Four ASX listed stocks are trading higher because of the recent announcements they have released. The major drivers of growth for the companies are positive and are supporting their long-term growth. Companies like Clinuvel Pharmaceuticals Ltd., Praemium Limited, Resolute Mining Limited and Zip Co Limited saw a rise in stock prices in recent days. Let’s look at the reason behind the surge in stock prices of these four companies.

Clinuvel Pharmaceuticals Ltd (ASX: CUV)

Clinuvel Pharmaceuticals Ltd is a leading and innovative Australian company focused on the development of SCENESSE, its proprietary first-in-class drug, as a photoprotective medication in a range of UV and light related skin disorders and as a depigmentation therapy in the common skin disorder vitiligo.

Currently the company has Scenesse in the market, which is used for the avoidance of phototoxicity in grown-up patients with erythropoietic protoporphyria (EPP). EPP is a unique metabolic condition which is responsible for serious phototoxic reactions when patients uncover the surface of their skin to visible light.

- SCENESSE® is the world’s first systemic photoprotective drug;

- The active ingredient in Scenesse, Afamelanotide, acts as an antioxidant and stimulates the production of melanin in skin to prevent phototoxic reactions in EPP patients;

- The company has been granted marketing authorisation in the USA (FDA) and Europe (EMA) for adult EPP patients and currently there are no approved treatments for EPP in Australia.

Stock Performance

The stock of CUV closed the day’s trading at $29.000 per share on 14 January 2020, with no change from its previous closing price. The company has a market capitalisation of $1.43 billion as on 14 January 2020. The total outstanding shares of the company stood at 49.41 million. The stock has given a total return of 7.65% in the time period of 1 month.

Praemium Limited (ASX: PPS)

Praemium Limited is a worldwide leader in providing technology platforms for managed accounts, investment administration and financial planning. The company services in excess of 300,000 investor accounts covering over $140 billion in funds globally for more than 1,000 financial institutions and intermediaries, including some of the world’s largest financial institutions.

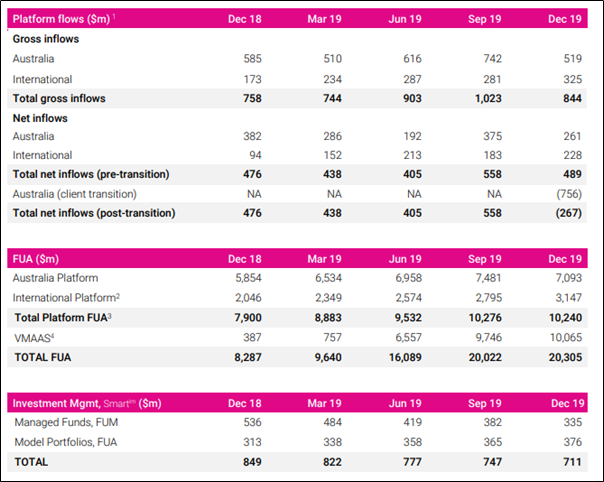

The shareholders of the company have responded positively after the release of the company’s latest quarterly update (for the quarter ended December 2019). Key highlights of the quarter:

- The company achieved record results for the International platform, with gross inflows of $325 million, net inflows of $228 million and platform FUA surpassing $3 billion for the first time;

- Funds under administration grew to $20.3 billion driven by quarterly gross inflows of $0.84 billion, the third highest on record;

- During the December quarter, the company added Australian Government Bonds to its Australian licence for custodial platform assets and launched a new range of multi-asset index models managed by Morgan Stanley.

Key Statistics (Source: Company’s Report)

Stock Performance

The stock of PPS closed the day’s trading at $0.545 per share on 14 January 2020, down by 1.802% from its previous closing price. The company has a market capitalisation of $222.56 million as on 14 January 2020. The total outstanding shares of the company stood at 408.37 million. The stock has given a total return of 2.83% in the time period of 1 month.

Resolute Mining Limited (ASX: RSG)

Resolute Mining Limited is engaged in the business of gold mining, development of resource projects and prospecting and exploration for minerals.

Recently, the company released its guidance for FY20, and it expects to increase its production to 500,000 ounces of gold this year, which is about 30% higher on year on year basis.

- All-In Sustaining Cost is expected to be US$980/oz;

- This is almost 10% decrease in FY19 costs;

- Gold production from Syama is expected to be 260,000oz at an AISC of US$960/oz;

- Gold production from Mako for FY20 is expected to be 160,000oz at an AISC of US$800/oz;

- At Ravenswood a production target for FY20 to be set at 80,000oz of gold at an AISC of US$1,200/oz.

The company also reported production for 12 months to 31st December 2019. Key highlights are:

- Total gold production of 384,731oz and gold sales of 394,920oz relative to production guidance of 400,000oz;

- AISC of US$1,090/oz relative to cost guidance of US$1,020/oz;

- Average gold price received of US$1,344/oz from total gold sales of 394,920 oz.

Stock Performance

The stock of RSG closed the day’s trading at $1.170 per share on 14 January 2020, up by 4% from its previous closing price. The company has a market capitalisation of $1.06 billion as on 14 January 2020. The total outstanding shares of the company stood at 903.15 million.

Zip Co Limited (ASX: Z1P)

Zip Co Limited is one of the top players in the payment industry and digital retail finance. It offers point-of-sale credit and digital payment services.

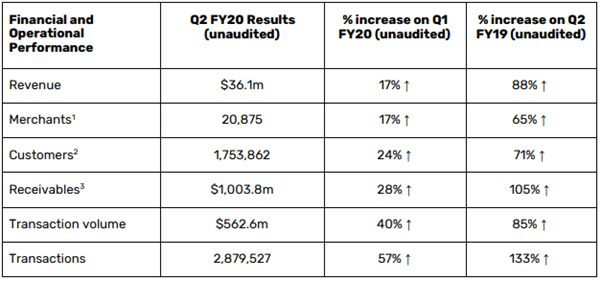

The company recently announced a record quarter for Q2FY20. Key highlights of the quarter are given below:

- Record quarterly revenue of $38.5 million, up 24% on Q1 FY20 (up 101% YOY);

- Receivables increased to $1,040.5 million, up 33% on Q1 FY20 (up 113% YOY);

- Record quarterly transaction volume of $562.6 million, up 40% on Q1 FY20 (up 85% YOY). The company is now annualising at $2.3 billion;

- Customer numbers increased to 1.8 million (up 24% on Q1 FY20).

During the quarter the company completed the acquisition of PartPay, a global instalment technology platform. PartPay will provide exposure to United States, United Kingdom, New Zealand and South Africa.

Key Operational Metrics (Source: Company’s Reports)

Stock Performance

The stock of Z1P closed the day’s trading at $3.630 per share on 14 January 2020, down by 0.275% from its previous closing price. The company has a market capitalisation of $1.42 billion as on 14 January 2020. The total outstanding shares of the company stood at 390.39 million. The stock has given a total return of 19.02% in the time period of 6 months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.