The COVID-19 driven restrictions mounting across Australia have again endangered the property market boom achieved after months of downturn. Existing economic headwinds and weaker consumer confidence have made the housing market vulnerable to fall in demand.

As coronavirus crisis continues to bite the nation, the consumer confidence is collapsing. This can be validated from the Westpac-Melbourne Institute Index of Consumer Sentiment, which tumbled 17.7 per cent from 91.9 in March to 75.6 in April 2020.

Westpac notified that the sentiment around housing crumpled in April 2020 with evaluations of both ‘time to buy’ and ‘price expectations’ plummeting to the most pessimistic levels since the Global Financial Crisis.

Additionally, the property consultant CoreLogic’s latest report has exhibited a fall in the number of new residential listings advertised for sale across the nation in the 28 days to Easter Sunday 2020. The consultant recorded this value as 24,051, which is 27.3 per cent below the comparable period last year and by far the lowest level for this time of the year in last many years.

Property Sentiment Plummets amid COVID-19

The latest ANZ Property Council industry survey for 2020 June quarter has revealed a sharp dip of 61 index points in the national industry confidence levels to 62 index points. The participants in the survey, including banks, builders and developers have announced the lowest ever levels of confidence.

Among all the property industry participants, the Western Australians were found to be the most concerned ones over the availability of debt finance. The lowest level of confidence in relation to office market sectors and growth in the value of house prices was reported from Western Australia.

Also Read Staying Positive while ABS Talks About COVID-19 Driven Impact on Businesses

Although early market indicators are demonstrating signs of a housing market downturn, this can be a temporary disruption, which may improve once Australia’s economic operations resume and social distancing policies are lifted. Besides, leniency by the banks and RBA & the federal government’s stimulus measures may prevent the possible house price falls.

Big Four Banks Offering Mortgage Relief to Borrowers

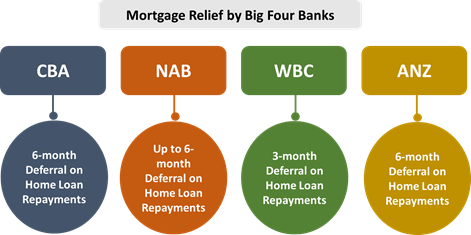

In order to support borrowers sail through this challenging phase, the Australian banks, including big four banks, have announced coronavirus mortgage relief for about three to six months. Let us have a quick look at how big four banks are supporting their borrowers:

Commonwealth Bank of Australia (ASX:CBA): As a financial assistance, the bank has allowed its home loan customers to defer their repayments for six months, with interest being added to their home loan. Moreover, the bank has decided to compensate any interest levied on the interest during the six months by making a one-off payment.

National Australia Bank Limited (ASX:NAB): To make it easier for borrowers to manage their home loan, the bank has allowed its eligible customers to access a home loan repayment break of up to six months. Additionally, the bank has announced lower interest rates on some specific new fixed-rate loans.

Westpac Banking Corporation (ASX:WBC): For its home loan customers who have suffered the loss of income or lost their job due to COVID-19, the bank is offering a three-month deferral on the customers’ home loan repayments with an increase of additional three months available after review.

Australia and New Zealand Banking Group Limited (ASX:ANZ): The bank is allowing its borrowers experiencing financial difficulty amid COVID-19 to pause home loan repayments for 6 months, with interest capitalised. Moreover, the bank has reduced the standard variable home loan rate by 0.15 per cent p.a.

Low Interest Rate Setting to Support Housing Sector

For the first time in history, the RBA lowered its interest rate twice in a month, taking it to a record low level of 0.25 per cent in March 2020. The home loan interest rates level standing at record low levels may act as a stimulator for the Australian housing market to weather through coronavirus-induced storm. Additionally, the RBA’s 3-year funding facility for authorised deposit-taking institutions and its quantitative easing program may also help.

However, in its latest Financial Stability Review, the RBA highlighted that there are some risks emerging from the property market. The central bank stressed that the COVID-19 associated uncertainty and the shock to economic activity have resulted in a fall in demand in the residential property market, which can raise the incidence of negative equity if prices drop.

Additionally, the central bank mentioned that it is difficult to evaluate changes in housing prices in the period ahead due to a significant reduction in housing turnover amid government restrictions on open inspections and auctions.

Fiscal Stimulus may Aid Property Market

Along with the RBA’s monetary policy measures, the Australian government’s robust fiscal stimulus packages announced to deal with harsh economic consequences of COVID-19, are likely to support the property market in the coming months.

The federal government’s consolidated package now amounts to $320 billion, representing balance sheet and fiscal support across the forward estimations of 16.4 per cent of annual GDP. Recognising the more prolonged impact of COVID-19 outbreak, the government has provided this stimulus to support businesses and households breeze through the challenging period ahead.

It is worth mentioning that the OECD and IMF consider Australia as one of the advanced economies in the best positions to deliver fiscal support without jeopardising debt sustainability.

Although the prospects of the Australian property market are not so bright for the months ahead, the monetary and fiscal policy measures may help prevent a material downturn in the sector. Moreover, the visible flattening of curve in the nation may minimise potential losses in the industry.

Interesting Read! Key Things We Learnt about Economies and Equity Markets Amid Crisis