The below mentioned two Supermarket stocks have witnessed improvement in their share prices during todayâs trade session. Let us take a closer look at their recent update and performances:

Coles Group Limited (ASX:COL)

Australiaâs leading retailer, Coles Group Limited (ASX: COL) is expecting to cut its costs via the strategy of âSmart sellingâ. In an announcement made on Tuesday 18th June 2019, the company announced that it expects to deliver $1 billion in cumulative savings by the financial year 2023. Coles intends to achieve this target by using technology to automate manual tasks which will reduce errors and reworks. Along with this, the company intends to simplify its above-store roles to remove duplication, in line with the companyâs Smart selling strategy. Coles believes that these initiatives will help it to reduce the impact of rising costs including energy and labour.

With the release of this announcement pertaining to refreshed strategy, the share prices of Coles Group went up by 3.45%, settling the dayâs trade at $13.210 with a market capitalization of circa $17.03 billion

In the last six months, the share price of the company increased by 7.04% as on 17 June 2019. The stockâs 52 weeks high price stands at $13.690 and its 52 weeks low price at $11.120 with an average annual volume of ~ 2,363,004.

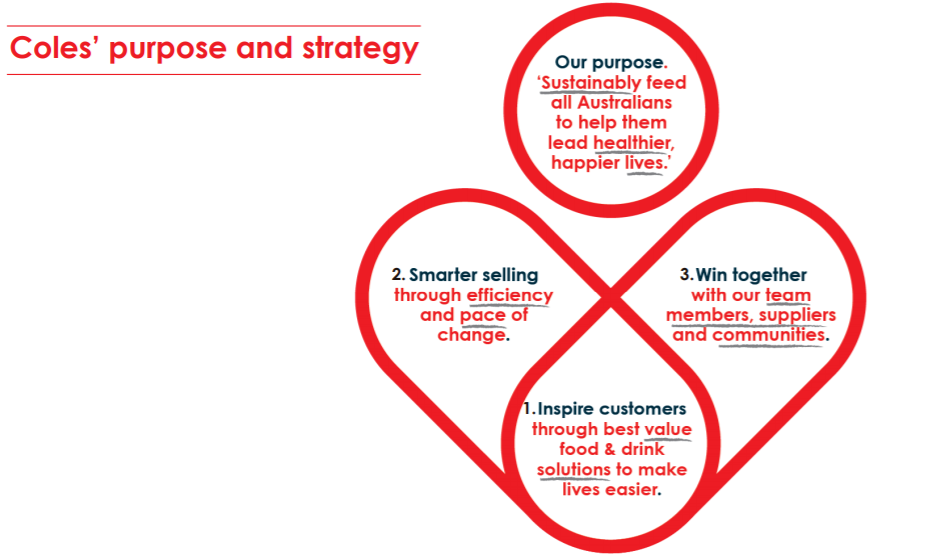

Today, Coles Group announced its refreshed strategy to deliver on its vision of becoming the most trusted retailer in Australia. It also shared its intentions to sustainably feed all Australians to help them lead healthier, happier lives as it sets the foundations for a second century of sustainable growth. Coles Groupâs CEO Steven Cain believes that Coles strategy will help it to differentiate itself in the Australian retail market.

Through its strategy, the company intends to create long-term shareholder value by growing revenue, reducing costs and generating enough cash to fund growth and innovation while delivering an attractive dividend payout ratio.

Colesâ purpose and strategy (Source: Company Reports)

Steven Cain believes that Coles refreshed strategy will help it to lead in online business as well as to establish itself as an Own Brand Powerhouse and a destination for health.

The Company is going to focus on the growth of its Own Brand and will emphasize on improving the quality and reducing the costs through deeper and more collaborative relationships with suppliers that will foster innovation. Along with this, the company will allocate additional resources to drive incremental revenue streams including meat exports and leveraging the flybuys joint venture. Further, the company intends to leverage Australian and Coles credentials to support the development of new sales channels. Currently, Coles has a significant meat export business with around $400 million in annualised revenue across 40+ countries. The company is planning to expand into other product areas once meat strategy is scaled.

Further, the company is embedding sustainability processes across the business to improve outcomes in areas like energy use and waste that will help Coles to be recognised as Australiaâs most sustainable supermarket.

