Global growth is an important factor in determining the performance of big Asset and Fund managers. Generally, leading investment managers, diversify their portfolio by investing in several markets. This way they reduce the risk of being dependent on one market.

For example, an investment manager in Australia may take money from investors and put it in the US equity market or European market. This way the investors have a chance to gain from outside markets if their domestic market is not doing well. Hence, global growth is very important for Asset and Fund managers to provide substantial returns to investors.

Sometimes major macroeconomic events create tensions in different markets which in turn put pressure on global growth. In today’s scenario, the ongoing uncertainty in relation to the US/China trade war, the looming war rumors between Iran and the US, and the bleaker prospects for future economic growth has caused investors in global equity markets to remain nervous.

In these scenarios, investors react by favoring companies perceived to be immune from external events and they avoid value stocks and/or those with a degree of earnings cyclicality.

Three Popular Wealth Managers in Australia

Raiz Invest Limited (ASX: RZI)

Raiz Invest Limited is a financial services company which provides financial services and products through its mobile first micro-investing platform and has a recurring revenue model, generating revenue from offering financial services and products to the customers it has on the Raiz platform.

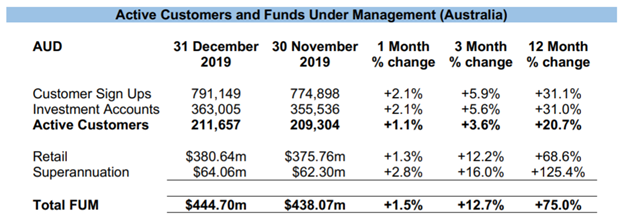

The company witnessed an increase of 1.5% in Total FUM (Funds Under Management) during the December month. Its total FUM currently stands at $444.7 million (as at 31 December 2019).

Active Customers and Funds Under Management (Source: Company Reports)

The company is focused on providing clients with innovative and extremely relevant products and continued financial market education Since launching in 2016, Raiz has achieved solid growth, amassing more than 1.15 million downloads, over 791,000 signups, with over 211,000 active monthly customers and over $444 million funds under management as at 31 December 2019.

In 2019, the company positioned Raiz in Indonesia – the world’s fourth most populous country with 270 million people – to the point where the app has been launched, while in Malaysia it has been establishing the foundations that will allow it to enter the market commercially by the third quarter of FY20.

“Total FUM, at $444.7 million, is edging towards the half billiondollar mark, ensuring we finished 2019 on a high note as well as setting the scene for another good year in 2020” said Raiz Invest CEO George Lucas while commenting on December months, and added that Superannuation FUM, which grew 125% over the year to $64.0 million, was better than expected and demonstrates that the company’s super product is increasingly appealing to its customers.

Notably, in the last six months, the stock of RZI has provided a return of 69.39% to its shareholders. BY AEDT 1:39 PM, RZI stock was trading at a price of $0.815 with a market cap of around $62.21 million. The stock has a 52 weeks high price of $1.172- and 52-weeks low price of $0.420 with an average volume of ~ 61,021.

Platinum Asset Management Limited (ASX: PTM)

A leading international investment manager, Platinum Asset Management Limited offers a highly differentiated product and maintains a strong position in the Australian retail market. The company is focussed on delivering strong, long-term investment returns for its clients and its business is both profitable and scalable with a strong dividend capacity and an unleveraged balance sheet.

In November 2019, Platinum experienced net outflows of around $173 million which included net outflows from the Platinum Trust Funds of around $131 million.

During the last financial year, the board paid a total dividend of 27 cents per share, fully franked and expects its future profits to be distributed by way of dividends, subject to the ongoing capital requirements of the company.

PTM stock is currently trading at a PE multiple of 16.8x with an annual dividend yield of 5.95%. By AEDT 1:39 PM, PTM stock was trading at a market price of $4.390, with a market cap of around $2.66 billion. The stock has a 52 weeks high price of $5.680 and a 52 weeks low price of $3.600 with an average volume of 921,611.

Magellan Financial Group Limited (ASX: MFG)

Leading wealth management group, Magellan Financial Group Limited witnessed 78% increment in its net profit after tax in FY19 and paid a total dividend of 185.2 cents per share during the year, significantly higher than the dividend of 134.5 cents per share paid last financial year.

During the year, the company’s Funds Management Segment witnessed 39% increase in the profitability, driven by:

- 31% increase in revenues driven by a 28% increase in average funds under management from $59 billion to $75.8 billion and a more than doubling of performance fees to $83.6 million;

- Positive operating leverage due to a modest increase in expenses of 4%

In December 2019, Magellan experienced net inflows of $469 million, taking Average FUM for the six months ended 31 December 2019 was $92,770 million.

In the last three months, MFG’s stocks have provided a return of 20.12% to its shareholders. The stock is currently trading at higher levels at a market price of $58.040. The company has a market cap of around $10.88 billion and is trading at a PE multiple of $28.020.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.