Brent oil prices are moving in an uptrend, with benchmark Brent oil spot (XBR) rising from the level of $50.41 (Dayâs low on 26th December 2018) to the level of $70.17 (Dayâs high on 2nd April 2019).

The prices were moving bidirectionally in the past amid the tug of war between the Organization of Petroleum Exporting Countries (OPEC) and the United States of America.

The voluntary production cut by the OPEC members supported the oil prices while the booming shale oil production from the U.S. exerted pressure on oil prices. However, in the status quo, the OPEC stance to curb the oil production overshadowed the increase in U.S. shale oil, which coupled with production loss from the U.S. ban on Venezuela state run oil mammoth PDVSA, supported the crude oil prices in international markets.

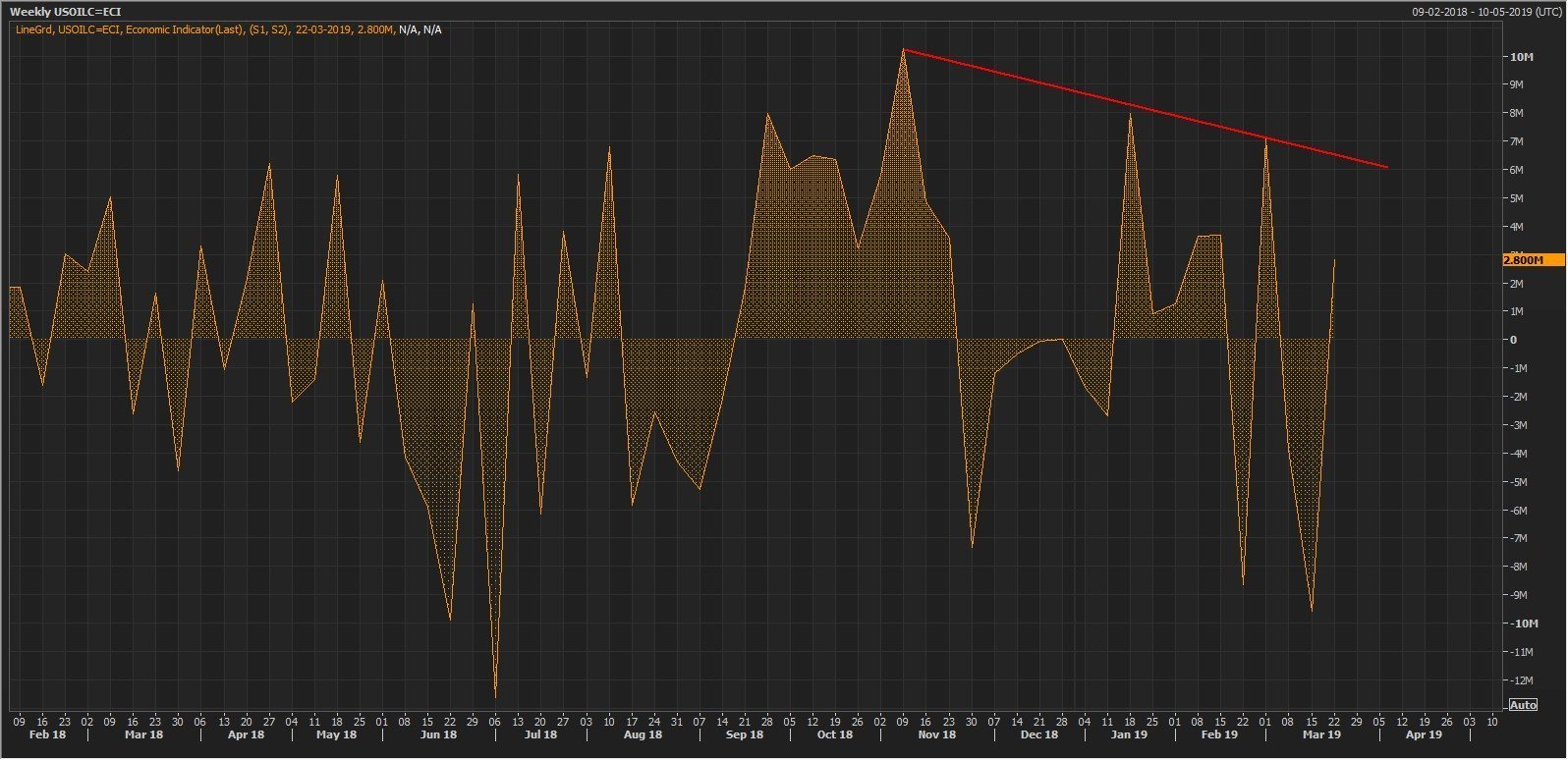

Crude oil prices experienced a surge recently after the U.S. Weekly Crude Output witnessed a decline amid fall in the number of operational rigs. The U.S. Weekly Crude Inventory