Health care Sector

Amid the blowing tension of global trade worries and lower returns on the investment, investors are clustering the equity market. One of the popular sectors evolving nowadays is Health care sector. The sector includes companies providing medical services, medical insurance, manufacturing of medical equipment or drugs, and providing services to the patients. The sector represents ample of lucrative stocks, with strong growth prospects. It is also considered a complex sector, along with fast-growing industries in the economy. The health care industry shows a positive trend without any signs of slowing down in 2019. According to the latest reports on the Australian health care industry it is amid growing populations, aging, health care problems and various diseases, which continues to increase health care demands and expenditures.

Despite being one of the best healthcare systems in the world, Australiaâs Healthcare sector has been a victim to several challenges including rising chronic diseases, increasing demand of new treatments, more hospital beds and so forth. These challenges call for an adoption of new technologies and platforms to offer best experience for the people.

Let us look at some of the key developments and recent updates from Mesoblast Limited.

Mesoblast Limited

Health care company, Mesoblast Limited (ASX:MSB) leads in developing allogeneic cellular medicines. MSB has utilised its proprietary tech platform to form a wide portfolio of late-phase candidates. It has facilities in the regions like Melbourne, New York, Texas and so forth.

Capital Raising concluded for $75 million

On 3 October 2019, MSB notified the market that it has concluded $75 million capital raising through a placement to old and new international and the Australian institutional investors. The placement would follow 37.5 mn issue of (fully paid ordinary) securities at a price of $2.00/share.

Also, the proceeds derived out of the capital raising would be utilised to create product inventory along with a focus on the US sales force in planning for the prospective US commercial introduction of remestemcal-L, to cure pediatric steroid-refractory severe graft vs. host illness. Further, the proceeds would be utilised to finalise Stage three trials for prolonged low back pain issues and advanced heart failure of a person, and for fulfilling objective like working capital and so forth.

Release of Shares

On 27 September 2019, MSB gave a notice in compliance with ASX listing Rule 3.10 A that 14,464,259 ordinary shares, would be released from escrow on 12 October 2019, subject to voluntary escrow arrangements.

Partnership of Grünenthal and Mesoblast

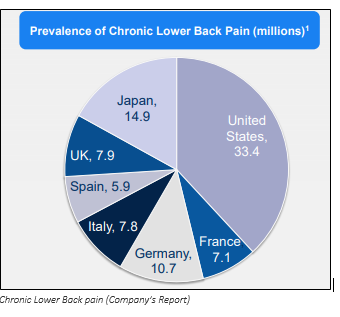

On 10 September 2019, the company made an announcement on entering into a partnership with Grünenthal for Latin America and Europe, to develop and commercialise Innovative Cell Therapy for the treatment of chronic low back pain.

Few key highlights of the partnership are as follow;

- The company with the new partner would work jointly on the developmental strategy and commercialisation of the candidate- MPC-06-ID to cure low back pain issues (chronic).

- The Stage 3 trial for the candidate under discussion in US was enrolled in March 2018, is currently near the finalisation stage. The readouts are planned for middle of FY 2020 period.

- Previously, the company in Stage 2 trial (US), had showed that a single intra-discal injection of the candiate MPC-06-ID, utilising 6 million allogeneic MPC or mesenchymal precursor cells/unit dose, had a significant effect and lasting improvements in people suffering from the pain.

- MSB would obtain upfront payments before the product is introduced, as well as commercialisation milestone payments, up to US$150 million.

- The cumulative milestone payments could surpass US$1 billion subject to the outcome of Stage 3 studies and a patientâs approval.

Partnership Benefits to MSB

- The transaction provides funding for phase 3 trials in Europe reducing the companyâs cash outflow.

- The Phase 3 trialsâ outcomes are expected to support regulatory approval in both Europe & US.

- Both MSB and its new partner will work together on the study design for the Phase 3 trial in Europe region.

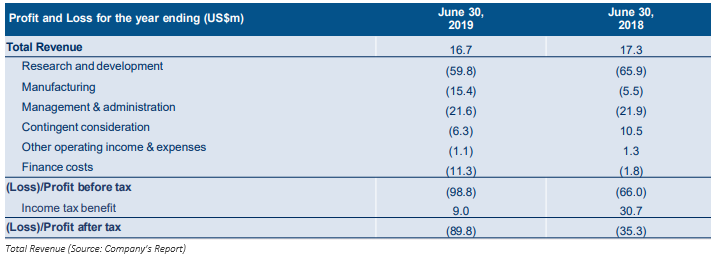

Financial result for the period ending 30 June 2019

On 29 August 2019, the company announced the FY 2019 results, below are a few pointers of the results;

- The companyâs revenue rose to US$1,967 against US$1,700 in the same period last year.

- Loss before income tax of the company increased to US$23,903.

- Cash and cash equivalents of MSB was recorded at US$50,426.

- Total current liabilities of the company increased drastically to US$44,331 from US$24,003 in pcp.

- Net cash outflows in operating activities of the company was reported at US$57,790.

Under this strategy, the company has access to additional source of capital as follows:

- The company is in the middle of advanced negotiations with a number of potential commercial partners concerning transactions.

- As per the deals with NovaQuest and Hercules Capital, MSB has US$35.0 million, which depends on the success of specific targets.

- Royalty payments will be obtained by the company from its current strategic partners.

- The Mesoblast has entered into a Subscription Commitment Letter with M&G Investment Management, one of the largest institutional shareholders for US$15.0 million in ordinary shares exercisable on or before 31 December 2019.

Corporate Highlights

- Constant increase in the companyâs revenues from royalties on the selling of TEMCELL in Japan region.

- The product implementation and compensation were witnessed in the Japanese GVHD market for TEMCELL.

- US market for Remestemcel-L is approximately 8 folds greater than the Japan region.

- Rolling BLA submission to FDA is expected to conclude the filing in CY2019 period.

- The company has an intention to expand its clinical program into the adult aGVHD section.

Stock Performance:

During the trading session, MSBâs stock quoted $1.990 on 4 October (AEST 11:54 AM). The company has approximately 498.66 million outstanding shares and a market cap of $994.83 million. The 52- high of the MSB stock was at $2.470. The stock has given a return of +33.00 per cent in the last six months timeframe, along with return of +57.71 per cent in year-to-date period.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.