Post the double whammy of bushfires and COVID-19, which hit the Australian economy hard over the past few months; the country has finally started on the road to recovery.

The easing of lockdown and relaxation in restrictions has led to the resumption in business activities across the country. The level at which companies can operate varies according to the degree of relaxations offered by the respective states.

As Australian businesses start getting back on their feet, let us look at a few ASX-listed companies from different sectors with their latest updates:

OFX Group Limited (ASX:OFX)

OFX Group Limited provides online international payment services for consumer and business clients.

Stable NOI Margins

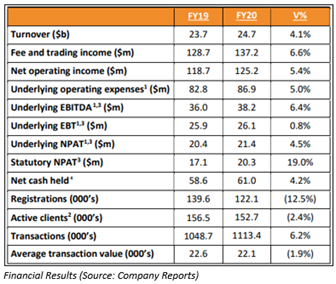

During FY20, OFX met all its financial commitments, which included growing EBITDA on an underlying basis, maintaining stable Net Operating Income (NOI) margins, and delivering positive annual operating leverage.

- OFX reported underlying EBITDA amounting to $38.2 million with a rise of 6.4% compared to the prior corresponding period.

- Net Operating Income for the period grew by 5.4% to $125.2 million, and the NOI margins were stable. The Company declared a ‘per share’ final dividend of 2.35 cents (unfranked).

- The Company added that these results demonstrate proper execution, and the sound fundamentals supporting the Company, which are especially valuable in uncertain times.

On 20 May 2020, OFX stock was trading at $1.375 (at 03:55 PM AEST), an increase of 7.422% from its previous close. The Company has a market cap of $318.38 million and ~248.73 million outstanding shares. The stock has generated returns of 4.49% and -5.88% in the last month and last six months, respectively.

Incitec Pivot Limited (ASX:IPL)

Incitec Pivot Limited is involved in the manufacturing and supply of industrial chemicals, industrial explosives, and fertilisers. The Company has recently opened its share purchase plan to raise up to $75 million. This share purchase follows the institutional placement through which the Company raised $600 million.

The Company would utilise the capital raised from the Placement and SPP to repay drawn balances of syndicated facilities, with the remaining amount held as cash on deposit.

This equity raising would cement IPL’s balance sheet to make its business healthy in the current uncertain scenario. This would also assist financial flexibility to chase organic growth prospects.

On 20 May 2020, IPL stock was trading at $1.952 (at 03:55 PM AEST), an increase of 0.103% from its previous close. The Company has a market cap of $3.73 billion and ~1.91 billion outstanding shares. The stock has generated returns of -6.70% and -41.44% in the last month and last six months, respectively.

Tabcorp Holdings Limited (ASX:TAH)

Tabcorp Holdings Limited is engaged in the provisioning of gambling and other entertainment services.

Under its Syndicated Facility Agreement, the Company has secured agreement from its bank lenders for a waiver of leverage and interest cover covenants concerning the next two testing dates such as 30 June 2020 and 31 December 2020. TAH has decided that it will pay a final dividend for FY20 as part of securing the waivers under the Syndicated Facility Agreement.

The Company had available liquidity amounting to $820 million as on 15 May 2020 as compared to liquidity of $749 million as on 3 April 2020.

Tabcorp has decreased its operating and capital expenditure and reviewing various commercial arrangement to address the impacts of COVID-19 on the businesses and financial position of TAH.

On 20 May 2020, TAH stock was trading at $3.270 (at 03:56 PM AEST), an increase of 0.615% from its previous close. The Company has a market cap of $6.61 billion and ~2.03 billion outstanding shares. The stock has generated returns of 9.06% and -33.26% in the last month and last six months, respectively.

Centuria Office REIT (ASX:COF)

Centuria Office REIT is engaged in making investments in commercial property within Australia. Centuria has recently secured additional debt facility from Crédit Agricole with a term of seven years. This facility increased weighted average debt maturity to 3.7 years from 3.4 years and rose undrawn debt to $131.5 million.

This new, extended duration debt facility improves available liquidity of the Company while further diversifying its debt maturity profile, with no debt facility expiring until June 2022.

On the outlook front, the Company has decided to suspend its FY20 FFO guidance due to the uncertainty arising from COVID-19 as well as the potential impact on business operating conditions. However, it expects to pay a distribution of 17.8 cents per unit during FY20.

On 20 May 2020, COF stock was trading at $1.900 (at 03:56 PM AEST), an increase of 1.333% from its previous close. The Company has a market cap of $964.73 million and ~514.52 million outstanding shares. The stock has generated returns of -2.34% and -40.48% in the last month and last six months, respectively.

Growthpoint Properties Australia (ASX:GOZ)

Growthpoint Properties Australia is a real estate company, which is engaged in investing in Australian commercial real estate. Growthpoint has secured a new debt facility of $100 million with a new banking partner. This new facility is into two equal tranches of five and seven years.

This new facility provides rise to its liquidity. GOZ currently has $345 million of undrawn debt lines and $42 million of cash on its balance sheet. GOZ’s weighted average debt maturity has increased to 4.6 years and it has no debt maturity until FY22.

On 20 May 2020, GOZ stock was trading at $3.010 (at 03:56 PM AEST), an increase of 1.689% from its previous close. The Company has a market cap of $2.28 billion and ~771.78 million outstanding shares. The stock has generated returns of -1.66% and -31.80% in the last month and last six months, respectively.

Decmil Group Limited (ASX:DCG)

Decmil Group Limited provides engineering construction services for the Infrastructure, Resources and Renewable Energy sectors. Recently, the Company has appointed Dickie Dique on the role of Chief Executive Officer. The Company further added that discussions around the sale its Homeground Gladstone asset are ongoing.

The stock of DCG is currently placed in a trading halt owing to the outcome release of the accelerated entitlement offer’s institutional component.

NOTE: $ denotes Australian Dollar, unless stated otherwise