An oil and gas exploration company, Carnarvon Petroleum Limited (ASX: CVN) has provided a drilling update on its Dorado-2 well today. Last week, CVN provided an update on the first appraisal well of the Dorado oil and gas field, in which it had advised that the company planned to acquire around 200 metres of whole bore core across the Caley and Baxter members.

In addition, since the last report, CVN has extended 233 metres of the whole well bore core from the well across the Caley and Baxter reservoirs. Further, the company has logged the Logging While Drilling (LWD) tools across the cored section and to the wellâs current depth.

As per the results of LWD tools, similar reservoirs have been encountered to those in the Dorado-1 discovery. Furthermore, the company has observed increased resistivity from LWD tools, which indicate that porous and permeable zones hold hydrocarbons as anticipated in the Caley, Baxter and Milne Members.

The company now requires wireline logging to obtain definitive results. The company will commence this process once the well has drilled to the total depth of approximately 4,548 metres Measured Depth (MD).

Today, the companyâs shares were up by 23.81% during the intraday trade.

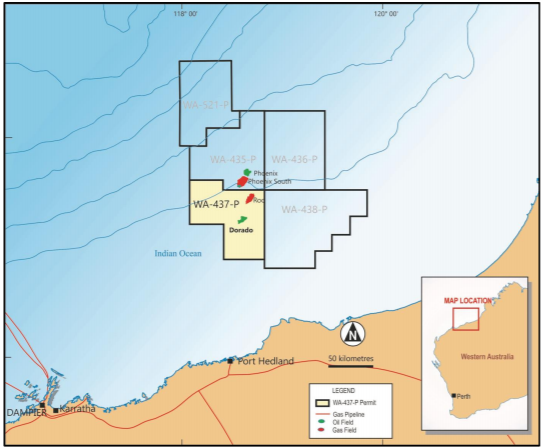

Map of WA-437-P showing the Dorado field (Source: Company Reports)

CVN plans to drill to around 4,548 metres Measured Depth and will then obtain wireline logging information over the complete section of open hole encompassing the Caley, Baxter, Crespin and Milne members. The wireline logging process includes fluid sampling and pressure testing, in order to obtain information regarding the quality of the reservoir sections and the nature of the hydrocarbon fluids encountered, including estimates of oil-water contacts.

The company intends to send core to the laboratories in as original condition as possible. The work will not commence on the core until after the analysis from the wireline has been completed hence the core is not able to be used to determine reservoir quality or hydrocarbon contacts at this time.

As at 31st March 2019, the company had cash and cash equivalents of $93,358K, which includes $17,588K of bank balances and $75,770 of call deposits.

Stock Performance:

Now, letâs have a glance at the companyâs share performance and the returns it has posted in the last few months. On 29th May 2019, the stock last traded at a price of $0.520, up by 23.81% during the dayâs trade with a market capitalisation of ~$563.95 million. The counter opened the day at $0.450 and reached the dayâs high at $0.522 and touched a dayâs low at $0.435, with a daily volume of 35,289,516. The stock has provided a YTD return of 27.27% and also posted returns of 23.53%, 3.70% & -7.69% over the past six months, three and one-month period, respectively. Its 52-week high price stands at $0.695 and 52 weeks low price at $0.125, with an average volume of ~3,379,510.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.