Cashwerkz Limited (ASX: CWZ) along with its subsidiaries, provide cash management marketplace in term deposit and At Call. Cashwerkz Technologies and RIM Securities are the subsidiaries of the company. The company provides investment services backed by its network of investors, advisors and banks.

On 05 June 2019, CWZ introduces its digital cash investment platform in collaboration with Praemium, reportedly.

As per the companyâs release, Praemium Integrated Managed Accounts Platform is an award-winning platform, which is now integrated with digital cash investment platform by Cashwerkz to service the wealth advisors in Australia. Also, the data feed partnership would immediately enable wealth advisors and their clients to use Cashwerkzâs marketplace, which offers services from numerous Authorised Deposit Taking Institutions (ADIs), in a unified platform and administration environment.

Hector Ortiz, CEO of Cashwerkz, stated that the new strategic alliance within fintech space is a win for both companies, ADI partners and Australian investors; this allows investors and wealth managers to search for competitive interest rates confidently. Also, he stated that CWZâs technology facilitates investor identification, onboarding for cash investment services and rollover capabilities, which fulfils the need of wealth managers underpinned by the breadth of ADI partners connected with Cashwerkz in the market today.

Mat Walker, Praemiumâs Head of Product and Marketing mentioned the scope of Cashwerkz as a data feed provider to Integrated Managed Accounts Platform by Praemium; also, the ability to facilitate the broadest range of investment assets for consolidated reporting is one of the major strengths of the platform. He also cited the alliance would provide escalated efficiencies in data feeds and reporting for advisory businesses for a broad range of term deposits, At Call solutions by Cashwerkz backed by the market-leading open architecture of Praemium.

Previously, in 2017, ASX listed Trustees Australia Limited merged with Cashwerkz Pty Ltd, and started to offer a diverse range of âtraditionalâ financial services backed by fintech capabilities of Cashwerkz, as reported.

Further, on 22 May 2019, the company released an announcement regarding the change of parent company name from Trustees Australia Limited (former parent company) to Cashwerkz Limited and adopted the new ASX ticker code CWZ, w.e.f. 23 May 2019. Reportedly, after the merger, Cashwerkz Group now provides services like the facility to search, manage, transact and report on the investment classes offered by the entity, which includes term deposits and other fixed interest products in an innovative online marketplace (now integrated with Praemiumâs Integrated Managed Accounts Platform).

As per the release, Cashwerkzâs connects multiple banks and investors in an efficient manner, which is faster, safer and does not interfere with investorâs money. Also, the company believes that merger had resulted in an integration of fintech capabilities with traditional fixed interest deal would be a disruptor in the fixed interest asset sector.

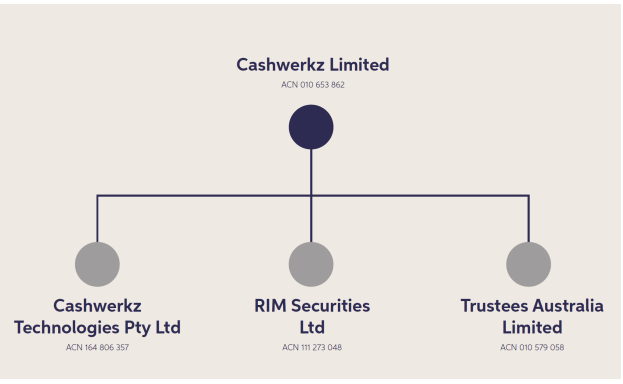

Group Organisation (Source: Companyâs Announcement)

As per the companyâs release in May, the former subsidiary company Cashwerkz Pty Ltd is now known as Cashwerkz Technologies Pty Ltd while RIM Securities Limited remains unchanged along with its share registry and contact details. Likewise, the name of the parent company was changed to Cashwerkz Limited, the existing additional subsidiary â Redgate Asset Management was renamed to Trustees Australia Limited.

During March 2019, the company released its Investor Presentation, which depicted the size of the business being handled by the group, wherein the group had been responsible for supplying $2 billion to banks to support capital funding requirements through its investment service platform.

The presentation also depicted the innovation capabilities of the group wherein it takes three clicks to invest, which include customer ID verification, embedded know your customer and anti-money laundering processes. On the security perspective, the groupâs innovative security feature operates with a bank level cybersecurity standard with 2-factor authentication protection, and the group regularly test the security levels along with maintenance of transaction logs and audit.

As per the presentation, the group had 41 bank partners offering services on the companyâs dedicated platform. Also, the groupâs customer return rate was a decent 80%, and the average number of days on spent on the platform were 291 days. Notably, during the period ranging from 31 December 2018 and 28 February 2019 the group witnessed a growth of 3922% in its funds invested to $1.81 billion.

The presentation also represented the investor focused business model followed by the group, wherein It provides easy access to term deposits for financial institutions and custodian backed by continuously evolving technologies. Reportedly, the services provided by the group are fee-free for investors and ADIâs pay fees to the group.

The stock of the company last traded at A$0.23 on 6 June 2019. CWZâs market capitalisation is A$36.77 million with 159.88 million shares outstanding. Performance of the companyâs stock in the long-term period of five years is +225.82% and in the past one-year +27.78%. In the short-term periods of six-month, three-month and one-month the returns are +24.32%, +27.78% and +15%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.