We will be discussing five diversified stocks and will discuss about the recent updates, stock price movements and financial performance of these companies which fall under the category of âsmall-capâ stocks.

Kogi Iron Limited (ASX: KFE)

Kogi Iron Limited is an Australia based steel producing company, which specializes in producing cast steel product which is supplied to the manufacturers of steel products. Recently, KFE announces issuance of 821,002 ordinary shares at a price consideration of $0.0543 per share.

Key Operating Highlights for FY19: KFE reported total income of $6,597 as compared to $3,549 on previous financial year. The company reported net loss of $2,537,274 as compared to a loss of $3,310,869 during FY18. During FY19 KFE reported exploration and evaluation expenses at $893,510 as compared to $1,507,987 during previous financial year. The company reported total current assets of $1,476,907 which includes $1,427,491 of cash balance. The company reported total assets of $1,477,812 and net assets of -$419,376 (liabilities) as on 30 June 2019.

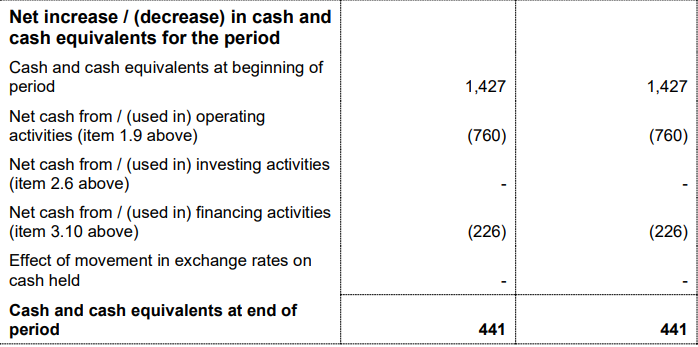

Q1FY20 Cash Flow Highlights for the period ended 30 September 2019: KFE announced its quarterly cashflow statements wherein the company reported $0.76 million used in operating activities followed by $0.226 million used for financing activities. The company reported a cash balance of $0.441 million as on 30 September 2019.

Q1FY20 Cash Flow Highlights (Source: Companyâs Reports)

Outlook: As per the management guidance, the company expects a cash outflow of $0.410 million for the Q2FY20 which includes exploration and evaluation at $0.17 million, staff costs at $0.1 million and administrative and corporate costs at $0.140 million.

Stock Update: The stock of KFE closed at $0.048 with a market capitalization of $33.88 million on 8th November 2019. The stock has given returns of -1.92% and -38.55% during the last three-months and six-months, respectively.

Titanium Sands Limited (ASX: TSL)

Titanium Sands Limited operates in mining activities of sands and operates in Mannar Island Mineral Sands Project. Recently, TSL announced its proposed acquisition of a group of companies that hold a substantive 38 square kilometer tenure package that holds an inferred mineral resource of 32Mt of HMS at 7.45% and complements the companyâs existing extensive tenure at Mannar Island in North West Sri Lanka.

Quarterly Highlights for the period ended 30 September 2019:

- Technical due diligence on the proposed adjoining tenure acquisition at the Mannar Island Project defines a high-grade surface exposed heavy mineral sand resource of 31.92Mt at 7.45% Total Heavy Mineral (THM%)

- RC aircore drilling below the existing above water table high grade Mannar Island resources commenced in August and 255 holes to a nominal depth of 12m (for 3,048m) have now been completed.

- The company reported Visual logging of the drill holes which was found near continuous significant heavy mineral content down to 12m in 235 of the 255 drill holes.

- Samples from the RC aircore drilling (till date 3,048) are being prepared and shipped to a mineral sands laboratory in South Africa, THM% results will be progressively received over the next 3 months.

Q1FY20 Cash Flow Highlights for the period ended 30 September 2019: TSL reported a cash of $0.601 million used in operating activities, $0.006 million used in investing activities. The company reported $2.649 million cash balance as on 30 September 2019.

Outlook: A per the next quarter cash flow guidance, TSL estimated a total cash outflow of $0.54 million which includes exploration and evaluation of $0.305 million, $0.1 million of staff costs and $0.135 million of administrative and corporate expense. The company is aiming at extension drilling at Mannar Project in Sri Lanka and targeting beneath the water table under parts of the shallow resource drilling.

Stock Update: The stock of TSL closed at 0.019, flat over the prior close, on 08 November 2019. The stockâs market capitalization is $12.07 million. The stock has given returns of -13.64% and 18.75% during the last three months and six-months, respectively.

Connexion Telematics Ltd (ASX: CXZ)

Connexion Telematics Ltd operates development of technology and primarily provides services like in-vehicle infotainment and data analytics services related to vehicle segment. Recently, with a press release, CXZ informed about change of directorâs interest where one of its directors named Mark Victor Caruso has disposed 1,667,757 number of shares at an average consideration of ~$0.026573 per share.

