Retail Sector -An Overview

Australia is one of the most developed societies in the world, with about 90 per cent of the people living in the urban areas of Sydney, Brisbane, Perth, Adelaide, and Melbourne, as well as in smaller towns and cities within 100 miles of the ocean.

Despite, rising household debt and low increases in wages, the Australian retail sector showed a positive growth. The retail industry is into the sale of customer products or services to consumers via various distribution channels to earn a profit from them. The retail space varies from other sectors in one important aspect: they do not manufacture a product. Rather, retailers buy products from the manufacturers and sell them to consumers.

The Australian retail sector has expanded substantially with 3.7 % YoY in September last year. The prospect of the Australian sector, moreover, is subject to customer buying behaviour, and there is a considerable shift in the customer spending plan due to an advancement in the technology.

Australia is presently counted as the tenth biggest eCommerce market on the basis of revenue around the globe. People are devoting more time on online platforms and purchasing from more often from there. It was predicted that by the close of this year, the Australian online businesses would witness a 15.1% rise in the revenue and online shoppers would be around 20.3 million which is 5% more than 2018.

On 30 September 2019, the S&P/ASX 200 Consumer discretionary (Sector) last traded at 2,606.4 points, with a dip of 0.83 per cent compared to the last close.

As depicted in the image above, there is an upward trend in the index S&P/ASX 200 Consumer Discretionary (Sector) as on 24 September 2019. Let us now discuss the five consumer stocks which had an increasing trend over a period.

Retail Food Group Limited

Retail Food Group Limited (ASX: RFG) is an international food and beverage entity. RFG owns the Australian regionâs biggest franchise of multi-brand retail food. The business of the company is supported through four growth drivers:

- Franchise

- International

- Coffee and Allied Beverage

- Commercial

The company is headquartered in Queensland and has 2,400 outlets located in Australia and internationally, with more than 15,000 employees.

Response to Media Speculation

On 25 September 2019, Retail Food Group Limited responded to a media speculation regarding a possible funding in a bid to reduce debt. The company is considering various options for funding such as asset sales along with debt & equity. No decision has been made by the board of RFG as to whether to proceed with the fund-raising option. There have been continuous discussions going on in relation to its proposal. The board will provide a further update on it in the due course.

Trading Halt

On 25 September 2019, the company had also announced on the temporary pause of trading in the securities.

Financial Results for the year ending 30 June 2019

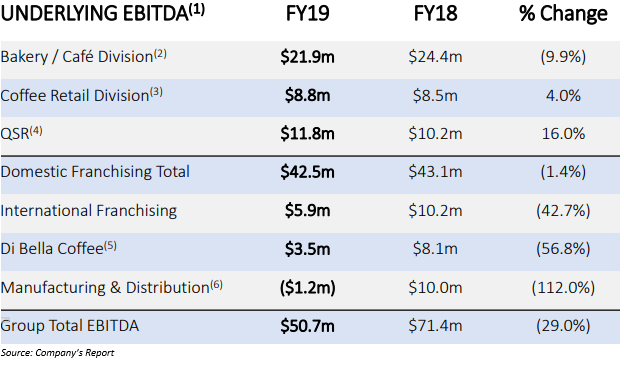

On 30 August 2019, the company announced the financial result for FY 2019 closed 30 June this year, a snapshot from the result are as follows:

- The companyâs underlying EBITDA decreased by 28.7 per cent to $50.7 million compared to the previous year same period.

- Revenue was decreased by 6.5 per cent to $349.8 million compared to the pcp.

- Underlying net profit after tax of the company decreased by 53.6 per cent to $15.4 million

- No dividend had been declared by the company.

- Net debt of the company remains consistent to $259.7 million.

- Underlying earnings per share decreased by 54.0 per cent to 8.4cps.

- Cash reserves of the company stood at $12.3 million.

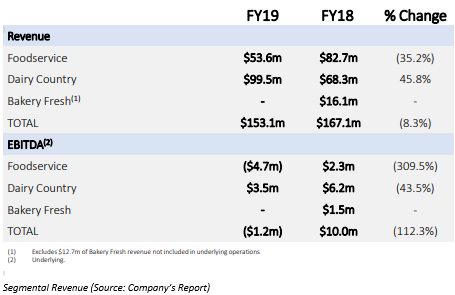

Segmental Revenue

- The companyâs foodservice segment decreased by 35.2 per cent to $53.6 million compared to the $82.7 million last year.

- Dairy Country revenue increased by 45.8 per cent to $99.5 million from pcp.

- Foodservice segment EBITDA decreased by 309.5 per cent to $4.7 million.

- Dairy Country EBITDA dipped by 43.5 per cent to $3.5 million.

The Financial year - 2019 Strategy

The company will re-focus on its core retail food franchise and coffee supply operations closure on the non-core business units. The company will improve the health of the domestic franchise network through product innovation and ongoing strategy implementation, also improving the balance sheet of the company for financial stability. RFG would leverage the Di Bella Coffeeâs competencies to profitably service the external consumer base, while keep on aiding the companyâs franchise partners. It would also propel growth in the companyâs franchise business by leveraging a strong network as a platform for fresh store sales.

Outlook

The company has started seeing the encouraging results of the business improvement methods applied in the RFG, which is a part of the companyâs turnaround plan. The management of the company is focussed on the execution of the FY 2019 strategy and continues to explore options to reduce the debt of the company. It also continues to roll out the new marketing and product strategy of RFG.

Stock Performance

The stock of RFG settled at $0.175 on 30 September 2019, lower by 2.778 per cent from its previous closing price. The company has a market cap of $32.89 million and approx. $182.75 million outstanding shares. The 52-week high and low of the stock has been noted at $0.510 and $0.125, respectively. The stock has generated a return of -14.29 per cent in the last six months period and a negative return of 38.98 per cent on the year-to-date timeframe.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.