In a trading update provided today, Coles announced that it will report its full year results on 22 August 2019. The company has also communicated that its Comparable Supermarket sales growth for the Q4 FY19 is now expected to be in the upper half of the range between the 2nd and 3rd quarter results, adjusted for the impact of New Yearâs Eve. The company has also informed that its Net capex is within the guidance of $700m - $800 million. Capital expenditure is skewed toward growth and efficiency initiatives. Going forward, the companyâs focus will be on gross operating capital expenditure given property capital expenditure and disposals are dependent on market conditions.

With the rapidly changing Australian retail landscape, it has become very important for retailers to take a careful look at their strategies in order to differentiate itself from competitors. Through its refreshed strategy, Coles Group Limited has taken a major step forward towards its vision of establishing itself as Australiaâs most trusted retailer.

Coles Board has reconfirmed a target dividend payout ratio of 80% - 90% of underlying earnings from 28 November 2018 to 30 June 2019 which will be payable in September 2019. The company has advised that the Dividends are going to be franked to the maximum extent possible.

Woolworths Group Limited (ASX:WOW)

The shares of Australiaâs another major retailer Woolworths Group Limited (ASX:WOW) were also up on ASX today, rising slightly by 0.99% by the end of the dayâs session.

Woolworths was recently in news over its decision regarding ârestructuringâ which was opposed by SDA (Shop, Distributive and Allied Employees' Association). SDA has already lodged a dispute with Woolworths in the Fair Work Commission arguing that Woolworths had not consulted the SDA on the proposed changes for the new operating model and it has stated that proposed changes are in no way connected to the new Woolworths Agreement. As per the Woolworths Supermarkets Agreement, any major change from Woolworths requires proper consultation from members and the SDA in order to avoid or minimise job losses and to minimize the impacts from the changes.

Many media sites have reported that many employees who have been with Woolworths for a long a time are getting impacted due to the restructuring process.

The company recently announced the plans for investing A$30 million into a strategic partnership with leading subscription-based meal kit provider, Marley Spoon in order to grow both the Marley Spoon and Dinnerly brands in Australia, and to build operational synergies.

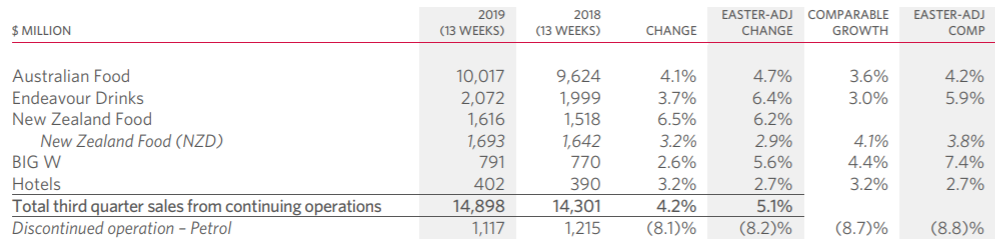

For the third quarter of FY19, the company reported Australian Food comparable sales growth of 4.2% (Easter-adjusted) and Endeavour Drinksâ sales growth of 5.9%, an encouraging piece of news for the company and its shareholders.

Improved sales momentum across the Group (Source: Company Reports)

The company has recently completed the sale of Woolworths Petrol to EG Group which has enabled the Group to return $1.7 billion to shareholders by way of an off-market buy-back. This complements the $1.4 billion of dividends already paid to shareholders this financial year through the F18 final and special dividends, and F19 interim dividends.

Earlier this year, the company welcomed highly experienced Jennifer Carr-Smith to the Woolworths Group Board as a non-executive director. It is expected that the strength of the companyâs Board will be improved by Jenniferâs extensive career experience including US online businesses Peapod and Groupon.

The companyâs Board seems to be determined to capitalise on the opportunities ahead to make Woolworths Group a better business benefitting customers, team members, suppliers and, importantly, shareholders.

In the past six months, WOW has provided a return of 12.78% as on 17 June 2019. The companyâ stock settled the dayâs trade at a price of $32.620 with a market capitalization of circa $40.66 billion as on 18 June 2019. The stockâs 52 weeks high price stands at $34.840 and its 52 weeks low price at $27.030 with an average volume of ~ 3,906,810.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.