Nowadays, more and more people are doing their grocery shopping through multiple smaller shops and small-format convenience stores. As per CMA 2017 Shopper Tracker Report, around 48% of consumers visit petrol and convenience stores to fulfil their eating, snacking and drinking needs. This means that a huge number of people are relying on small-format convenience stores to fulfil their consumption and shopping needs. Many department store retailers are aware of this above-mentioned scenario and are trying to address the shopping needs of consumers.

Australiaâs leading premium fuel retailer, BP Australia has joined hands with David Jones, a leading premium department store retailer to create market leading food convenience offer that addresses the needs of todayâs on-the-go Australians.

In an announcement made on 27 August 2019, BP Australia announced a partnership with David Jones to create all-new centres of convenience and to provide a new way to Australian consumers to shop for food, reflecting the evolution of convenience retailing and global urbanization trends.

This partnership is in line BPâs vision of transforming convenience retailing in Australia and enhancing its brand through strategic partnerships.

Currently, BP has around 1,400 branded retail fuel sites across Australia. Under this partnership, the high-quality product range of David Jones will be distributed through BP sites, which will provide Australians easy access to locally sourced ready-made meals as well as other fresh and quality offers.

Currently, David Jones has around 47 stores New Zealand and Australia, which provides range of food products to consumers. Through this partnership with BP, David Jones will be able to provide its wide range of food products to the Australians who are travelling or are in a hurry.

There are various retailers and departmental store owners who are trying new ways to cater to the increasing needs of consumers.

Recently, Australiaâ leading retailer Woolworths Group Limited (ASX: WOW) entered into a strategic partnership with Marley Spoon AG (ASX: MMM), a leading global subscription-based meal kit provider, to grow both the Marley Spoon and Dinnerly brands in Australia as well as to build operational synergies.

While Marley Spoon will benefit from Woolworthsâ deep industry experience, Woolworths will gain valuable insights from Marley Spoonâs market experience and besides that, this partnership will give Woolworths exposure to the high-growth ready-to-cook meal kits segment, which will help it to provide healthy and convenient meal solutions to its customers.

Recently, Woolworths Group announced an agreement to combine its drinks and hospitality businesses, Endeavour Drinks and ALH Group into a single entity to create a large integrated drinks and hospitality business in Australia with sales of around $10 bn and EBITDA of $1 bn. After combining these businesses into a single entity, Woolworths Group intends to demerge this entity so that it can benefit from a simplified organizational structure.

On the stock performance front, WOWâs stock has provided a return of 24.72% as on 26 August 2019. WOWâs stock has a PE multiple of 26.930x and an annual dividend yield of 2.66%. The stock has a 52-week high price of $36.650 and 52 weeks low price of $27.030. At market close on 27 August 2019, WOWâs stock was trading at a price of $35.930 with market capitalization of circa 44.9 billion. It is to be noted that the stock is trading very near to its 52 weeks high price.

Australiaâs another leading retailer, Wesfarmers Limited (ASX: WES) recently completed the acquisition of Catch Group Holdings Limited, an established, profitable and cash-generative business, to leverage the Catch teamâs expertise to accelerate digital and e-commerce capabilities across Wesfarmers and Kmart Group.

On 27 August 2019, Wesfarmers Limited has announced its full year results for FY19 in which it reported strong results & improved shareholder returns for the full year. The company earned net profit after tax (NPAT) of $5,510 million in FY19 which includes post-tax significant items of $3,171 million. The NPAT from continuing operations increased by 13.5% to $1,940 million in FY19 as compared to the previous corresponding period.

Wesfarmers Limited FY19 Results (Source: Company Reports)

Wesfarmers Limited FY19 Results (Source: Company Reports)

During the year, Wesfarmers Limited completed a number of actions to reposition the portfolio, resulting in gains on the demerger of Coles & divestments of Bengalla, KTAS, Quadrant Energy.

On 23 May 2019, the company announced that it had entered into a Scheme Implementation Deed with Kidman Resources Limited (Kidman) under which it is proposed that Wesfarmers will acquire 100 per cent of the outstanding shares in Kidman for $1.90 per share by way of Scheme of Arrangement

The acquisition remains subject to shareholder approval and subsequent court approval. In the event these approvals are received, it is expected that the transaction will complete in September 2019.

