On 13 February 2020, Corazon Mining Limited (ASX:CZN), a focussed explorer of two quality projects including the Mt Gilmore Project and the Lynn Lake Ni-Cu-Co Mining Centre, informed the exchange that it has received firm commitments from sophisticated and professional investors for raising a total fund of approximately $1.1 Million through a placement of up to 315,867,854 fully paid ordinary shares at an issue price of $0.0035 per share.

The new shares include the immediate issue of 107,036,473 shares under ASX Listing Rule 7.1 and 208,831,381 shares under ASX Listing Rule 7.1A, and attaching options on each share, to be subscribed at $0.007 cents each and with an expiry date 10 July 2022. The issuance of the options would require the shareholder's approval.

CZN closed at $0.003 a share on 13 February 2020, with a market capitalisation of $6.26 Million.

Corazon will seek the shareholder approval on the issuance of the attaching options in the upcoming General Meeting in late March 2020. The 315,867,854 Attaching Options will have the same terms and conditions as the existing listed options CZNO. The placement shares are intended to be issued on 19 February 2020.

Corazon: Pursuing the right commodities at the right time – Read Here

The fundraise was managed by Sanlam Private Wealth Pty Ltd and would be paid 6% commission on the funds raised and will receive 20,000,000 CZNO options.

The capital raised would be utilised to fast track the exploration activities at the Manitoba based Lynn Lake Nickel project and for the working capital.

CZN was overwhelmed by the response and support from the investors for this placement and expressed its commitment to the Lynn Lake project. The funds raised would be utilised for the next phase of the drilling program, scheduled to commence later this month.

Source: Corazon Mining

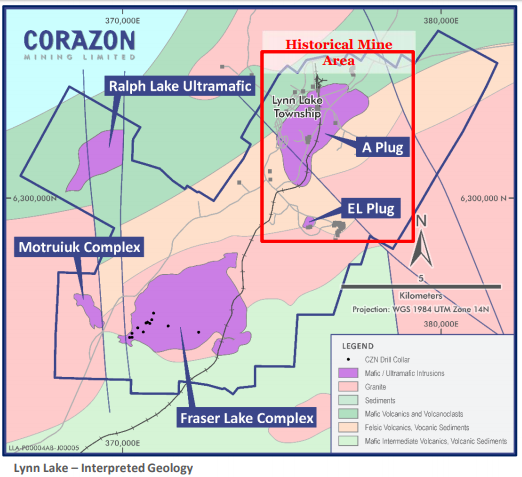

The Lynn Lake Nickel project is located in the mature mining environment of Manitoba, Canada and hosts most of the required infrastructure to bring the project on stream at minimal upfront capital investment.

High-Grade Nickel Drilling Results Enhancing Mineral Resources Potential: Read Here

CZN followed the strategy to explore high prospect targets from the historically mined regions with mineralisation intersections at low depth, thus optimising the mining and overburden related cost, once the project commences. Corazon intends to accelerate the Lynn Lake Nickel Project with the anticipated boost by the EV sector boom and the positive results from the project.

Next Drilling Phase

The "A Orebody" and "E Orebody" areas hold further prospects which are yet to be tested to explore their full potential. In addition, several other areas within the historic mining centres may provide interesting opportunities for near-surface mineralisation. The drilling and study of these areas is a priority for Corazon.

The superficial mineralisation would not only ease the future operations by minimising the operating cost but also at the minimal drilling and exploration costs. Exploration will also target areas outside the Mining Centre, that hold good potential for discovery.

Prospective areas around and off the historic mining centres also might hold good potential for discovery and may be included in the upcoming drilling programs.

Fraser Lake Complex remains amongst the priority targets for CZN with the recently released results from the area reassuring the presence of strong mineralisation in the region-

- 22.6 metres @ 0.70% Ni & 0.35% Cu from 258m

- 27 metres @ 0.37% Ni & 0.16% Cu from 30m

The exploration at FLC is ongoing to identify the priority drill targets for the upcoming drilling programs.

Two Ace Projects: Lynn Lake and Mt Gilmore- Read Here

Latest Exploration Results

Corazon completed the 1,122 metres diamond drilling program in December and recently published the assay results for the priority diamond drilling samples from the “A Orebody” and “E Orebody” areas-

A Orebody

- 37.8 metres @ 1.68%Ni, 0.67%Cu, 0.050%Co from 10 metres; including

- 22.6 metres @ 2.30%Ni, 0.82%Cu, 0.068%Co from 24.4 metres

E Orebody

- 4.5 metres @ 1.17%Ni, 0.22%Cu, 0.029%Co from 25 metres

- 4.1 metres @ 2.09%Ni, 0.57%Cu, 0.073%Co from 26.9 metres

Corazon intends to accelerate the Lynn Lake Nickel Project with the anticipated boost by the EV sector boom and the positive results from the project., CZN would focus on such assets to be defined during the feasibility studies.