marked a steep decline to the level of -9.6 million barrels for the week ended 15th March 2019, significantly below the market expectation of 0.5 million barrels.

Source: Thomson Reuters: U.S. Weekly Crude Inventory

The U.S Crude stockpiles declined from the level of 7.069 million marked for the week ended 1st March 2019 to the level of -9.589 million. The steep fall in crude inventory noticed a second decline after an initial reduction to the level of -3.862 million for the week ended 8th March 2019.

However, U.S. Weekly Crude Inventories slightly rose to 2.80 million for the week ended 22nd March 2019. But the rise in U.S. inventory was soon indemnified by the further production cut from Saudi Arabia.

Falling Crude inventory provided a respite to the market participants over the previous building U.S. Shale oil and in turn, supported the crude oil prices.

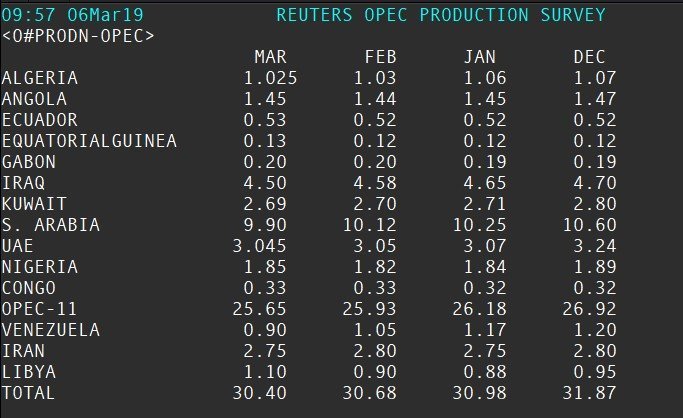

Another factor which supported the crude oil prices was the incessant production cut from the OPEC members.