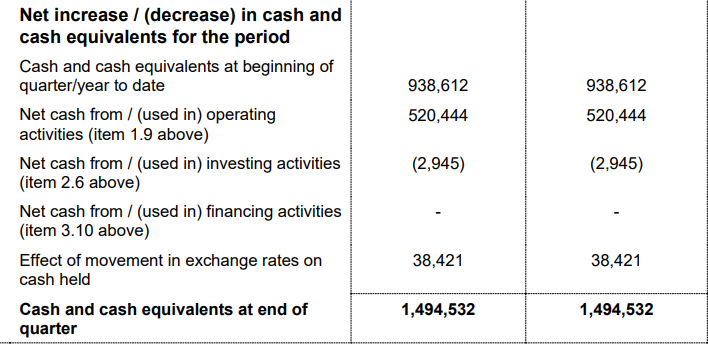

Q1FY20 Quarterly updates: CXZ reported net cash flow from operating activities at $520,444 followed by an investment of $2,945 during the first quarter of FY20. The company reported cash and cash equivalents of $1,494,532 as on 30 September 2019.

Three Months Cash Flow Statement (Source: Company Reports)

The business reported CTP/CTA subscription at above 72k vehicles per month on a consistent basis. The group subscription base stood at 77,634 vehicles. CXZ reported improvement in customization for GM at $221k during the quarter. The cash position of the company increased by 60% to $1.5 million at the end of the quarter.

Outlook: As per the cash flow guidance, the company estimates total estimated cash outflows of $1,842,597 for the next quarter, which includes product manufacturing and operating costs of $1,195,829, advertising and marketing expense of $6,330, staff costs of $289,477 and administration and corporate expense of $350,961.

Stock Update: The stock of CXZ closed at $0.029, down 3.33% as on 08 November 2019. The stock has given stellar returns of 76.47% and 200% during the last three-months and six-months, respectively.

Ignite Limited (ASX:IGN)

Ignite Limited provides re-imagining talent services relating to contract and temporary workers. These may be employed with nongovernment, government entities and private clients of different sizes across the Asia-Pacific region. Recently, IGN informed about the appointment of Mr. Brad Shotland for the post of General Manager for NSW. Mr. Shotland has a rich experience of more than 20 years in NSW across the recruitment industry.

Three months Cash Flow update for the period ending 30 September 2019: NSW reported net cash used in operating activities at $0.52 million, net cash used in investing activities at $0.018 million as on 30 September 2019. The business reported cash balance of $0.747 million at the end of the first quarter of FY20. IGN reported $41.9 million as receipts from customer during the first three months of FY20 followed by staff costs and administration and corporate costs of $5.417 million and $2.1 million, respectively.

Outlook: As per the cash flow guidance, IGN estimates a total cash outflow of $39.057 million including product manufacturing and operating costs at $28.237 million, advertising and marketing expense of $0.147 million, leased assets of $1.052 million, staff costs of $5.347 million, administrative and corporate costs of $1.954 million.

Stock Update: The stock of IGN closed at $0.03 with a market capitalization of $2.69 million on 8th November 2019. The stock has given returns of -28.57% and -49.15% during the last three months and six-months, respectively.

NVOI Ltd (ASX: NVO)

NVOI Ltd is a communication services company which focuses on developing and marketing of a cloud-based workforce management system used to secure and manage employees for on-site, non-permanent work assignments. On 06 November 2019, NVOI Limited informed about the appointment of Raife Watson for the position of Chief Executive Officer.

Earlier, on 14 October 2019, NVO placed a request of trading halt due to its pending released announcement. The company informed; the trading halt will continue till the release is made or until the commencement of normal trading on 16th October 2019, whichever was earlier.

FY19 Financial Update for period ended 30 June 2019: NVO declared its full year financial results wherein the company reported revenues from ordinary activities at $13,480, a 84.61% decline on y-o-y basis. The company reported a loss of $1,417,869, down by 60.06% on y-o-y basis. During the year the company reported employee benefits expense at $ 857,867 as compared to $ 484,843 on previous financial year. The companyâs research and development came in at $393,590 as compared to $1,056,281 in FY18. Finance and administration, during FY19 stood at $284,899 against $405,224 during previous financial year. As per the balance sheet figures, the company reported total current assets at $1,751,562 which includes cash and cash equivalents of $1,555,663 and trade and other receivables of $195,899. Total assets stood at $1,755,235 followed by net assets of $1,642,166 as on 30 June 2019.

Stock Update: The stock of NVO closed at 0.021, up 10.526% as on 08 November 2019. The stockâs market capitalization is $24.62 million. The stock has given a strong return of 58.33% and 72.73% during the last one month and three-months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.