US companies are renowned for being innovative. They are also famous for guarding their booming technology secrets. With new businesses emerging by the day, the country has always been confident of its future. In this article, we would discuss two famous US-based giants- Apple Inc. and Ford Motor Company.

The Apple-Ford Connection

A couple of years back, Ford and Apple were growing close in many ways, while maintaining their great reputation as one of the best United States companies. Ford was getting heavier and heavier into technology while Apple was focussing on utilising its cash to make even more of it. The two companies were a hot topic of discussion when there were whiffs that Tim Cook, the CEO of Apple, was aiming to have Ford. As Mr Cook had indicated interest in the world of the core technology of autonomous systems, several market experts were anticipating that Apple would buy an automaker, in order to build and sell the entire autonomous vehicle.

Tim Cook had foreseen three major vectors of change hovering over the near future, which have come out to be legit in the current times- autonomous systems, battery electric vehicles, and ride sharing services.

Experts believed that it made sense for Apple to buy Ford, as the latter was a lifelong US-based company, had high trust levels amid Americans and worldwide, and was paving its way towards autonomous electric vehicles and ride sharing. To add on, the Ford shares were tagged as a good buy at the time of this discussion.

Let us now discuss these two companies in detail and look at their recent updates and stock performances on the NASDAQ.

Apple Inc.

An American technology based MNC founded by Steve Jobs, Ronald Wayne and Steve Wozniak and headquartered in California, Apple designs, develops and sells electronics for consumers and computer software, in addition to providing online services. Apple is one of the constituents of the tech giant group FAANG, along Facebook, Amazon, Netflix and Google.

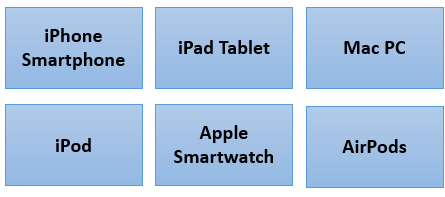

Few of the Apple products include:

After the founder and former CEO Steve Jobsâ demise, the baton is currently in the hands of Tim Cook. Apple is best known for its size and revenues, and it is regarded as the worldâs largest tech company by revenue besides being one of the most valuable. Last year, the company emerged as the first ever US company (public) to be valued at more than $1Â trillion.

The Recent with Apple

So far, 2019 has been a productive year for Apple and currently, the world is awaiting the launch of the pioneer iPhone 11 and its variants, which is due later this month. Besides this, in February 2019, the company had acquired DataTiger to make use of the latterâs digital marketing technology. Later in July, the company, along with Intel, announced that it would acquire the smartphone modem business of Intel Mobile Communications for approximately $1 billion.

iPhone 11 (Source: Company website)

Appleâs Third Quarter Results

On 30 July 2019, the company pleasingly released its results for the fiscal 2019 third quarter ended 29 June 2019, reporting a quarterly revenue of $53.8 billion, up by 1 per cent on pcp, with global sales accounting for 59 per cent of the revenue. The quarterly earnings per diluted share were down by 7 per cent, reaching $2.18.

Setting a record quarter, the company notified that this had by far been the biggest June quarter ever, acknowledging revenue from services, great performances of iPad and Mac, positive iPhone trends and strong growth from wearables, from all geographic segments.

Operating cash flow for the concerned quarter was reported at $11.6 billion, and the company returned more than $21 billion to its shareholders during the period ($17 billion through open market repurchases of shares and $3.6 billion in dividends and equivalents). For Q3, the company announced a cash dividend of $0.77 per share, which was payable on 15 August 2019.

Appleâs Outlook

For Q4 FY19, Apple expects its revenue to range between $61 billion and $64 billion, while tax rate is anticipated to be around 16.5 per cent. Gross margin is anticipated to lie between 37.5 per cent and 38.5 per cent for the fourth quarter of fiscal year 2019. Meanwhile, the company is expected operating expenses to be in between $8.7 billion and $8.8 billion. Apple is expecting other income of $200 million.

Stock Performance

After the trading session on NASDAQ on 13 September 2019, Apple (NASDAQ:AAPL) closed the dayâs trading at $223.09. The company has a market capitalisation of $1.008 trillion and its P/E ratio is 18.94x. The stock has been adhering the investor sentiments, as the company has recently unveiled a new suite of products that include the iPhone 11 and a streaming device.

Ford Motor Company

Headquartered in Michigan, Ford Motor Company is an American MNC automaker that was founded by Henry Ford. The company, which was incorporated in the year in 1903, sells automobiles and commercial vehicles. The company also owns Troller, a Brazilian SUV manufacturer. Ford has a basket of stakes in other automotive companies like Aston Martin and Jiangling Motors.

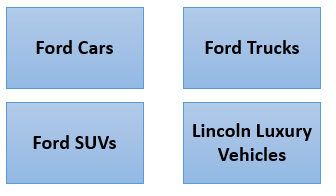

Ford is recognised as the second-largest US-based automaker, only next to GM and is the fifth largest across the globe. The company has manufacturing operations across the world in China, India, the US, Australia and Germany, to name a few. The automobiles are sold under the Ford marque worldwide and additional range of luxury automobiles are sold in the US under the Lincoln marque. Some of the company products include:

The Recent with Ford

A couple of months back, Ford intimated that it would cut about a fifth of its European work force and shut down five plants, driven by the fact that it was facing a weak demand for its cars and was struggling in Europe amid the ongoing political instability and uncertainty of trade relationships. Beyond this, Ford was aspiring to build electric vehicles in the region, as part of its new business model aimed at streamlining the companyâs operations in the region and turn a profit.

Besides this, the company was a hot topic of discussion when it was confirmed that it would develop commercial vans and medium-sized pickups for global markets along with Volkswagen as early as 2022. Investments would be shared by the two companies, which have signed an MoU. Under the deal, the companies would investigate partnership in the areas of autonomous vehicles, electric vehicles and mobility services.

Fordâs Revenue

The Ford Motor revenue for the quarter ended 30 June 2019 was $38.853 billion, down by 0.17 per cent on a year-on-year basis. The North America segment contributed the highest in this quarter. Revenue for twelve months ended 30 June 2019 was $158.654 billion. In 2018, the company had reported revenue of $160.3 billion and the revenue has unevenly fluctuated throughout the last few quarters.

Stock Performance

After the trading session on NYSE on 13 September 2019, Ford Motor Company (NYSE:F) closed the dayâs trading at $9.41. The stockâs dividend yield is 6.37 per cent and its P/E ratio is 17.43x. The stock has recently fallen victim to Moodyâs Investors Service bond downgrade, as it cut Fordâs credit rating to junk, given the operating and market challenges faced by the company.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.Â