On the stock performance front, WESâs stock has provided a return of 18.32% as on 26 August 2019. WESâs stock has a PE multiple of 7.920x and an annual dividend yield of 5.69%. The stock has a 52-week high price of $40.430 and 52 weeks low price of $27.537. At market close on 27 August 2019, WESâs stock was trading at a price of $38.980, up by 0.75% intraday, with market capitalization of circa 43.87 billion. It is to be noted that the stock is trading very near to its 52 weeks high price.

In March 2019, Coles Group Limited (ASX: COL) joined hand with Ocado, global leader in online end-toend solutions to provide worldâs leading end-to-end online supermarket customer experience to its customers. This partnership is in line with Colesâ strategy of making life easier for its customers and team members through investments in automation and digital solutions.

Coles recently released its FY19 results. Major highlights for FY19 Include:

- Comparable sales growth of 2.7% driven by online and successful collectable campaigns;

- Gross margin increased by 20bps due to strategic sourcing and continued execution of Own Brand strategy

- EBIT increased by 2.2% driven by higher sales and improved gross margin;

- Smarter Selling restructuring provision of $19 million included in 2H19 EBIT;

- ASX listed following a successful demerger from Wesfarmers;

- Strategic refresh to âsustainably feed all Australians to help them lead healthier, happier livesâ;

- Strategic partnerships announced with Optus and SAP (HR, Procurement and Finance) to accelerate technology-led transformation of stores, support centres and supply chain;

- Entered into an incorporated Joint Venture with Australian Venue Co in relation to Colesâ hotel and retail liquor business in Queensland to focus on liquor retailing;

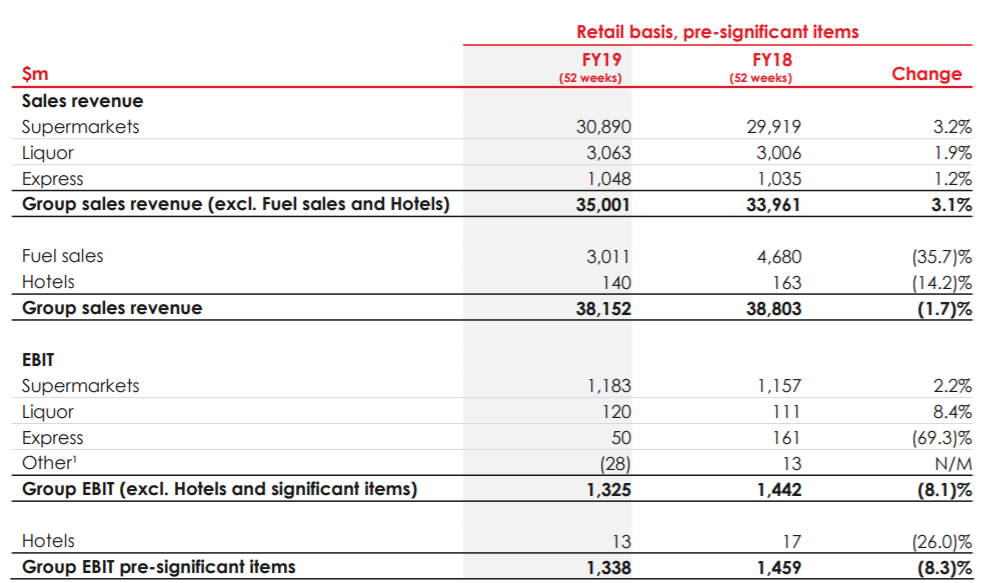

In FY19, Coles witnessed a decline of 8.1% in its EBIT (excluding Hotels and pre-significant items), impacted by lower Express fuel volumes and corporate costs associated with being a standalone ASX listed company.

FY19 Results Snapshot (Source: Company Reports)

FY19 Results Snapshot (Source: Company Reports)

On the stock performance front, COLâs stock has provided a return of 18.27% as on 26 August 2019. COLâs stock is trading at a PE multiple of 12.70x has a 52-week high price of $14.390x and 52 weeks low price of $11.120x. At market close on 27 August 2019, COLâs stock was trading at a price of $13.560, down by 0.732% intraday, with a market capitalization of circa 18.22 billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.