 and a Total equity of $900,118 (as on 30 June 2019).

On 19 November 2019, DW8 ended the day at $0.006 on the ASX, with a market cap of $6.13 million and $1.02 billion shares outstanding.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.