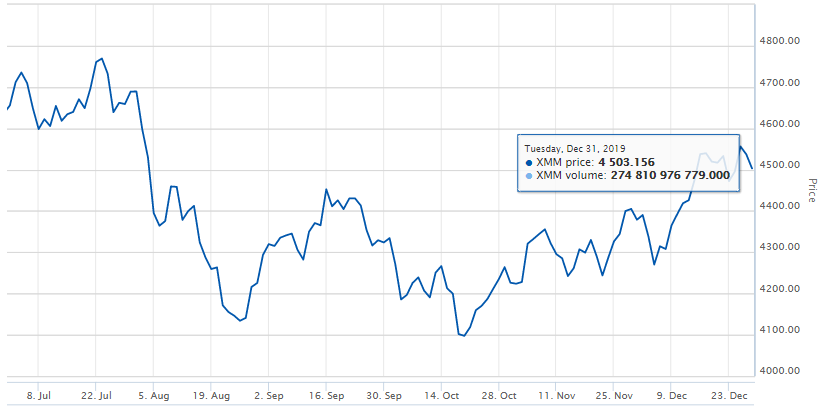

The Australian mining sector has approximately soared by ~10% from last six months, with the lowest dip contemplating S&P/ASX 300 Metals and Mining at $4097.713 on 18th October to $4503.156 on 31st December 2019 as shown below.

Source: Australian Stock Exchange

The index revived after tumbling by 13% from AUD 4769.269 on 23rd July to AUD 4141.069 on 27th August 2019. Due to the hope of improvement in US and China trade, escalated iron ore, copper and gold prices and strong demand of steel by Asian market to mention few.

In milieu of which, it is quintessential to see what the latest update from the industry is. For the same we are discussing a company with Gold project and the other one producing Nickel.

On 2 January 2020, S&P/ASX 300 Metals and Mining (Industry) last traded at 4,503.7 points, moving up by 0.01 percent from its last close.

Let us now have a look at the two stocks from metals and mining sector trading on ASX.

Gold Road Resources Ltd (ASX:GOR)

Gold Road Resources Ltd (ASX:GOR) is an exploration and production company based in Australia. GOR focuses on the development of its newest goldfield; the Yamarna Belt located 200 km east of Laverton in Western Australia covering an area of ~6,000 km2 and a strike length over 180 km, extending access to one of the extraordinarily potential yet under-explored greenstone belts.

The company divides Yamarna exploration activities into three main areas, as shown below:

- Central Project Area – It includes two tenements, i.e. Gruyere gold mine only producing mine in 50:50 partnership with Gold Fields Limited and 100% owned Golden Highway Deposits.

- Northern Project Area – It includes 100% owned Corkwood, Bloodwood and stock route-target areas.

- Southern Project Area – It includes 100% owned the Smokebush, Wanderrie (Gilmour), Toppin Hill and Hopwood Camp Scale Target areas.

The Yamarna Belt

Source: Company Annual Report

Gruyere gold mine achieved commercial production in late June 2019 and has milled 1.227 Mt of ore at 0.97 g/t of grade with the recovery of 93.8% till 30th September 2019. The mining rate anticipated to achieve the processing capacity of Gruyere's mill, i.e. around 7.5 Mtpa to 8.2 Mtpa by 2020. The production guidance for FY19 predicted to be about 75 koz to 100 koz on 100% basis at AISC of AUD 1,050 to AUD 1,150 per ounce. Whereas, ore contribution from Golden highway deposit is expected by 2023.

Following the achievement of Gruyere gold mine, new 297.6 koz mineral resources at Gilmour and Renegade added reaching total mineral resources of 3.5 million tonnes at 2.62 g/t Au for 297,600 ounces at gold price assumption of $1,850 per ounce. On 19th December 2019, positive diamond and reverse circulation assay results were reported across central and southern project areas.

- Southern Project Area – Diamond and RC drilling verified continuity and geometry immediately north and south of high?grade mineralization intersecting at:

- 13 metres at 1.98 g/t Au from 56 metres, including 8 metres at 2.75 g/t Au from 61 metres

- 18 metres at 1.33 g/t Au from 18 metres, including 2 metres at 5.61 g/t Au from 34 metres

- Central Project Area – The final assay results exceeded the expectation, and the details are:

- 6 metres at 1.46 g/t Au from 437.4 metres

- 2 metres at 1.47 g/t Au from 275.7 metres

- 4 metres at 2.52 g/t Au from 372.3 metres

- 5 metres at 1.25 g/t Au from 418.9 metres

Addition to Yamarna Belts, the company has also signed earn-in joint venture agreements with Cygnus Gold Ltd (ASX:CY5) in late 2017. The area covered under agreement is ~3400 km2 of the Wadderin and Lake Grace greenfield exploration projects in the south-west of Western Australia. The deal allows GOR to secure up to 75% interest in these two projects and can establish Yandina Project covering 1,600 km2 in JV with an immediate 75% ownership with Cygnus.

