CBG Capital Limited (ASX:CBC) updated the market on 22 July 2019, regarding a bidderâs statement from Clime Capital Limited (ASX:CAM) after the close of trading on the Australian Securities Exchange (ASX) on 19 June 2019. The statement is related to a scrip-for-scrip off-market bid made by CAM to acquire CBC shares that it currently doesnât own.

The bidder's statement, which has been submitted to the Australian Securities and Investments Commission, highlighted a consideration of 0.8441 CAM shares and 0.2740 CAM notes for each CBC share held by its shareholders. The implied value of the offer consideration is $ 1.0336 for each share of CBC.

James Beecher and Peter Velez, CBCâs independent directors, have given a unanimous recommendation, favouring the offer in the absence of a better bid offer. CBG Capital Limited is yet to receive any other alternative proposal to the offer. Moreover, the independent directors have appointed an independent expert, who is responsible to prepare a report into whether the offer is fair and reasonable to the companyâs non-associated shareholders. The independent expert is due to complete and provide the report around end-July 2019.

CBC is likely to release its statement attaching the report on ASX at the beginning of August 2019.

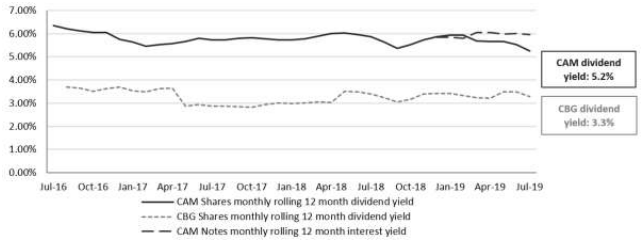

Implied Dividend Yield on CAM and CBG Shares (Source: CAM Report)

Let us discuss these two companies in detail, along with their recent updates and stock performance.

About CBG Capital Limited: CBG Capital Limited is an ASX listed investment company, which targets to pay a fully franked dividend to its investors twice a year. The company is engaged in making investments in a portfolio of Australian equities. Of the total portfolio investments, stocks from the S&P/ASX 200 index account for at least 75 per cent. It focuses majorly on high quality companies, thereby lowering the risk of permanent capital loss. The company got listed on ASX in December 2014 and is headquartered at Sydney, Australia.

Preliminary Final Report for FY19: On 19 July 2019, the company released its unaudited preliminary final report for the year ended 30 June 2019, highlighting a 10 per cent year-on-year fall in revenue from ordinary activities to $ 3.31 million. The company attributed the fall to lower unrealised gains on portfolio recognised during FY19, which were partially offset by an increase of $ 1.49 million in realised gains on sale of investments.

Its profit after tax attributable to members reached $ 2.15 million in FY2019, down 10 per cent year-on-year from $ 2.38 million reported during the same period a year ago. Also, due to the higher payment of performance fees to the investment manager owing to the portfolio performance in FY19, the companyâs total expenses stood at $ 783,000, compared with $ 706,000 in the year-ago period.

The companyâs net tangible asset backing after tax reached $ 1.04 per share as at 30 June 2019, up from $ 0.99 per share at the end of twelve months to June 2018. Its interim dividend for FY19, which was fully franked, stood at $ 1.70 cents each share. The company operates a dividend reinvestment plan and applied the same to all the dividends paid during FY19.

Stock Performance: With a market cap of $ 26.38 million and 26.19 million outstanding shares, CBG Capital stock was trading at $ 1.000 on 23 July 2019 (as at AEST 12:18 PM), down 0.498 per cent or $ 0.005 from its previous closing price. It has generated positive returns of 0.50 per cent and 11.67 per cent during the last one month and six months, respectively, while the three-month return stands at a negative 1.47 per cent. CBG Capital Limited has an annual dividend yield of 3.28 per cent, while its EPS stands at negative $ 0.030.

About Clime Capital Limited: Clime Capital Limited is an investment company, engaged predominantly in making investments in ASX listed securities. The company, which got listed on ASX in February 2004, has both ordinary and converting preference shares. It pays fully franked dividends to its shareholders on a quarterly basis. The fund manager is headquartered at New South Wales, Australia. It is majorly focused on attaining strong risk-adjusted returns for its shareholders in excess of the benchmark for lower levels of risk. Clime Investment Management Limitedâs wholly owned subsidiary Clime Asset Management Pty Limited manages the portfolio of the company.

Preliminary Final Report for FY19: Under its unaudited preliminary final report for the year ended 30 June 2019, the company announced an 8 per cent fall in its revenue from ordinary activities to $ 11.98 million. Its profit from ordinary activities after tax attributable to members stood at $ 6.60 million in FY19, down 17 per cent year-on-year from $ 7.95 million reported during the same period a year ago. The companyâs profit during the year was impacted by lower unrealised gains on portfolio recognised during FY19.

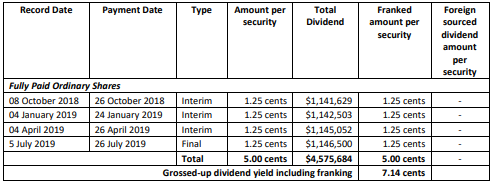

Clime operates a dividend reinvestment plan and applied the same to all the dividends that the company paid during FY19. Below figure gives a summary regarding dividend distribution by the company for the period.

Source: Companyâs Report

The companyâs total operating expenses increased to $ 1.97 million during the year, compared with $ 1.64 million from the same period a year ago. Moreover, during the financial year 2019, the company did not gain or lose control over any entities. Its dividend, trust distribution, and interest income registered an increase of 21 per cent and reached $ 4.0 million in FY19, compared with $ 3.3 million in the previous corresponding period.

Stock Performance: With a market cap of $ 84.84 million and 91.72 million outstanding shares, Clime Capital stock was trading at $ 0.930 on 23 July 2019, up 0.541 per cent or $ 0.005 from its previous closing price (as at AEST 12: 30 PM). It has generated positive returns of 2.78 per cent, 5.71 per cent and 10.12 per cent during the last one month, three month and six months, respectively. Clime Capital Limited has an annual dividend yield of 5.541 per cent, while its EPS stands at negative $ 0.030.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.