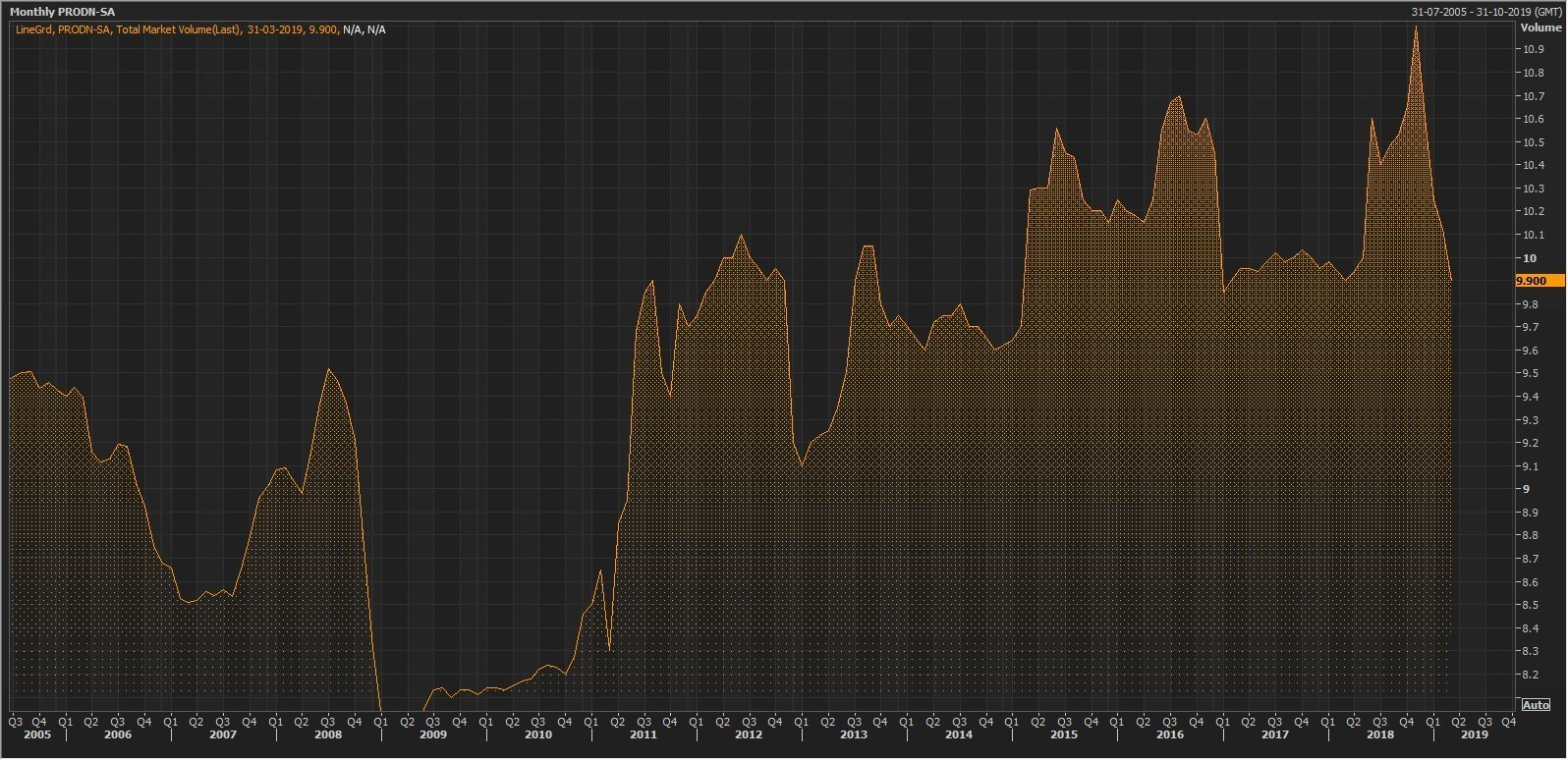

The kingpin of oil, Saudi Arabia experienced a decline in its production from the level of 11,000bpd to approx. 10.12K bpd for November 2018 and Saudi further declined the production to approx. 9.90K bpd for March 2019.

Source: Thomson Reuters: Saudi Arabia Monthly Oil Production

The decline in production by the king ping and the rest of the members of oil-producing consortium supported the oil prices.

Source: Thomson Reuters: Reuters OPEC Production Survey

Apart from the production cut by OPEC and decreased output from the U.S., another factor which supported the crude oil prices was the sanctions of the U.S. president Donald Trump on various oil exporting counties such as Venezuela and Iran, which concerned the market participants over the supply disruption of oil in the global economy.

In the recent event, the U.S. official told media channels that the United States is considering further sanctions against Iran and Venezuela. The senior official also mentioned that out of eight countries to which Washington granted waivers to import oil from Iran; three countries have now cut their shipments from Iran to zero.

The production cut and ban on significant crude exporting countries concerned the market participants over, supply shortage, which in turn, lift the crude prices above $70 per barrel.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.