However, with the recent announcement by 27th December 2019, GOR has taken the initiative to withdraw from Wadderin letter agreement returning 100% per cent to CY5. As per the agreement Gold Road (Projects) Pty Ltd, as a wholly owned subsidiary of Gold Resources has already reached the milestone of $900 thousand by November 2019, the minimum expenditure required before withdrawal from the agreement. While concerning Lake Grace and Yandina Project, Gold Resources and Cygnus are finalising budgeted exploration expenses for FY2020.

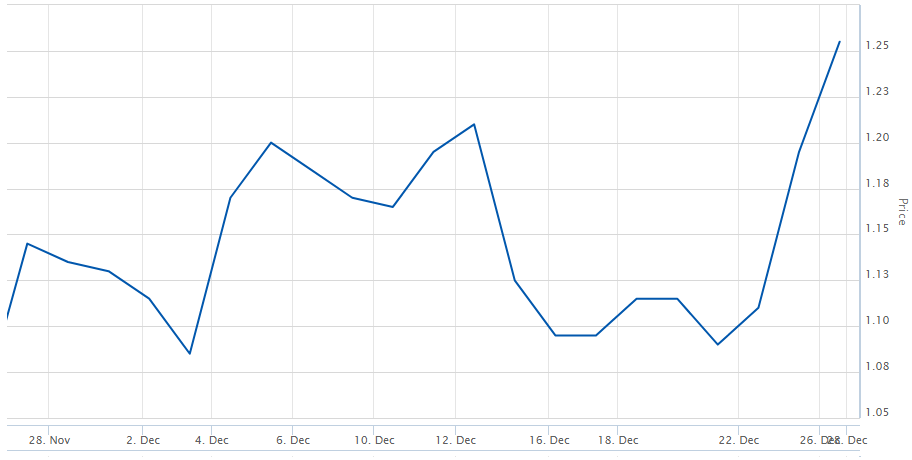

The share price was up by 15% from the last dip at $1.090 on 20th December 2019 to AUD 1.255 on 27th December 2019, as shown below:

Source: Australian Stock Exchange

There is no dividend paid or recommended during the FY18 and the company has an EPS of $0.044. Its 52 weeks high and 52 weeks low stand at $1.645 and $0.600, respectively, and has a market cap of AUD 1.18 billion. GOR stock last traded at $1.370, rising by 2.239 percent from the last trade (as on 2 January 2020).

Independence Group NL (ASX:IGO)

Australia based Independence Group NL (ASX:IGO) is an exploration and mining company. IGO has high-quality asset owning 100% of Nova nickel-copper-cobalt operation in the Fraser Range and 30% of Tropicana Gold Mine on the western edge of the Great Victoria Desert.

The performance of the mine in the first quarter of FY20 is decent and in the scope of the guidance. Nova nickel and copper production are in the range of 7.724 kt and 3.49 kt crossing the pro-rata quarterly guidance of the year (FY20 guidance divided by four), i.e. 6.75 kt to 7.5 kt and 2.75 kt to 3.125 kt for nickel and copper respectively. Whereas, gold production from Tropicana mine stands in between the quarterly guidance, i.e. 123.32 koz of gold production which is in the range with quarterly guidance of 112.5 koz to 125 koz on 100% attributable basis.

While the company FY20 production guidance is as Ni – 27 to 30 kilotonnes, Cu – 11 to 12.5 kilotonnes and Co – 850 to 950 tonnes for Nova operations with cash cost as $2.00 to $2.50/lb of Ni. Tropicana expected to produce gold in the range of 450koz to 500koz with cash cost in the range of $700/oz - $780/oz Au in FY20.

The share price has increased by ~12.98% from last one month’s lowest dip at AUD 5.78 on 4th December to AUD 6.53 on 27h December 2019 as shown below.

Source: Australian Stock Exchange

The impulse of ~4.82% is spotted in the share price on 27th December from last traded price of AUD 6.23 courtesy to the announcement related to the takeover of Panoramic Resources Ltd (ASX:PAN). IGO has intended to allow its offer to acquire the ordinary shares in Panoramic to lapse at 7:00 pm (Sydney time) on 17th January 2020. The step has taken up due to the breach of several defeating conditions of the offer, i.e. related to its production guidance, Savannah financing agreement, technical expert report and target's statement confirmations, cited by the Independence Group.

The company has annual dividend yield of 1.6 % with a P/E ratio of 48.410x and EPS of $0.129. EBITDA from continuing operations during FY19 was $341 million with the dividend declared as 4.0 cents per share and $3.13 net tangible assets per share. Its 52 weeks high and 52 weeks low stand at $6.65 and $3.61, respectively, and has a market cap of $3.69 billion. IGO stock last traded at $6.170, falling by 1.122 percent from the last trade (as on 2 January 2020).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.